Supercore inflation measures the price changes of goods and services excluding volatile food and energy sectors, providing a clearer view of underlying inflation trends. Personal Consumption Expenditures (PCE) inflation captures changes in the prices paid by consumers for goods and services, serving as the Federal Reserve's preferred inflation gauge. Explore the distinctions between supercore inflation and PCE inflation to better understand their impacts on economic policy and market decisions.

Why it is important

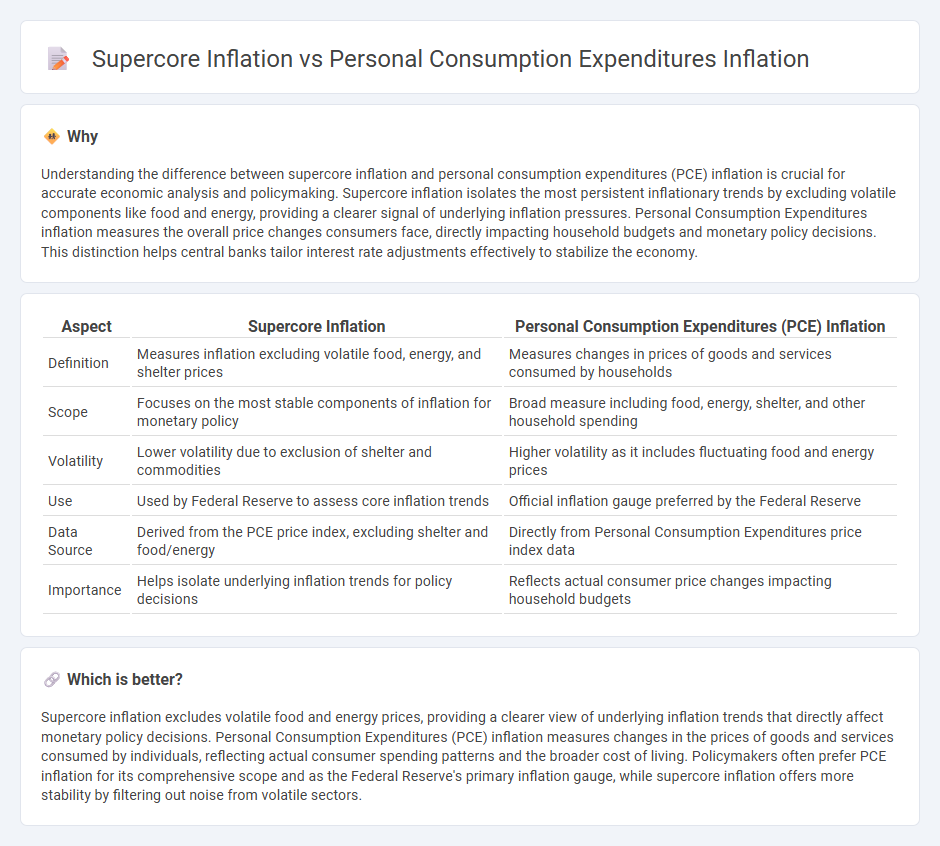

Understanding the difference between supercore inflation and personal consumption expenditures (PCE) inflation is crucial for accurate economic analysis and policymaking. Supercore inflation isolates the most persistent inflationary trends by excluding volatile components like food and energy, providing a clearer signal of underlying inflation pressures. Personal Consumption Expenditures inflation measures the overall price changes consumers face, directly impacting household budgets and monetary policy decisions. This distinction helps central banks tailor interest rate adjustments effectively to stabilize the economy.

Comparison Table

| Aspect | Supercore Inflation | Personal Consumption Expenditures (PCE) Inflation |

|---|---|---|

| Definition | Measures inflation excluding volatile food, energy, and shelter prices | Measures changes in prices of goods and services consumed by households |

| Scope | Focuses on the most stable components of inflation for monetary policy | Broad measure including food, energy, shelter, and other household spending |

| Volatility | Lower volatility due to exclusion of shelter and commodities | Higher volatility as it includes fluctuating food and energy prices |

| Use | Used by Federal Reserve to assess core inflation trends | Official inflation gauge preferred by the Federal Reserve |

| Data Source | Derived from the PCE price index, excluding shelter and food/energy | Directly from Personal Consumption Expenditures price index data |

| Importance | Helps isolate underlying inflation trends for policy decisions | Reflects actual consumer price changes impacting household budgets |

Which is better?

Supercore inflation excludes volatile food and energy prices, providing a clearer view of underlying inflation trends that directly affect monetary policy decisions. Personal Consumption Expenditures (PCE) inflation measures changes in the prices of goods and services consumed by individuals, reflecting actual consumer spending patterns and the broader cost of living. Policymakers often prefer PCE inflation for its comprehensive scope and as the Federal Reserve's primary inflation gauge, while supercore inflation offers more stability by filtering out noise from volatile sectors.

Connection

Supercore inflation, which excludes volatile food and energy prices, closely tracks long-term trends in personal consumption expenditures (PCE) inflation by reflecting underlying consumer demand pressures and wage growth. PCE inflation measures changes in the prices paid by consumers for goods and services, serving as a key indicator for Federal Reserve policy decisions. Together, supercore inflation and PCE inflation provide a comprehensive view of inflation dynamics, highlighting persistent price changes driven by sustained consumer spending patterns.

Key Terms

Core Inflation

Core Inflation, derived from personal consumption expenditures (PCE) inflation, excludes volatile food and energy prices to provide a clearer view of long-term inflation trends. Supercore Inflation further refines this measure by focusing on services inflation excluding housing, capturing persistent price pressures in the economy. Explore detailed analysis and data trends to deepen your understanding of this critical inflation metric.

Services Inflation

Personal consumption expenditures (PCE) inflation captures broad price changes across goods and services, while supercore inflation specifically measures the price trends of services excluding volatile categories like energy and food. Services inflation, a significant driver of supercore inflation, reflects steady wage growth and sustained consumer demand, often signaling persistent inflationary pressures beyond transient shocks. Explore deeper insights on how services sector dynamics influence inflation trajectory and monetary policy adjustments.

Expenditure Categories

Personal consumption expenditures (PCE) inflation measures the overall change in consumer spending prices, capturing key categories like durable goods, nondurable goods, and services. Supercore inflation, often tracked by focusing on services excluding housing, provides a more stable reflection of underlying inflation trends by filtering out volatile components. Explore detailed insights on how specific expenditure categories drive these inflation metrics.

Source and External Links

Personal Consumption Expenditures Price Index - The PCE price index measures inflation by tracking changes in prices of goods and services purchased by U.S. consumers, showing a 2.3% annual increase as of May 2025.

Personal Consumption Expenditures Price Index, Excluding Food and Energy - The core PCE price index excludes volatile food and energy prices to highlight underlying inflation trends and stood at 2.7% year-over-year in May 2025.

Median PCE Inflation - Federal Reserve Bank of Cleveland - The median PCE inflation rate, which provides a measure of underlying inflation by focusing on the median price change, helps forecast inflation trends beyond the volatile components included in the headline PCE index.

dowidth.com

dowidth.com