Girl math focuses on practical, everyday budgeting strategies often centered around small savings and personal finance hacks, contrasting with boomer math, which emphasizes long-term investments and traditional financial planning. This shift highlights generational differences in economic behavior and money management approaches. Explore how these contrasting math mindsets influence spending and saving habits across age groups.

Why it is important

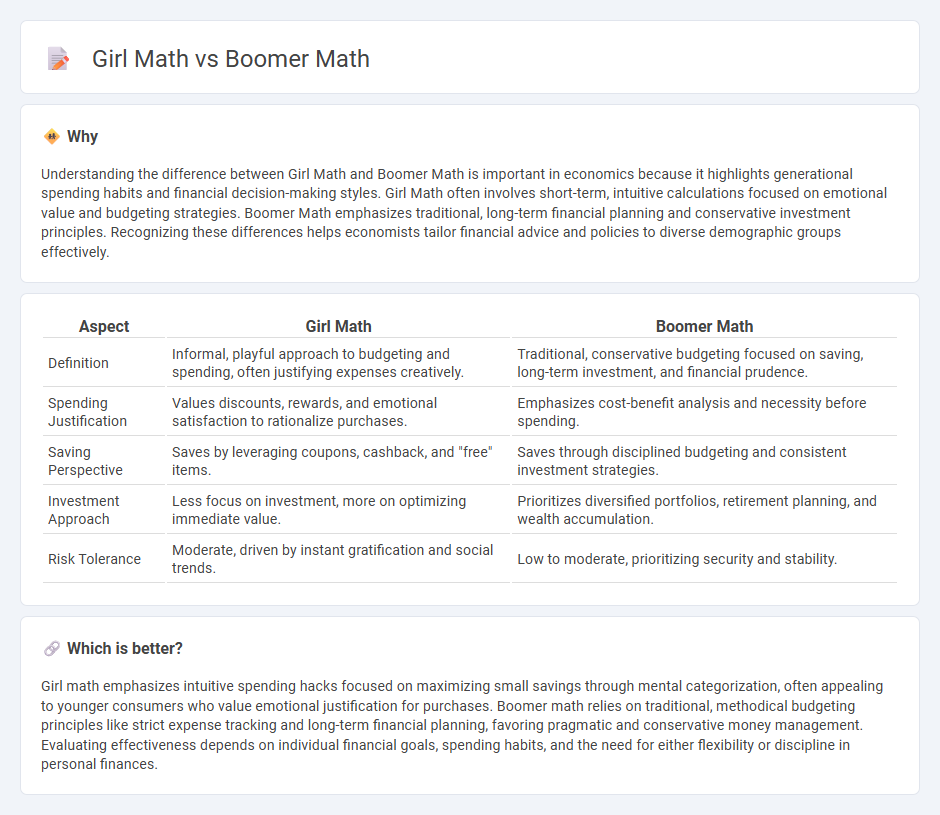

Understanding the difference between Girl Math and Boomer Math is important in economics because it highlights generational spending habits and financial decision-making styles. Girl Math often involves short-term, intuitive calculations focused on emotional value and budgeting strategies. Boomer Math emphasizes traditional, long-term financial planning and conservative investment principles. Recognizing these differences helps economists tailor financial advice and policies to diverse demographic groups effectively.

Comparison Table

| Aspect | Girl Math | Boomer Math |

|---|---|---|

| Definition | Informal, playful approach to budgeting and spending, often justifying expenses creatively. | Traditional, conservative budgeting focused on saving, long-term investment, and financial prudence. |

| Spending Justification | Values discounts, rewards, and emotional satisfaction to rationalize purchases. | Emphasizes cost-benefit analysis and necessity before spending. |

| Saving Perspective | Saves by leveraging coupons, cashback, and "free" items. | Saves through disciplined budgeting and consistent investment strategies. |

| Investment Approach | Less focus on investment, more on optimizing immediate value. | Prioritizes diversified portfolios, retirement planning, and wealth accumulation. |

| Risk Tolerance | Moderate, driven by instant gratification and social trends. | Low to moderate, prioritizing security and stability. |

Which is better?

Girl math emphasizes intuitive spending hacks focused on maximizing small savings through mental categorization, often appealing to younger consumers who value emotional justification for purchases. Boomer math relies on traditional, methodical budgeting principles like strict expense tracking and long-term financial planning, favoring pragmatic and conservative money management. Evaluating effectiveness depends on individual financial goals, spending habits, and the need for either flexibility or discipline in personal finances.

Connection

Girl math and boomer math both reflect generational approaches to personal finance, highlighting different spending habits and value perceptions. Girl math often involves mental shortcuts and justifications for small purchases, while boomer math emphasizes traditional budgeting and long-term savings. Understanding these mindsets reveals how economic behavior varies across age groups and impacts consumer markets.

Key Terms

Purchasing Power

Boomer math emphasizes traditional budgeting and value for money, often prioritizing long-term investments and cost-saving strategies, reflecting a cautious approach to purchasing power. Girl math, a modern and playful concept, reframes spending by categorizing expenses through mental math techniques, focusing on maximizing perceived value and immediate satisfaction without guilt. Explore the distinct ways these mindsets influence purchasing power and spending habits to uncover practical financial insights.

Opportunity Cost

Boomer math emphasizes precise calculations and financial discipline, often valuing traditional budgeting and saving methods. Girl math, on the other hand, incorporates opportunity cost by weighing emotional value and short-term satisfaction alongside monetary expenses. Explore how understanding opportunity cost can transform your approach to everyday spending and decision-making.

Inflation

Boomer math often emphasizes traditional budgeting and saving techniques that focus on tangible assets and long-term financial stability, while girl math incorporates contemporary spending habits, leveraging small daily conveniences and digital financial tools to manage inflation's impact subtly. Inflation drives both groups to rethink strategies: boomers may prioritize fixed expenses and investments resistant to inflation, whereas girl math highlights creative budgeting hacks, discounts, and calculated indulgences that align with fluctuating prices. Explore how these distinct approaches to inflation management shape financial decisions across generations.

Source and External Links

Boomer mathematics: why older generations insist that ... - "Boomer mathematics" is a term for the flawed reasoning older generations use to underestimate the real financial challenges facing younger people today, especially regarding housing affordability.

The math IS mathing: Boomers really DID have it easier ... - "The math IS mathing" highlights the economic reality that Boomers benefited from easier financial conditions than Millennials and Gen Z, especially regarding cost of living and wealth accumulation.

Boomer Math - "Boomer math" can also refer to the quirky, often inconsistent rules and restrictions that parents (typically Boomers) imposed on their children, such as bizarre food rules.

dowidth.com

dowidth.com