Greedflation refers to price increases driven by excessive corporate profit margins rather than underlying cost pressures. Structural inflation arises from fundamental imbalances in the economy, such as supply chain disruptions or labor market constraints, causing persistent price rises. Explore the key differences and impacts of greedflation versus structural inflation to understand their roles in current economic trends.

Why it is important

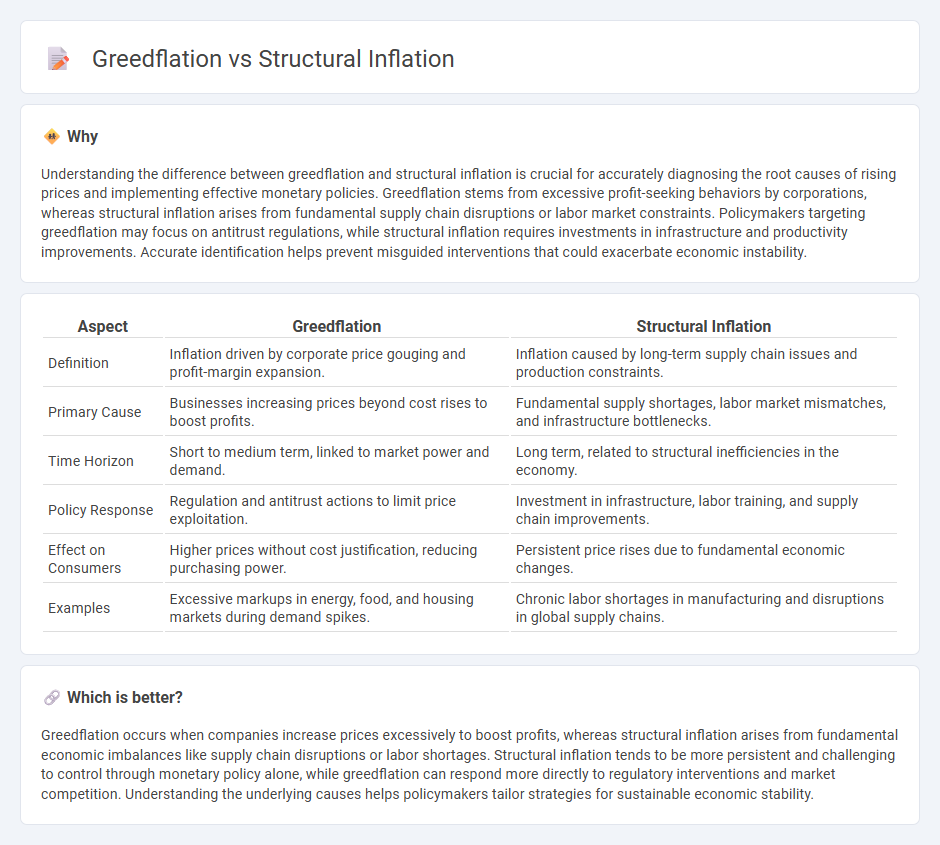

Understanding the difference between greedflation and structural inflation is crucial for accurately diagnosing the root causes of rising prices and implementing effective monetary policies. Greedflation stems from excessive profit-seeking behaviors by corporations, whereas structural inflation arises from fundamental supply chain disruptions or labor market constraints. Policymakers targeting greedflation may focus on antitrust regulations, while structural inflation requires investments in infrastructure and productivity improvements. Accurate identification helps prevent misguided interventions that could exacerbate economic instability.

Comparison Table

| Aspect | Greedflation | Structural Inflation |

|---|---|---|

| Definition | Inflation driven by corporate price gouging and profit-margin expansion. | Inflation caused by long-term supply chain issues and production constraints. |

| Primary Cause | Businesses increasing prices beyond cost rises to boost profits. | Fundamental supply shortages, labor market mismatches, and infrastructure bottlenecks. |

| Time Horizon | Short to medium term, linked to market power and demand. | Long term, related to structural inefficiencies in the economy. |

| Policy Response | Regulation and antitrust actions to limit price exploitation. | Investment in infrastructure, labor training, and supply chain improvements. |

| Effect on Consumers | Higher prices without cost justification, reducing purchasing power. | Persistent price rises due to fundamental economic changes. |

| Examples | Excessive markups in energy, food, and housing markets during demand spikes. | Chronic labor shortages in manufacturing and disruptions in global supply chains. |

Which is better?

Greedflation occurs when companies increase prices excessively to boost profits, whereas structural inflation arises from fundamental economic imbalances like supply chain disruptions or labor shortages. Structural inflation tends to be more persistent and challenging to control through monetary policy alone, while greedflation can respond more directly to regulatory interventions and market competition. Understanding the underlying causes helps policymakers tailor strategies for sustainable economic stability.

Connection

Greedflation occurs when corporations exploit market power to raise prices beyond cost increases, intensifying consumer inflation experiences. Structural inflation stems from deep-rooted economic shifts such as labor market rigidities and supply chain disruptions, establishing persistent upward pressure on prices. Both phenomena interact as greedflation amplifies the underlying structural factors, reinforcing prolonged inflationary trends within an economy.

Key Terms

Wage-Price Spiral

Structural inflation arises from persistent supply-side constraints and labor market rigidities that drive up production costs and wages over time. Greedflation, by contrast, is fueled by companies raising prices beyond cost increases, exploiting market power and consumer inelasticity, intensifying the wage-price spiral as workers demand higher wages to keep up with rapidly escalating prices. Explore deeper insights into how the wage-price spiral uniquely influences each inflation type and their broader economic impacts.

Market Power

Structural inflation arises from long-term economic changes like persistent supply chain disruptions and rising production costs, influencing overall price levels. Greedflation is driven by dominant firms exploiting their market power to increase profit margins disproportionately, beyond cost increases. Explore the dynamics between these inflation types and their impacts on market competition and consumer prices.

Cost-Push Factors

Structural inflation arises from persistent cost-push factors such as rising wages, supply chain disruptions, and increased raw material prices, which keep production costs elevated across the economy. Greedflation, on the other hand, occurs when companies exploit these cost increases by inflating prices beyond the necessary margin to boost profits, intensifying inflationary pressures. Explore the detailed distinctions and economic impacts of structural inflation versus greedflation for a deeper understanding of inflation dynamics.

Source and External Links

Trend inflation and structural shocks - Structural inflation is primarily driven by four shocks: price mark-up and government policy shocks tend to increase trend inflation, while finance and productivity shocks tend to reduce it, with price mark-up and government policy having long-run inflationary effects.

The "five Ds" of structurally higher inflation - Structural inflation in advanced economies is shaped by five key factors--decarbonization, demographics, digitalization, deglobalization, and debt--with demographics and decarbonization increasing costs, while digitalization can enhance corporate pricing power, and the net effect is generally inflationary.

STRUCTURAL INFLATION definition - Cambridge Dictionary - Structural inflation refers to inflation caused by underlying economic or policy structures rather than temporary changes in supply and demand.

dowidth.com

dowidth.com