Neobank stacking leverages digital-first financial services to provide seamless, user-friendly banking experiences without traditional branch networks, driving innovation and customer-centric solutions. Shadow banking operates outside conventional regulatory frameworks, offering credit and liquidity through non-bank entities, often introducing higher risk and less transparency in the financial system. Explore how these emerging models are reshaping the global economy and financial landscape.

Why it is important

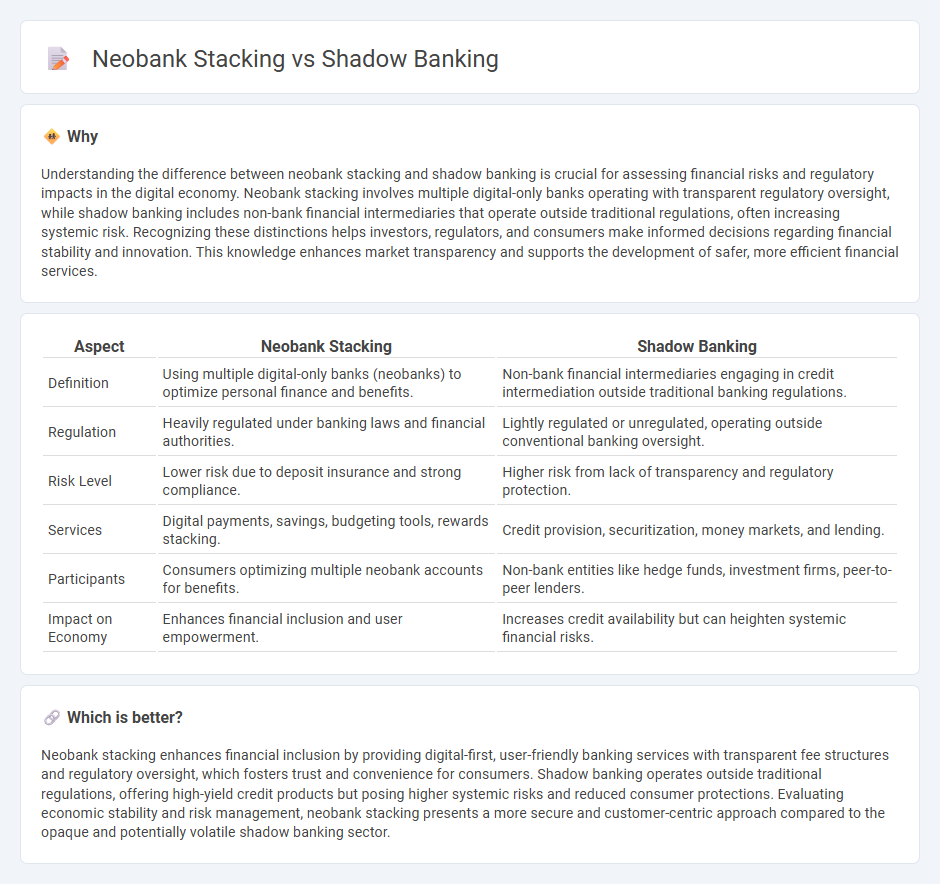

Understanding the difference between neobank stacking and shadow banking is crucial for assessing financial risks and regulatory impacts in the digital economy. Neobank stacking involves multiple digital-only banks operating with transparent regulatory oversight, while shadow banking includes non-bank financial intermediaries that operate outside traditional regulations, often increasing systemic risk. Recognizing these distinctions helps investors, regulators, and consumers make informed decisions regarding financial stability and innovation. This knowledge enhances market transparency and supports the development of safer, more efficient financial services.

Comparison Table

| Aspect | Neobank Stacking | Shadow Banking |

|---|---|---|

| Definition | Using multiple digital-only banks (neobanks) to optimize personal finance and benefits. | Non-bank financial intermediaries engaging in credit intermediation outside traditional banking regulations. |

| Regulation | Heavily regulated under banking laws and financial authorities. | Lightly regulated or unregulated, operating outside conventional banking oversight. |

| Risk Level | Lower risk due to deposit insurance and strong compliance. | Higher risk from lack of transparency and regulatory protection. |

| Services | Digital payments, savings, budgeting tools, rewards stacking. | Credit provision, securitization, money markets, and lending. |

| Participants | Consumers optimizing multiple neobank accounts for benefits. | Non-bank entities like hedge funds, investment firms, peer-to-peer lenders. |

| Impact on Economy | Enhances financial inclusion and user empowerment. | Increases credit availability but can heighten systemic financial risks. |

Which is better?

Neobank stacking enhances financial inclusion by providing digital-first, user-friendly banking services with transparent fee structures and regulatory oversight, which fosters trust and convenience for consumers. Shadow banking operates outside traditional regulations, offering high-yield credit products but posing higher systemic risks and reduced consumer protections. Evaluating economic stability and risk management, neobank stacking presents a more secure and customer-centric approach compared to the opaque and potentially volatile shadow banking sector.

Connection

Neobank stacking involves multiple digital banks offering layered financial services on a single platform, enhancing user accessibility and transaction efficiency. Shadow banking comprises non-traditional financial intermediaries that operate outside regular banking regulations, often facilitating credit flow through alternative channels. These practices intersect as neobank stacking can leverage shadow banking mechanisms to provide diversified, agile financial products while navigating regulatory boundaries, impacting economic credit markets and risk distribution.

Key Terms

Regulatory Arbitrage

Shadow banking operates through non-bank financial intermediaries, exploiting regulatory gaps to offer credit and liquidity without the constraints of traditional banking regulations. Neobank stacking involves layering multiple digital banking services to bypass conventional regulatory frameworks, enabling enhanced customer experiences while maintaining compliance flexibility. Explore how regulatory arbitrage shapes the competitive dynamics between shadow banking and neobank stacking.

Financial Intermediation

Shadow banking involves non-bank financial intermediaries providing credit and liquidity outside traditional banking regulations, often leading to increased risk and less transparency. Neobank stacking refers to the use of multiple digital-first financial services and platforms to optimize banking experiences, enhancing efficiency and customer convenience through technology-driven intermediation. Explore how these evolving models reshape financial intermediation by diving deeper into their mechanisms and impacts.

Digital Banking

Shadow banking involves non-bank financial intermediaries providing credit and liquidity-like services outside traditional banking regulations, enhancing financial system complexity. Neobank stacking leverages multiple digital banking platforms, allowing users to optimize services such as payments, savings, and investments seamlessly through app integrations. Explore the evolving digital banking landscape to understand how these models transform financial access and innovation.

Source and External Links

Shadow banking system - Wikipedia - The shadow banking system comprises non-bank financial intermediaries that provide credit and liquidity much like traditional banks, but do so without relying on deposits or access to central bank funding and safety nets like deposit insurance.

What Is Shadow Banking? - Back to Basics - Shadow banking refers to financial institutions that perform bank-like activities--such as maturity transformation--but operate outside traditional banking regulation, lack emergency central bank support, and do not have insured depositors.

Shadow Banking - Shadow banking involves credit, maturity, and liquidity transformation conducted through securitization and secured funding techniques like asset-backed commercial paper and repurchase agreements, largely without access to public liquidity or credit backstops.

dowidth.com

dowidth.com