Shadow bailouts refer to undisclosed government support to failing financial institutions, often bypassing formal approval processes to stabilize markets secretly. Emergency liquidity assistance (ELA) involves central banks providing temporary funds to banks facing short-term liquidity shortages to prevent systemic collapse. Explore the distinctions and implications of these financial interventions for a deeper understanding of economic stability.

Why it is important

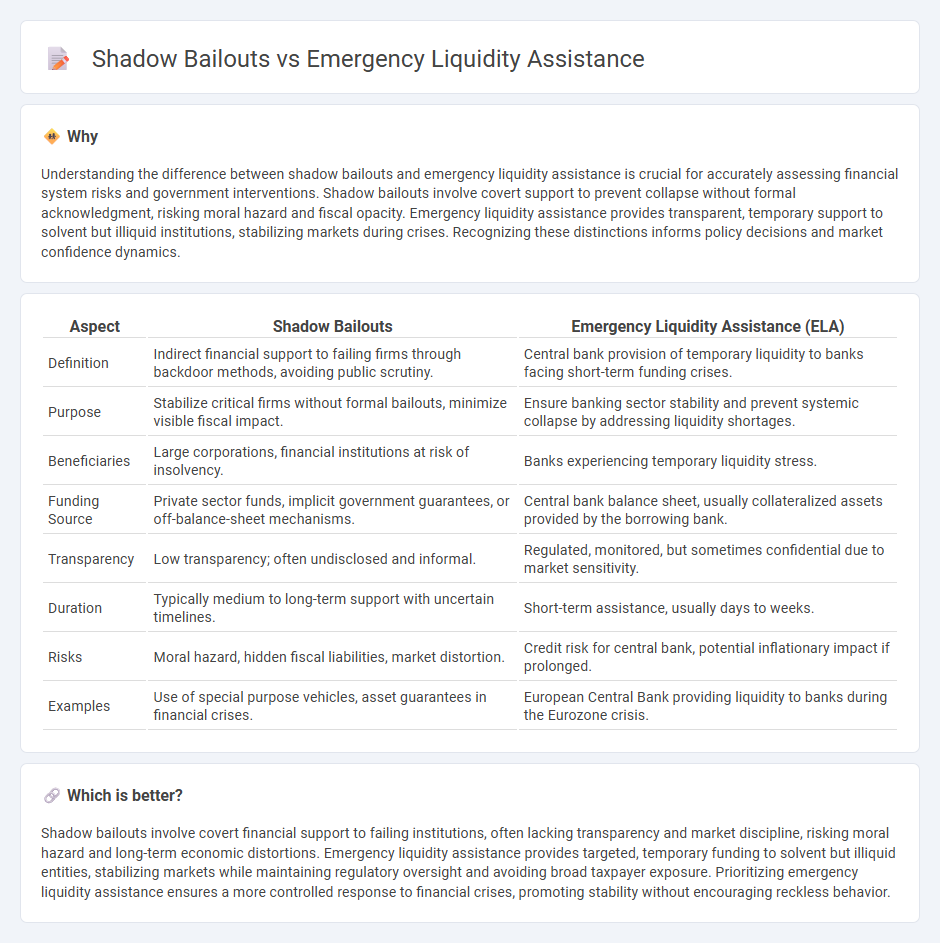

Understanding the difference between shadow bailouts and emergency liquidity assistance is crucial for accurately assessing financial system risks and government interventions. Shadow bailouts involve covert support to prevent collapse without formal acknowledgment, risking moral hazard and fiscal opacity. Emergency liquidity assistance provides transparent, temporary support to solvent but illiquid institutions, stabilizing markets during crises. Recognizing these distinctions informs policy decisions and market confidence dynamics.

Comparison Table

| Aspect | Shadow Bailouts | Emergency Liquidity Assistance (ELA) |

|---|---|---|

| Definition | Indirect financial support to failing firms through backdoor methods, avoiding public scrutiny. | Central bank provision of temporary liquidity to banks facing short-term funding crises. |

| Purpose | Stabilize critical firms without formal bailouts, minimize visible fiscal impact. | Ensure banking sector stability and prevent systemic collapse by addressing liquidity shortages. |

| Beneficiaries | Large corporations, financial institutions at risk of insolvency. | Banks experiencing temporary liquidity stress. |

| Funding Source | Private sector funds, implicit government guarantees, or off-balance-sheet mechanisms. | Central bank balance sheet, usually collateralized assets provided by the borrowing bank. |

| Transparency | Low transparency; often undisclosed and informal. | Regulated, monitored, but sometimes confidential due to market sensitivity. |

| Duration | Typically medium to long-term support with uncertain timelines. | Short-term assistance, usually days to weeks. |

| Risks | Moral hazard, hidden fiscal liabilities, market distortion. | Credit risk for central bank, potential inflationary impact if prolonged. |

| Examples | Use of special purpose vehicles, asset guarantees in financial crises. | European Central Bank providing liquidity to banks during the Eurozone crisis. |

Which is better?

Shadow bailouts involve covert financial support to failing institutions, often lacking transparency and market discipline, risking moral hazard and long-term economic distortions. Emergency liquidity assistance provides targeted, temporary funding to solvent but illiquid entities, stabilizing markets while maintaining regulatory oversight and avoiding broad taxpayer exposure. Prioritizing emergency liquidity assistance ensures a more controlled response to financial crises, promoting stability without encouraging reckless behavior.

Connection

Shadow bailouts and emergency liquidity assistance are interconnected mechanisms that stabilize financial institutions during crises by providing covert or formal support to prevent insolvency. Shadow bailouts often involve undisclosed government or central bank interventions that complement emergency liquidity assistance, ensuring market confidence without triggering public backlash. Both tools aim to maintain systemic stability by supplying essential funding and mitigating cascading failures in the economy.

Key Terms

Central Bank

Emergency liquidity assistance (ELA) involves central banks providing short-term funding to solvent but illiquid financial institutions during crises to stabilize the banking system and prevent systemic collapse. Shadow bailouts occur when central banks indirectly support failing banks through unconventional measures like asset purchases or extensive guarantee frameworks without formal government recapitalization. Explore how central banks balance transparency, moral hazard, and financial stability in deploying these critical tools.

Off-balance-sheet support

Emergency liquidity assistance (ELA) provides central banks with a mechanism to supply financial institutions with short-term funding during crises, often recorded on the central bank's balance sheet, whereas shadow bailouts involve off-balance-sheet support executed through contingent liabilities or guarantees that avoid immediate fiscal visibility. Off-balance-sheet support can obscure the real extent of financial backstops, raising concerns about transparency and risk assessment in both emergency liquidity frameworks and unreported shadow bailout measures. Explore the critical differences and implications of these support mechanisms in greater detail to understand their impact on financial stability and policy-making.

Moral hazard

Emergency liquidity assistance (ELA) provides temporary central bank funding to solvent institutions facing short-term liquidity shortages, aiming to stabilize the financial system without incentivizing reckless risk-taking. Shadow bailouts, often involving unofficial government or private sector interventions, risk exacerbating moral hazard by shielding failing entities from consequences, encouraging future imprudent behavior. Explore the detailed impacts of ELA and shadow bailouts on moral hazard to better understand their roles in financial stability.

Source and External Links

Banca d'Italia - Emergency Liquidity Assistance - Emergency liquidity assistance (ELA) is exceptional financing granted by central banks to solvent financial institutions facing temporary liquidity shortages, typically in the form of collateralized loans or liquidity injections.

ECB - Emergency Liquidity Assistance and Monetary Policy - ELA provides central bank money to solvent banks experiencing temporary liquidity problems outside standard monetary policy operations, with specific rules and oversight by the Eurosystem's Governing Council.

ECB Agreement on Emergency Liquidity Assistance (2024) - The ECB's 2024 agreement defines ELA as assistance provided by national central banks to financial institutions facing liquidity issues, outside the scope of single monetary policy, and outlines responsibilities, risk allocation, and compliance with EU treaty prohibitions on monetary financing.

dowidth.com

dowidth.com