Zombie companies are firms that generate just enough revenue to continue operating without eliminating debt, often stifling economic growth by misallocating resources. Monopolies dominate markets by restricting competition, potentially leading to higher prices and reduced innovation. Explore the critical differences and economic impacts of zombie companies versus monopolies to deepen your understanding.

Why it is important

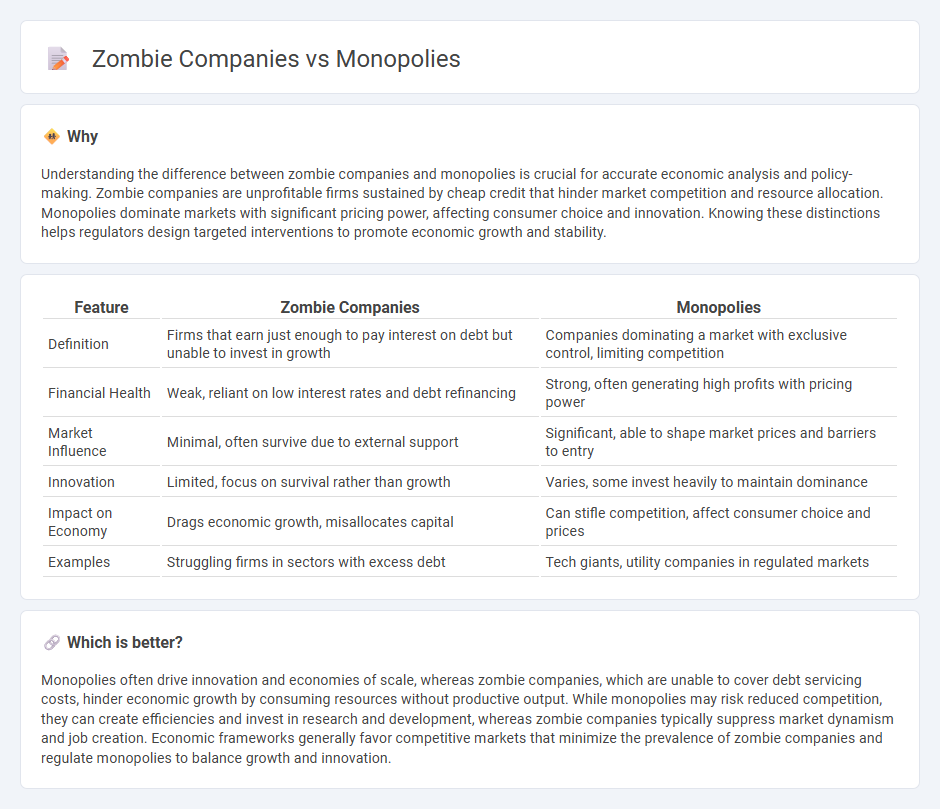

Understanding the difference between zombie companies and monopolies is crucial for accurate economic analysis and policy-making. Zombie companies are unprofitable firms sustained by cheap credit that hinder market competition and resource allocation. Monopolies dominate markets with significant pricing power, affecting consumer choice and innovation. Knowing these distinctions helps regulators design targeted interventions to promote economic growth and stability.

Comparison Table

| Feature | Zombie Companies | Monopolies |

|---|---|---|

| Definition | Firms that earn just enough to pay interest on debt but unable to invest in growth | Companies dominating a market with exclusive control, limiting competition |

| Financial Health | Weak, reliant on low interest rates and debt refinancing | Strong, often generating high profits with pricing power |

| Market Influence | Minimal, often survive due to external support | Significant, able to shape market prices and barriers to entry |

| Innovation | Limited, focus on survival rather than growth | Varies, some invest heavily to maintain dominance |

| Impact on Economy | Drags economic growth, misallocates capital | Can stifle competition, affect consumer choice and prices |

| Examples | Struggling firms in sectors with excess debt | Tech giants, utility companies in regulated markets |

Which is better?

Monopolies often drive innovation and economies of scale, whereas zombie companies, which are unable to cover debt servicing costs, hinder economic growth by consuming resources without productive output. While monopolies may risk reduced competition, they can create efficiencies and invest in research and development, whereas zombie companies typically suppress market dynamism and job creation. Economic frameworks generally favor competitive markets that minimize the prevalence of zombie companies and regulate monopolies to balance growth and innovation.

Connection

Zombie companies, which are firms that generate enough revenue to continue operating but cannot cover their debt interest, often thrive in markets dominated by monopolies due to reduced competition and market entry barriers. Monopolies can suppress innovation and market dynamism, allowing inefficient zombie companies to persist by benefiting from protected market shares and distorted pricing power. This connection hampers economic growth by misallocating resources and stifling competitive pressures essential for productivity improvements.

Key Terms

Market Power

Monopolies wield significant market power by controlling large market shares, enabling them to set prices and restrict competition, often resulting in higher consumer costs and reduced innovation. Zombie companies, despite lacking market power, persist primarily due to continuous debt servicing, which undermines overall market efficiency and allocative resources. Explore deeper insights into the distinct impacts of monopolies and zombie companies on market dynamics.

Efficiency

Monopolies often exhibit inefficiencies due to lack of competitive pressure, leading to higher prices and reduced innovation. Zombie companies survive primarily through external support despite being inefficient and unprofitable, draining resources from more productive firms. Explore how efficiency metrics differ between monopolies and zombie companies to understand their economic impact.

Resource Allocation

Monopolies often result in inefficient resource allocation by limiting competition and innovation, allowing dominant firms to control prices and reduce market dynamism. Zombie companies, in contrast, consume valuable capital and labor without generating sufficient returns, distorting resource flows by propping up unproductive businesses. Explore how these entities impact economic efficiency and growth by optimizing or misallocating resources.

Source and External Links

Monopoly - Wikipedia - A monopoly is a market structure where a single seller has significant market power, often resulting in higher prices and limited choices due to barriers to entry.

6 Reasons Monopolies Are Bad for Consumers and the Economy - Monopolies can control entire markets, eliminate competition, and lead to higher prices, lower quality, and fewer choices for consumers, often prompting legal and government intervention.

Monopoly - Econlib - Many lasting monopolies rely on government policies, and economists primarily criticize them for transferring wealth from consumers to producers by charging above competitive prices, rather than for inherent moral reasons.

dowidth.com

dowidth.com