Shrinkflation involves reducing product size or quantity while maintaining prices, subtly impacting consumer purchasing power and inflation measurements. Recession signifies a widespread economic downturn characterized by falling GDP, rising unemployment, and reduced consumer spending. Explore the detailed differences and economic implications of shrinkflation versus recession to understand their effects on markets and households.

Why it is important

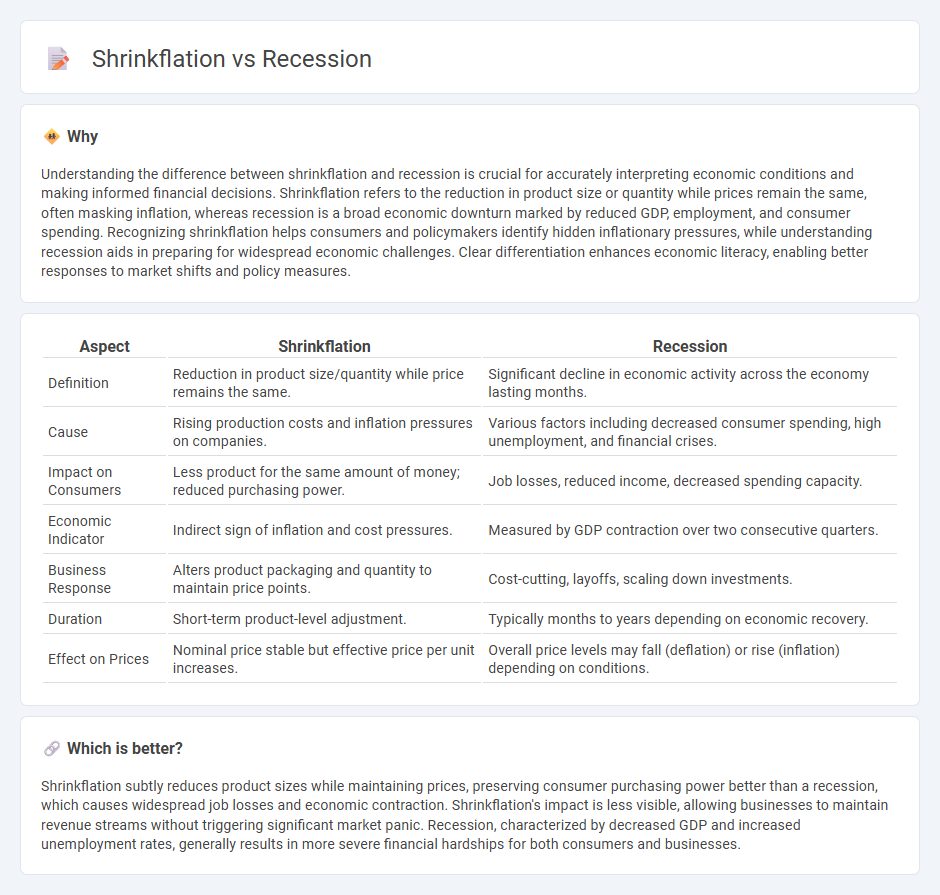

Understanding the difference between shrinkflation and recession is crucial for accurately interpreting economic conditions and making informed financial decisions. Shrinkflation refers to the reduction in product size or quantity while prices remain the same, often masking inflation, whereas recession is a broad economic downturn marked by reduced GDP, employment, and consumer spending. Recognizing shrinkflation helps consumers and policymakers identify hidden inflationary pressures, while understanding recession aids in preparing for widespread economic challenges. Clear differentiation enhances economic literacy, enabling better responses to market shifts and policy measures.

Comparison Table

| Aspect | Shrinkflation | Recession |

|---|---|---|

| Definition | Reduction in product size/quantity while price remains the same. | Significant decline in economic activity across the economy lasting months. |

| Cause | Rising production costs and inflation pressures on companies. | Various factors including decreased consumer spending, high unemployment, and financial crises. |

| Impact on Consumers | Less product for the same amount of money; reduced purchasing power. | Job losses, reduced income, decreased spending capacity. |

| Economic Indicator | Indirect sign of inflation and cost pressures. | Measured by GDP contraction over two consecutive quarters. |

| Business Response | Alters product packaging and quantity to maintain price points. | Cost-cutting, layoffs, scaling down investments. |

| Duration | Short-term product-level adjustment. | Typically months to years depending on economic recovery. |

| Effect on Prices | Nominal price stable but effective price per unit increases. | Overall price levels may fall (deflation) or rise (inflation) depending on conditions. |

Which is better?

Shrinkflation subtly reduces product sizes while maintaining prices, preserving consumer purchasing power better than a recession, which causes widespread job losses and economic contraction. Shrinkflation's impact is less visible, allowing businesses to maintain revenue streams without triggering significant market panic. Recession, characterized by decreased GDP and increased unemployment rates, generally results in more severe financial hardships for both consumers and businesses.

Connection

Shrinkflation and recession are interconnected phenomena where shrinkflation, the practice of reducing product sizes while maintaining prices, often emerges as a response to rising costs during economic downturns. Recession triggers decreased consumer spending power and demand, prompting companies to adopt shrinkflation to preserve profit margins without overtly increasing prices. This subtle price adjustment affects consumer perception and purchasing behavior, potentially prolonging the negative effects of a recession on overall economic growth.

Key Terms

GDP (Gross Domestic Product)

Recession refers to a significant decline in GDP across an economy, indicating reduced economic output and often rising unemployment. Shrinkflation impacts GDP differently by maintaining product prices while reducing quantity or size, which can mask inflation without immediately altering GDP figures. Explore how these economic phenomena interact and affect consumer behavior in detail.

Purchasing Power

Recession significantly reduces overall economic activity, leading to job losses and decreased consumer spending, which directly impacts purchasing power by limiting available income. Shrinkflation subtly diminishes product sizes or quantities while maintaining prices, eroding purchasing power without an apparent cost increase. Explore the detailed effects of recession and shrinkflation on your budget to better manage your finances.

Consumer Demand

Recession significantly reduces consumer demand as widespread economic uncertainty leads to decreased spending power and cautious purchasing behavior. Shrinkflation, on the other hand, subtly impacts demand by reducing product sizes while maintaining prices, often leading to consumer dissatisfaction and gradual demand erosion over time. Explore further to understand how these economic phenomena differently shape consumption patterns and market strategies.

Source and External Links

Recession - A recession is a period of broad economic decline, typically marked by falling output, rising unemployment, and reduced consumer spending, lasting more than a few months.

What is a recession and what does it mean for you? - During a recession, the economy contracts, leading to job losses, weaker business performance, lower stock prices, and higher borrowing costs, often triggering a cycle of reduced spending and further economic decline.

Great Recession - The Great Recession was a severe global economic downturn from late 2007 to mid-2009, sparked by the U.S. housing market collapse and financial crisis, and was the worst since the Great Depression of the 1930s.

dowidth.com

dowidth.com