Economic scarring refers to the long-term damage to labor markets, productivity, and income resulting from a severe economic downturn, often characterized by persistent unemployment and reduced investment. Economic stagnation involves prolonged periods of minimal or no growth in gross domestic product (GDP), typically accompanied by low inflation, weak demand, and subdued wage increases. Explore the differences between economic scarring and stagnation to understand their impacts on recovery strategies and policy decisions.

Why it is important

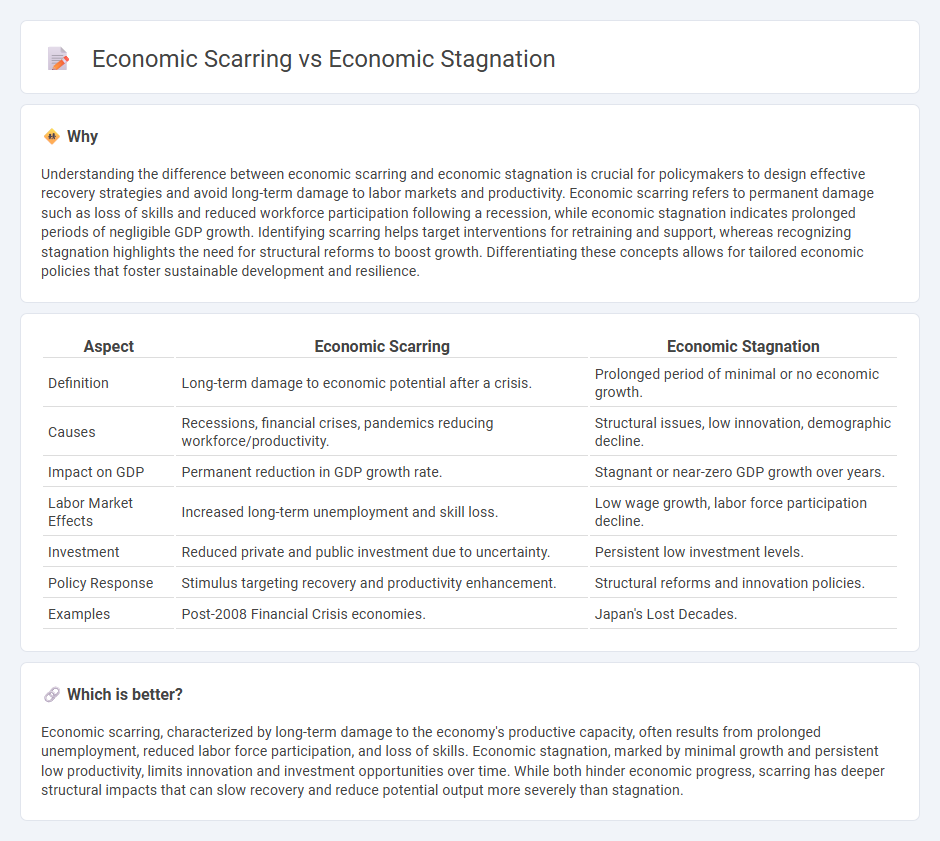

Understanding the difference between economic scarring and economic stagnation is crucial for policymakers to design effective recovery strategies and avoid long-term damage to labor markets and productivity. Economic scarring refers to permanent damage such as loss of skills and reduced workforce participation following a recession, while economic stagnation indicates prolonged periods of negligible GDP growth. Identifying scarring helps target interventions for retraining and support, whereas recognizing stagnation highlights the need for structural reforms to boost growth. Differentiating these concepts allows for tailored economic policies that foster sustainable development and resilience.

Comparison Table

| Aspect | Economic Scarring | Economic Stagnation |

|---|---|---|

| Definition | Long-term damage to economic potential after a crisis. | Prolonged period of minimal or no economic growth. |

| Causes | Recessions, financial crises, pandemics reducing workforce/productivity. | Structural issues, low innovation, demographic decline. |

| Impact on GDP | Permanent reduction in GDP growth rate. | Stagnant or near-zero GDP growth over years. |

| Labor Market Effects | Increased long-term unemployment and skill loss. | Low wage growth, labor force participation decline. |

| Investment | Reduced private and public investment due to uncertainty. | Persistent low investment levels. |

| Policy Response | Stimulus targeting recovery and productivity enhancement. | Structural reforms and innovation policies. |

| Examples | Post-2008 Financial Crisis economies. | Japan's Lost Decades. |

Which is better?

Economic scarring, characterized by long-term damage to the economy's productive capacity, often results from prolonged unemployment, reduced labor force participation, and loss of skills. Economic stagnation, marked by minimal growth and persistent low productivity, limits innovation and investment opportunities over time. While both hinder economic progress, scarring has deeper structural impacts that can slow recovery and reduce potential output more severely than stagnation.

Connection

Economic scarring refers to the long-term damage to an economy's productive capacity caused by recessions, including job losses, reduced investment, and skill depreciation, which contribute directly to economic stagnation characterized by prolonged slow growth and minimal improvements in employment and income levels. Persistent unemployment from economic scarring weakens labor market participation and consumer demand, undermining business investment and innovation needed for expansion. Structural impediments created by scarring, such as diminished workforce skills and lower capital formation, create a feedback loop that entrenches stagnation and hampers recovery momentum.

Key Terms

Long-term unemployment

Economic stagnation often manifests as persistently low growth rates, while economic scarring refers to the long-term damage caused by events like prolonged unemployment, which erodes workers' skills and reduces future earnings potential. Long-term unemployment significantly contributes to economic scarring by increasing the risk of skill atrophy and social exclusion, thereby hampering economic recovery and productivity. Explore in-depth analyses to understand how these dynamics affect labor markets and economic policy decisions.

Productivity

Economic stagnation limits growth by maintaining low productivity levels, while economic scarring results in long-term declines in workforce skills and capital efficiency, deepening productivity gaps. Prolonged periods of reduced output and investment due to crises can erode labor market dynamics and innovation capacity, amplifying structural productivity challenges. Explore how targeted policies can mitigate these effects and foster sustainable productivity improvements.

Potential output

Economic stagnation occurs when an economy experiences prolonged periods of negligible growth, leading to underutilization of resources and diminished potential output. Economic scarring refers to the lasting damage that downturns inflict on an economy's productive capacity, reducing potential output by impairing labor markets, investment, and innovation. Explore more to understand how these phenomena uniquely impact long-term growth and policy responses.

Source and External Links

Stagnation: What is it, Importance, Types, Example, FAQ | POEMS - Economic stagnation is defined as a period of very slow or no economic growth, often marked by decreased income, increased unemployment, and lower GDP growth below 2-3%, which can occur temporarily due to economic shocks or long-term structural issues.

Economic stagnation - Wikipedia - Economic stagnation is a prolonged stretch of slow GDP growth usually accompanied by high unemployment, with the theory of secular stagnation describing a fundamental and extended reduction in economic progress that may become a normal state rather than a temporary condition.

Deconstructing global economic stagnation - Lloyd's - Economic stagnation involves persistently low growth often below 2%, with scenarios ranging from temporary shocks causing short stagnation to severe or structural stagnation with prolonged low growth, high unemployment, and slow recovery impacting advanced economies more significantly.

dowidth.com

dowidth.com