Girl math redefines everyday spending by justifying small purchases as savings, while mom math balances household expenses and long-term budgeting with practical financial management. Both approaches reveal unique perspectives on personal finance and decision-making patterns that influence economic behavior. Discover how these contrasting methods impact budgeting strategies and economic outcomes.

Why it is important

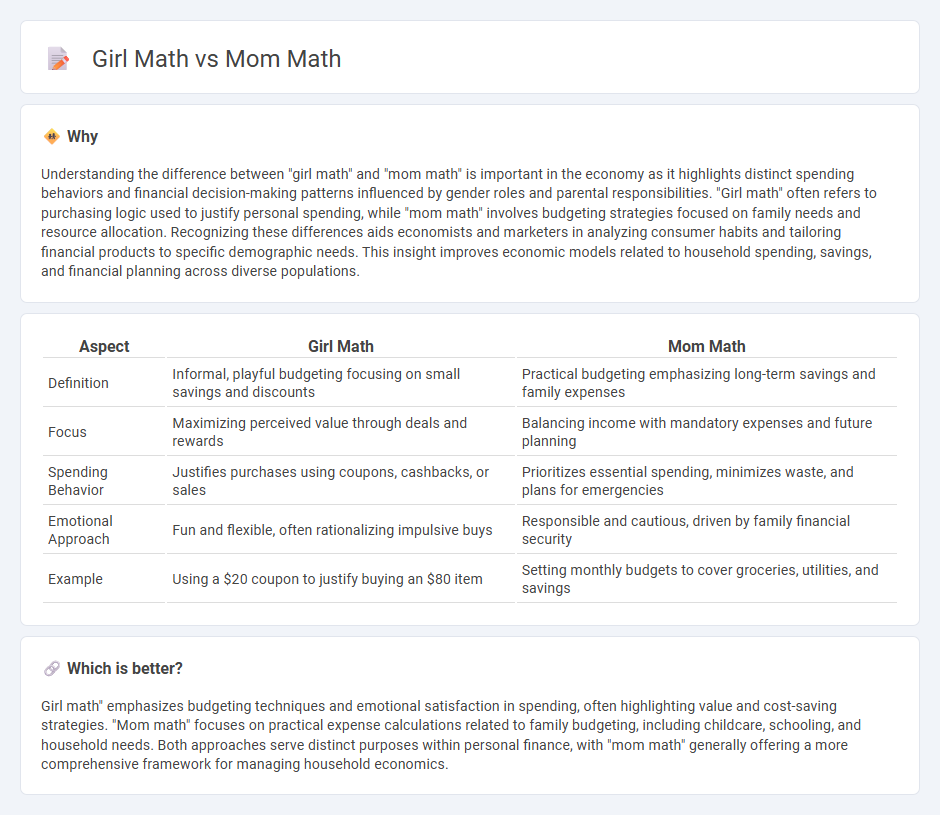

Understanding the difference between "girl math" and "mom math" is important in the economy as it highlights distinct spending behaviors and financial decision-making patterns influenced by gender roles and parental responsibilities. "Girl math" often refers to purchasing logic used to justify personal spending, while "mom math" involves budgeting strategies focused on family needs and resource allocation. Recognizing these differences aids economists and marketers in analyzing consumer habits and tailoring financial products to specific demographic needs. This insight improves economic models related to household spending, savings, and financial planning across diverse populations.

Comparison Table

| Aspect | Girl Math | Mom Math |

|---|---|---|

| Definition | Informal, playful budgeting focusing on small savings and discounts | Practical budgeting emphasizing long-term savings and family expenses |

| Focus | Maximizing perceived value through deals and rewards | Balancing income with mandatory expenses and future planning |

| Spending Behavior | Justifies purchases using coupons, cashbacks, or sales | Prioritizes essential spending, minimizes waste, and plans for emergencies |

| Emotional Approach | Fun and flexible, often rationalizing impulsive buys | Responsible and cautious, driven by family financial security |

| Example | Using a $20 coupon to justify buying an $80 item | Setting monthly budgets to cover groceries, utilities, and savings |

Which is better?

Girl math" emphasizes budgeting techniques and emotional satisfaction in spending, often highlighting value and cost-saving strategies. "Mom math" focuses on practical expense calculations related to family budgeting, including childcare, schooling, and household needs. Both approaches serve distinct purposes within personal finance, with "mom math" generally offering a more comprehensive framework for managing household economics.

Connection

Girl math and mom math reflect behavioral economics by highlighting how individuals, particularly women and mothers, mentally categorize expenses to justify spending decisions. These concepts demonstrate the cognitive biases and emotional factors influencing personal finance management, revealing patterns in budgeting and saving. Understanding these frameworks offers insights into consumer behavior, financial prioritization, and economic decision-making within households.

Key Terms

Opportunity Cost

Mom math often involves calculating practical opportunity costs like budget allocation and time management for family needs, while girl math emphasizes personal value and emotional satisfaction derived from purchases or experiences. Both mental models assess trade-offs but apply distinct criteria: mom math prioritizes utility and necessity, girl math highlights perceived savings and self-reward. Explore how these approaches influence spending behavior and decision-making strategies.

Perceived Value

Mom math prioritizes calculating savings and budgeting around family needs, emphasizing practical and perceived financial value through discounts, bulk buying, and cost-efficiency. Girl math often centers on personal spending happiness and perceived value via rewards, cash back, or justify purchases as investments in self-care or lifestyle enhancements. Explore the psychological and behavioral distinctions between mom math and girl math for deeper financial insights.

Budgeting

Mom math emphasizes practical budgeting tactics like meal planning, coupon clipping, and prioritizing household expenses to optimize family finances. Girl math often involves fun, intuitive spending justifications or "mental accounting" practices that frame small purchases as guilt-free treats. Discover more about how these distinct budgeting mindsets influence financial decision-making and money management styles.

Source and External Links

Mom Perfectly Describes Mental Load Of 'Mom Math' - Motherly - 'Mom math' describes the exhausting mental calculations and planning required for everyday parenting tasks, like estimating how much earlier to leave the house to get everyone out the door on time.

Understanding the Chaos of Mom Math During School Days - TikTok - This video humorously captures the chaos of mom math as a parent juggles routines, school prep, and homework for multiple kids.

Mom math - YouTube - The video highlights how 'mom math' involves constantly timing out daily tasks, a source of mental exhaustion for moms everywhere.

dowidth.com

dowidth.com