Supercore inflation measures the persistent rise in prices of essential goods and services, excluding volatile food and energy sectors, reflecting underlying inflationary pressures. Demand-pull inflation occurs when aggregate demand in an economy outpaces aggregate supply, causing prices to increase across various markets. Explore the differences and impacts of these inflation types to better understand their roles in economic policy.

Why it is important

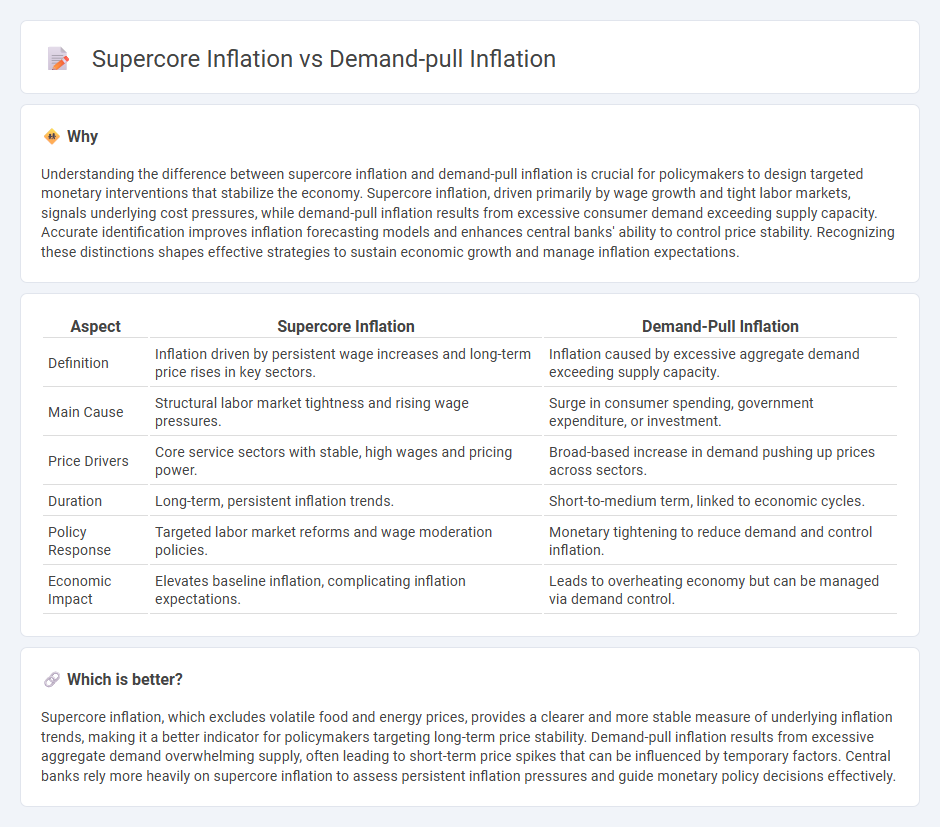

Understanding the difference between supercore inflation and demand-pull inflation is crucial for policymakers to design targeted monetary interventions that stabilize the economy. Supercore inflation, driven primarily by wage growth and tight labor markets, signals underlying cost pressures, while demand-pull inflation results from excessive consumer demand exceeding supply capacity. Accurate identification improves inflation forecasting models and enhances central banks' ability to control price stability. Recognizing these distinctions shapes effective strategies to sustain economic growth and manage inflation expectations.

Comparison Table

| Aspect | Supercore Inflation | Demand-Pull Inflation |

|---|---|---|

| Definition | Inflation driven by persistent wage increases and long-term price rises in key sectors. | Inflation caused by excessive aggregate demand exceeding supply capacity. |

| Main Cause | Structural labor market tightness and rising wage pressures. | Surge in consumer spending, government expenditure, or investment. |

| Price Drivers | Core service sectors with stable, high wages and pricing power. | Broad-based increase in demand pushing up prices across sectors. |

| Duration | Long-term, persistent inflation trends. | Short-to-medium term, linked to economic cycles. |

| Policy Response | Targeted labor market reforms and wage moderation policies. | Monetary tightening to reduce demand and control inflation. |

| Economic Impact | Elevates baseline inflation, complicating inflation expectations. | Leads to overheating economy but can be managed via demand control. |

Which is better?

Supercore inflation, which excludes volatile food and energy prices, provides a clearer and more stable measure of underlying inflation trends, making it a better indicator for policymakers targeting long-term price stability. Demand-pull inflation results from excessive aggregate demand overwhelming supply, often leading to short-term price spikes that can be influenced by temporary factors. Central banks rely more heavily on supercore inflation to assess persistent inflation pressures and guide monetary policy decisions effectively.

Connection

Supercore inflation, which excludes volatile food and energy prices, reflects sustained price increases primarily driven by demand-pull inflation, where consumer demand outpaces supply capacity. In economies experiencing robust demand growth, businesses raise prices due to elevated production costs and stretched resources, directly impacting the supercore inflation rate. Monitoring supercore inflation offers a clearer indication of demand-pull pressures without short-term volatility interfering with economic policy decisions.

Key Terms

Aggregate demand

Demand-pull inflation occurs when aggregate demand exceeds aggregate supply, driving prices upward due to increased consumer and business spending. Supercore inflation excludes volatile components like food and energy, providing a clearer measure of underlying inflation trends influenced by persistent demand pressures. Explore more to understand how aggregate demand shapes these distinct inflation measures.

Core inflation

Core inflation measures the change in prices of goods and services excluding food and energy, emphasizing underlying inflation trends. Demand-pull inflation occurs when increased demand surpasses supply, pushing core inflation upward. Explore deeper insights into core inflation dynamics and their implications.

Services sector

Demand-pull inflation arises when increased consumer spending outpaces supply, driving up prices in the services sector, while supercore inflation isolates price changes excluding volatile food and energy components, highlighting persistent inflation trends mainly driven by services such as healthcare, education, and housing. The services sector, being less sensitive to supply shocks, plays a critical role in supercore inflation analysis as its price rigidities and wage-driven costs contribute to sustained inflationary pressure. Explore further to understand how these inflation types impact monetary policy decisions in service-driven economies.

Source and External Links

Causes of Inflation | Explainer | Education | RBA - Demand-pull inflation happens when aggregate demand exceeds aggregate supply in the economy, causing widespread price increases as firms raise prices and wages rise due to competition for labor, further fueling inflation.

Demand-Pull Inflation: How Does It Work? - SmartAsset - Demand-pull inflation occurs during strong economic growth when higher spending by consumers, businesses, or government outpaces supply of goods and services, leading to higher prices and potentially a wage-price spiral.

Demand-pull inflation - Wikipedia - Demand-pull inflation arises when aggregate demand surpasses aggregate supply in a full employment economy, causing real GDP to rise initially but eventually resulting in rising prices due to capacity constraints and creating the phenomenon of "too much money chasing too few goods".

dowidth.com

dowidth.com