Rentvesting offers a strategy where individuals rent in desirable locations while investing in more affordable properties to build equity and wealth. Shared equity schemes allow buyers to purchase a portion of a property while a partner, often a government or developer, owns the remainder, reducing initial costs and increasing housing accessibility. Explore the benefits and considerations of rentvesting versus shared equity to determine which approach suits your financial goals.

Why it is important

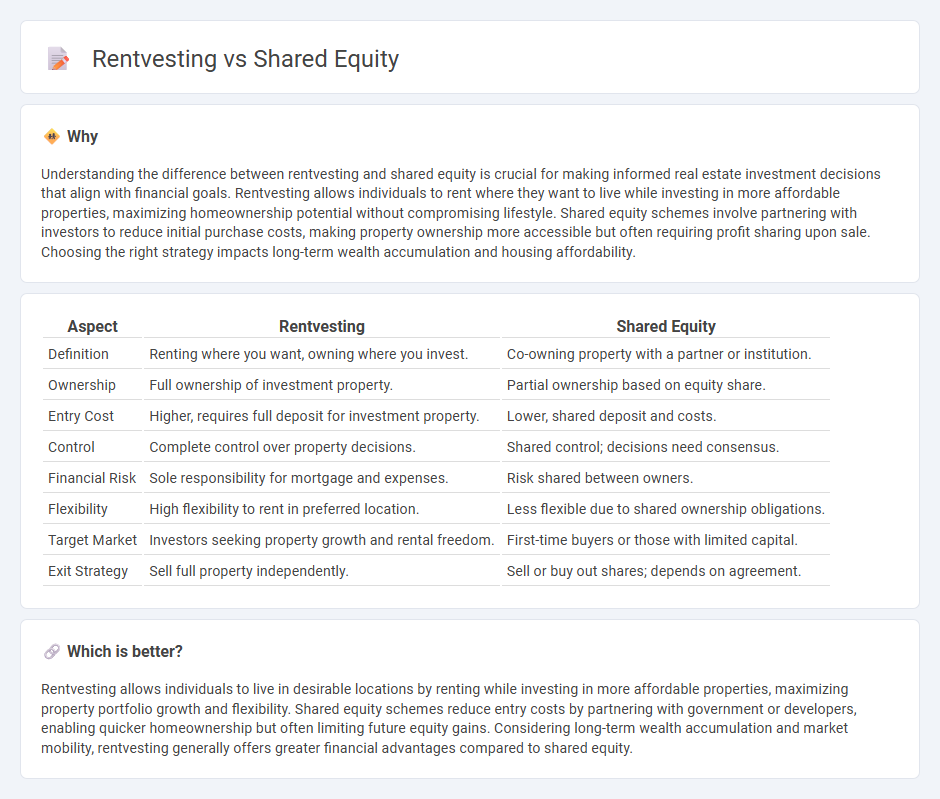

Understanding the difference between rentvesting and shared equity is crucial for making informed real estate investment decisions that align with financial goals. Rentvesting allows individuals to rent where they want to live while investing in more affordable properties, maximizing homeownership potential without compromising lifestyle. Shared equity schemes involve partnering with investors to reduce initial purchase costs, making property ownership more accessible but often requiring profit sharing upon sale. Choosing the right strategy impacts long-term wealth accumulation and housing affordability.

Comparison Table

| Aspect | Rentvesting | Shared Equity |

|---|---|---|

| Definition | Renting where you want, owning where you invest. | Co-owning property with a partner or institution. |

| Ownership | Full ownership of investment property. | Partial ownership based on equity share. |

| Entry Cost | Higher, requires full deposit for investment property. | Lower, shared deposit and costs. |

| Control | Complete control over property decisions. | Shared control; decisions need consensus. |

| Financial Risk | Sole responsibility for mortgage and expenses. | Risk shared between owners. |

| Flexibility | High flexibility to rent in preferred location. | Less flexible due to shared ownership obligations. |

| Target Market | Investors seeking property growth and rental freedom. | First-time buyers or those with limited capital. |

| Exit Strategy | Sell full property independently. | Sell or buy out shares; depends on agreement. |

Which is better?

Rentvesting allows individuals to live in desirable locations by renting while investing in more affordable properties, maximizing property portfolio growth and flexibility. Shared equity schemes reduce entry costs by partnering with government or developers, enabling quicker homeownership but often limiting future equity gains. Considering long-term wealth accumulation and market mobility, rentvesting generally offers greater financial advantages compared to shared equity.

Connection

Rentvesting allows individuals to enter the property market by renting where they want to live while investing in more affordable areas, creating opportunities for shared equity arrangements. Shared equity schemes enable buyers to co-own property with investors or government bodies, reducing upfront costs and facilitating homeownership for rentvestors. Both strategies address housing affordability challenges by combining flexible living options with collaborative property investment models.

Key Terms

Ownership Structure

Shared equity involves co-ownership where both parties hold a stake in the property, reducing initial financial burden and sharing both risks and rewards. Rentvesting, on the other hand, separates residence and investment by renting a home in a preferred location while owning an investment property elsewhere, allowing homeowners to build equity without compromising lifestyle. Explore the advantages and structural differences between these strategies to determine the optimal path to property ownership.

Capital Growth

Shared equity schemes enable homeowners to purchase a portion of a property, reducing upfront costs while benefiting from capital growth proportional to their share. Rentvesting allows investors to rent where they want to live while purchasing properties in more affordable areas with higher capital growth potential. Explore how these strategies impact your long-term wealth by learning more about their capital growth benefits.

Cash Flow

Shared equity schemes allow homebuyers to reduce mortgage costs by partnering with investors or government bodies, improving cash flow through lower monthly repayments. Rentvesting involves renting in a preferred location while investing in more affordable property elsewhere, enhancing cash flow by potentially generating rental income that offsets housing expenses. Explore detailed comparisons to understand which strategy optimizes your cash flow more effectively.

Source and External Links

Shared-Equity Homeownership: The Basics - Shared equity homeownership involves lowering home prices by sharing ownership stakes, benefiting households with affordability and communities by retaining vital workers, often with long-term resale restrictions to preserve affordability and allow subsidy recycling for successive families.

Shared equity or Partnership Mortgages - Shared equity mortgages provide a loan alongside a main mortgage in exchange for a share of future home value gains, helping first-time buyers by reducing mortgage size and allowing repayment linked to the property's value.

Shared Equity Housing - Shared equity housing creates permanently affordable homes by limiting sale prices, sharing appreciation gains, and engaging residents in governance, fostering wealth building, preventing displacement, and sustaining inclusive neighborhoods.

dowidth.com

dowidth.com