Soft saving involves setting aside money in liquid, low-risk accounts like savings or money market funds, emphasizing flexibility and moderate returns. Hard saving focuses on accumulating wealth through tangible assets such as real estate or precious metals, offering potential protection against inflation and economic instability. Explore the advantages and strategies of soft and hard saving to optimize your financial security.

Why it is important

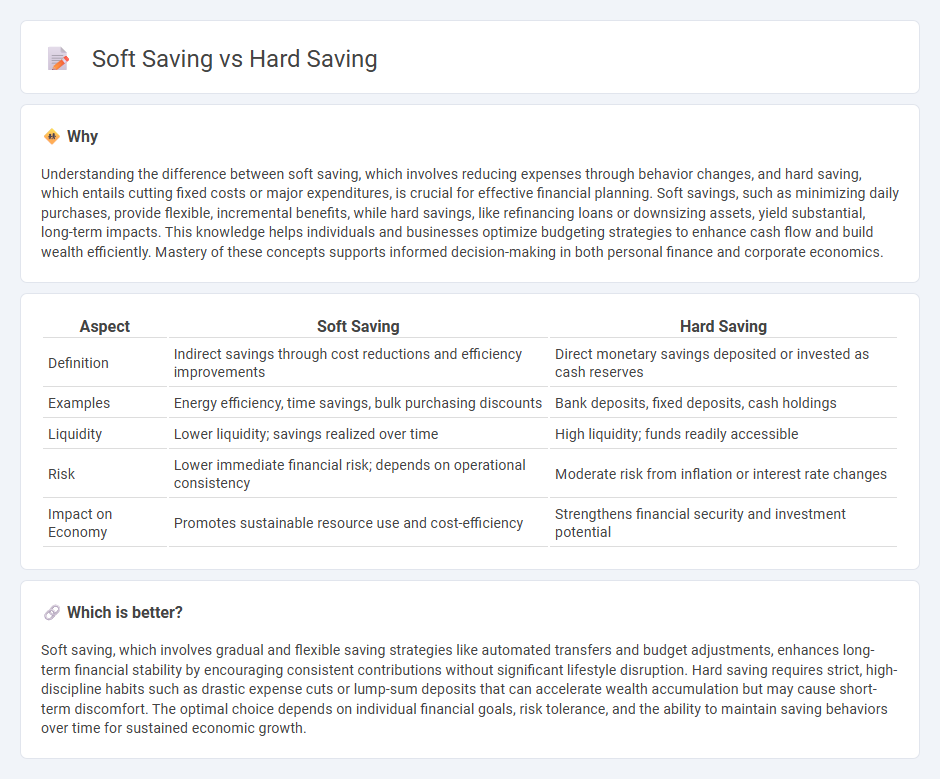

Understanding the difference between soft saving, which involves reducing expenses through behavior changes, and hard saving, which entails cutting fixed costs or major expenditures, is crucial for effective financial planning. Soft savings, such as minimizing daily purchases, provide flexible, incremental benefits, while hard savings, like refinancing loans or downsizing assets, yield substantial, long-term impacts. This knowledge helps individuals and businesses optimize budgeting strategies to enhance cash flow and build wealth efficiently. Mastery of these concepts supports informed decision-making in both personal finance and corporate economics.

Comparison Table

| Aspect | Soft Saving | Hard Saving |

|---|---|---|

| Definition | Indirect savings through cost reductions and efficiency improvements | Direct monetary savings deposited or invested as cash reserves |

| Examples | Energy efficiency, time savings, bulk purchasing discounts | Bank deposits, fixed deposits, cash holdings |

| Liquidity | Lower liquidity; savings realized over time | High liquidity; funds readily accessible |

| Risk | Lower immediate financial risk; depends on operational consistency | Moderate risk from inflation or interest rate changes |

| Impact on Economy | Promotes sustainable resource use and cost-efficiency | Strengthens financial security and investment potential |

Which is better?

Soft saving, which involves gradual and flexible saving strategies like automated transfers and budget adjustments, enhances long-term financial stability by encouraging consistent contributions without significant lifestyle disruption. Hard saving requires strict, high-discipline habits such as drastic expense cuts or lump-sum deposits that can accelerate wealth accumulation but may cause short-term discomfort. The optimal choice depends on individual financial goals, risk tolerance, and the ability to maintain saving behaviors over time for sustained economic growth.

Connection

Soft saving involves setting aside small amounts of money regularly using digital tools or informal methods, while hard saving requires stricter budgeting and consistent, larger contributions to savings accounts or investments. Both strategies contribute to overall financial stability by promoting disciplined money management and gradual wealth accumulation. Combining soft saving's flexibility with hard saving's rigor enhances economic resilience and long-term financial goals.

Key Terms

Personal Financial Discipline

Hard saving emphasizes strict budgeting and cutting non-essential expenses to build a robust financial buffer, fostering rigorous personal financial discipline. Soft saving incorporates flexibility by setting achievable savings goals and occasional discretionary spending, promoting sustainable long-term habits without stress. Explore detailed strategies to balance hard and soft saving approaches for optimal financial health.

Emergency Fund

Hard saving for an emergency fund involves strict budgeting and immediate allocation of a fixed percentage of income to build financial security rapidly, ensuring funds are readily available during unforeseen crises. Soft saving, by contrast, relies on a more flexible, gradual approach where small, sporadic deposits accumulate over time, accommodating fluctuating expenses and lifestyle changes. Explore effective strategies for both methods to optimize your emergency fund today.

Consumption Behavior

Hard saving involves strict budgeting and prioritizing savings over current consumption, leading to reduced discretionary spending and enhanced financial discipline. Soft saving adopts flexible saving strategies, balancing immediate consumption desires with future savings goals to maintain a smoother lifestyle. Discover how these saving behaviors impact consumer spending patterns and financial well-being.

Source and External Links

Hard Savings vs Soft Savings: What Counts Matters - Hard savings are directly measurable and quantifiable financial benefits that can be clearly seen on a company's profit and loss statement, such as reduced costs of goods sold, lower operating expenses, or increased revenue.

Understanding Hard vs Soft Cost Savings in Procurement - Hard cost savings are tangible reductions that directly impact the company's bottom line, achieved through actions like bulk purchasing, process improvements, or negotiating better prices for existing products and services.

Hard and Soft Savings: What Counts Can Be Counted - Hard savings include reductions in unit costs of operation, transaction costs, overhead, headcount, and increases in throughput or revenue, making them easily identifiable and directly linked to financial statements.

dowidth.com

dowidth.com