Tipflation refers to the rising costs of tipping services driven by increased consumer demand and labor shortages, influencing discretionary spending habits in various sectors. Hyperinflation, on the other hand, denotes an extreme and rapid increase in overall price levels, often exceeding 50% per month, severely eroding currency value and economic stability. Explore the distinct impacts of tipflation and hyperinflation on modern economies to understand their causes and consequences.

Why it is important

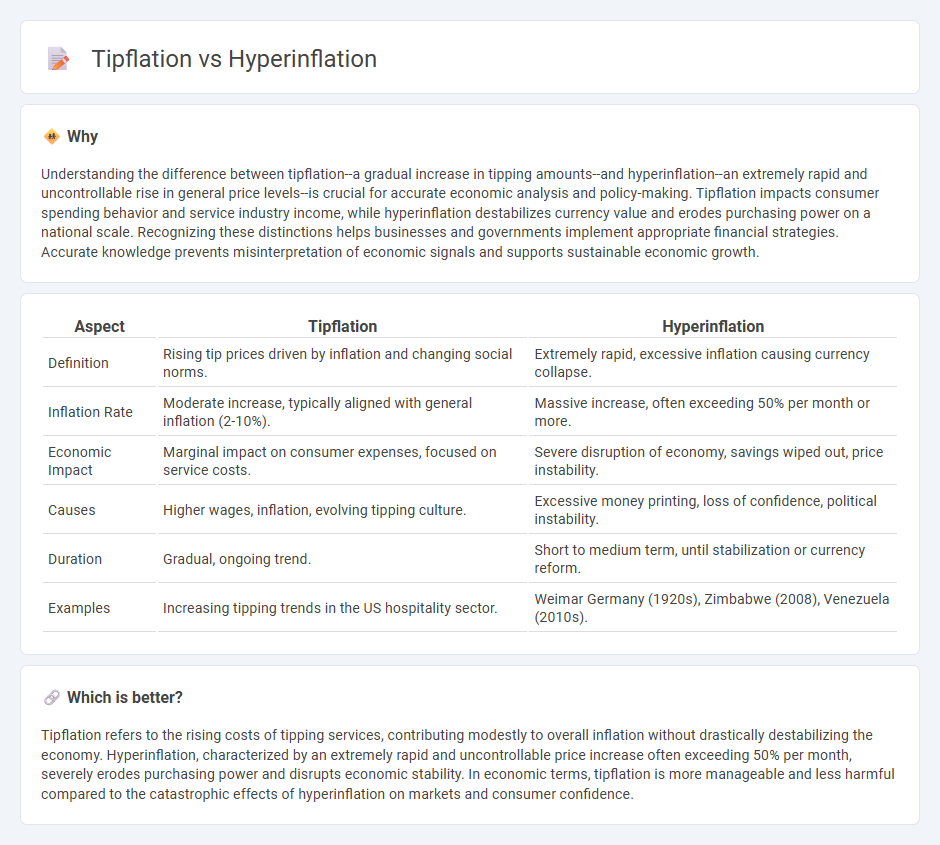

Understanding the difference between tipflation--a gradual increase in tipping amounts--and hyperinflation--an extremely rapid and uncontrollable rise in general price levels--is crucial for accurate economic analysis and policy-making. Tipflation impacts consumer spending behavior and service industry income, while hyperinflation destabilizes currency value and erodes purchasing power on a national scale. Recognizing these distinctions helps businesses and governments implement appropriate financial strategies. Accurate knowledge prevents misinterpretation of economic signals and supports sustainable economic growth.

Comparison Table

| Aspect | Tipflation | Hyperinflation |

|---|---|---|

| Definition | Rising tip prices driven by inflation and changing social norms. | Extremely rapid, excessive inflation causing currency collapse. |

| Inflation Rate | Moderate increase, typically aligned with general inflation (2-10%). | Massive increase, often exceeding 50% per month or more. |

| Economic Impact | Marginal impact on consumer expenses, focused on service costs. | Severe disruption of economy, savings wiped out, price instability. |

| Causes | Higher wages, inflation, evolving tipping culture. | Excessive money printing, loss of confidence, political instability. |

| Duration | Gradual, ongoing trend. | Short to medium term, until stabilization or currency reform. |

| Examples | Increasing tipping trends in the US hospitality sector. | Weimar Germany (1920s), Zimbabwe (2008), Venezuela (2010s). |

Which is better?

Tipflation refers to the rising costs of tipping services, contributing modestly to overall inflation without drastically destabilizing the economy. Hyperinflation, characterized by an extremely rapid and uncontrollable price increase often exceeding 50% per month, severely erodes purchasing power and disrupts economic stability. In economic terms, tipflation is more manageable and less harmful compared to the catastrophic effects of hyperinflation on markets and consumer confidence.

Connection

Tipflation and hyperinflation both reflect the impact of inflationary pressures on consumer behavior and economic stability. Tipflation describes rising tipping amounts often linked to increased service costs during inflation, while hyperinflation denotes extreme, rapid price increases eroding currency value. Together, they illustrate different scales of inflation affecting purchasing power, spending habits, and overall market confidence.

Key Terms

Price Level

Hyperinflation causes the overall price level of goods and services to skyrocket rapidly, often exceeding monthly rates of 50%, severely eroding purchasing power. Tipflation, on the other hand, refers to the incremental increase in tipping amounts, subtly raising the effective price level for consumers in the hospitality sector without a corresponding spike in official inflation metrics. Explore the detailed economic impact and real-world examples of hyperinflation and tipflation to understand their influence on price levels.

Purchasing Power

Hyperinflation drastically erodes purchasing power as prices surge uncontrollably, often exceeding 50% per month, making everyday goods unaffordable. Tipflation, the rising cost of tipping services, subtly decreases consumers' disposable income by increasing overall expenses in tipping-dependent industries. Explore detailed analyses and real-world impacts of both phenomena on your wallet to make informed financial decisions.

Consumer Behavior

Hyperinflation dramatically erodes currency value, causing consumers to prioritize essential goods and shift spending patterns toward immediate needs. Tipflation, the subtle increase in tipping expectations, influences discretionary spending and alters social norms around service compensation. Explore these economic phenomena to understand their nuanced impacts on consumer behavior and financial decision-making.

Source and External Links

Hyperinflation | EBSCO Research Starters - Hyperinflation is an extreme economic condition where prices increase faster than 50% per month, caused primarily by excessive money printing without economic growth, resulting in currency devaluation and severe social and financial disruption, with historic examples including post-WWI Germany and recent cases like Zimbabwe and Venezuela.

Hyperinflation: Definition, Causes, Effects and Examples - NetSuite - Hyperinflation leads to collapsing currency values, soaring import costs, failing businesses, wiped-out savings, hoarding, shortages, and social unrest, often culminating in regime changes and international bailouts, as seen in Venezuela's multi-year hyperinflation crisis.

Hyperinflation - Definition, Causes and Effects, Example - Hyperinflation is defined as inflation exceeding 50% per month, triggered by excessive money supply growth not backed by economic output, causing rapid currency devaluation and driving individuals to exchange unstable currency for durable or perishable goods to preserve value.

dowidth.com

dowidth.com