Polycrisis refers to the convergence of multiple, simultaneous crises such as economic downturns, geopolitical conflicts, and environmental disasters that collectively amplify global instability. Systemic risk involves vulnerabilities within interconnected financial systems that can trigger widespread economic collapse if a single entity or sector fails. Explore deeper insights into how these complex threats shape global economic resilience and policy responses.

Why it is important

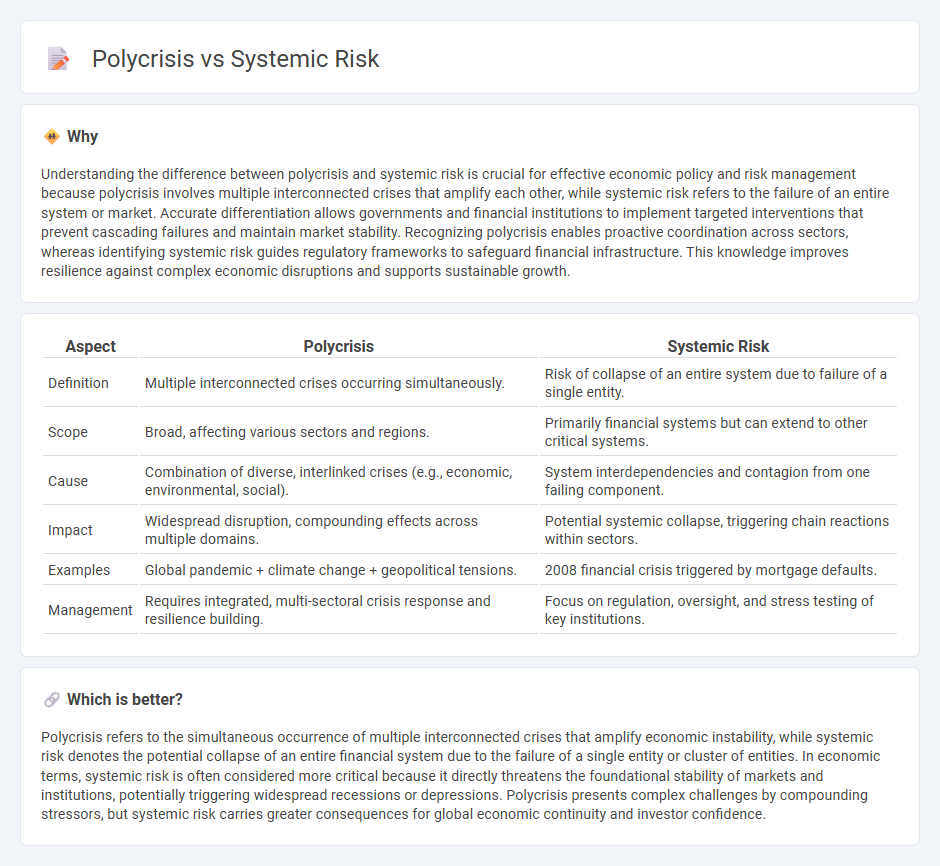

Understanding the difference between polycrisis and systemic risk is crucial for effective economic policy and risk management because polycrisis involves multiple interconnected crises that amplify each other, while systemic risk refers to the failure of an entire system or market. Accurate differentiation allows governments and financial institutions to implement targeted interventions that prevent cascading failures and maintain market stability. Recognizing polycrisis enables proactive coordination across sectors, whereas identifying systemic risk guides regulatory frameworks to safeguard financial infrastructure. This knowledge improves resilience against complex economic disruptions and supports sustainable growth.

Comparison Table

| Aspect | Polycrisis | Systemic Risk |

|---|---|---|

| Definition | Multiple interconnected crises occurring simultaneously. | Risk of collapse of an entire system due to failure of a single entity. |

| Scope | Broad, affecting various sectors and regions. | Primarily financial systems but can extend to other critical systems. |

| Cause | Combination of diverse, interlinked crises (e.g., economic, environmental, social). | System interdependencies and contagion from one failing component. |

| Impact | Widespread disruption, compounding effects across multiple domains. | Potential systemic collapse, triggering chain reactions within sectors. |

| Examples | Global pandemic + climate change + geopolitical tensions. | 2008 financial crisis triggered by mortgage defaults. |

| Management | Requires integrated, multi-sectoral crisis response and resilience building. | Focus on regulation, oversight, and stress testing of key institutions. |

Which is better?

Polycrisis refers to the simultaneous occurrence of multiple interconnected crises that amplify economic instability, while systemic risk denotes the potential collapse of an entire financial system due to the failure of a single entity or cluster of entities. In economic terms, systemic risk is often considered more critical because it directly threatens the foundational stability of markets and institutions, potentially triggering widespread recessions or depressions. Polycrisis presents complex challenges by compounding stressors, but systemic risk carries greater consequences for global economic continuity and investor confidence.

Connection

Polycrisis refers to the simultaneous occurrence of multiple, interconnected crises that amplify systemic risk within the economy, threatening financial stability and growth. These overlapping crises expose vulnerabilities in economic systems, increasing the likelihood of cascading failures across markets and institutions. Understanding the link between polycrisis and systemic risk is essential for developing resilient economic policies and risk management strategies.

Key Terms

Interconnectedness

Systemic risk refers to the potential collapse of an entire financial system or market due to the failure of a single entity or group, emphasizing the fragility and interconnectedness within financial networks. Polycrisis describes multiple, simultaneous crises affecting various sectors such as environment, economy, and geopolitics, highlighting how interconnected global challenges exacerbate overall instability. Explore how understanding interconnectedness shapes strategies to mitigate both systemic risk and polycrisis comprehensively.

Contagion

Systemic risk refers to the potential collapse of an entire financial system or market due to the interconnectedness of institutions and the contagion effect spreading financial distress. Polycrisis involves multiple overlapping crises across different sectors or geographies, where contagion amplifies impacts through cascading failures in economic, environmental, or political systems. Explore these complex contagion dynamics to understand their implications for global stability and risk management strategies.

Multi-dimensional shocks

Systemic risk refers to the potential collapse of an entire financial system or market due to the failure of a single entity or group, leading to widespread economic disruption. Polycrisis involves multiple, interrelated crises occurring simultaneously, compounding their impacts across social, economic, and environmental dimensions. Explore the complexities of multi-dimensional shocks to better understand how interconnected threats amplify vulnerabilities in global systems.

Source and External Links

Systemic Risk & Management in Finance - Systemic risk refers to the risk of a breakdown of an entire system, not just the failure of individual parts, and in finance it means the risk of cascading failure across the financial sector that can cause a severe economic downturn.

Understanding How Systemic Risk Affects the Economy - Systemic risk is the risk associated with the collapse or failure of a company, industry, financial institution, or even an entire economy, often spreading from weaker to healthier entities through interconnected systems.

Systemic Risk Indicator - The Cleveland Fed measures systemic risk in the U.S. banking system by comparing the average risk of insolvency across individual banks to the risk of the banking system as a whole, indicating when the risk of widespread financial stress is elevated.

dowidth.com

dowidth.com