Revenge spending refers to the surge in consumer purchases following periods of economic restriction, often driven by pent-up demand and a desire to reclaim lost enjoyment. Frugality, in contrast, emphasizes cautious and deliberate spending habits aimed at maximizing savings and financial security amid economic uncertainty. Explore how these opposing behaviors impact market trends and personal finance strategies.

Why it is important

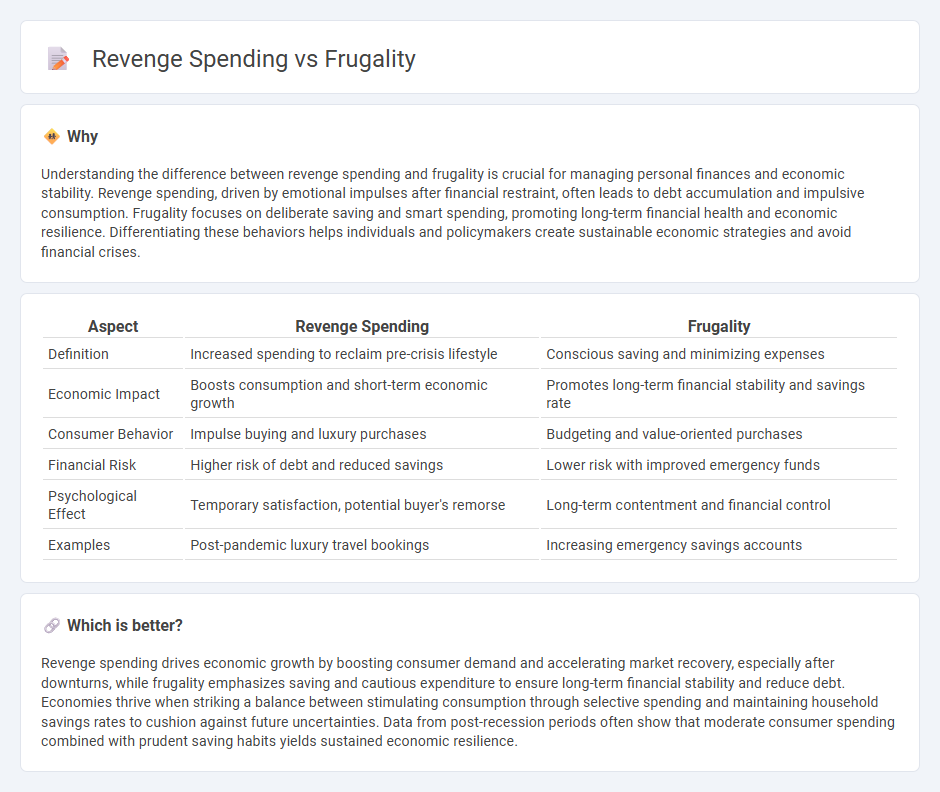

Understanding the difference between revenge spending and frugality is crucial for managing personal finances and economic stability. Revenge spending, driven by emotional impulses after financial restraint, often leads to debt accumulation and impulsive consumption. Frugality focuses on deliberate saving and smart spending, promoting long-term financial health and economic resilience. Differentiating these behaviors helps individuals and policymakers create sustainable economic strategies and avoid financial crises.

Comparison Table

| Aspect | Revenge Spending | Frugality |

|---|---|---|

| Definition | Increased spending to reclaim pre-crisis lifestyle | Conscious saving and minimizing expenses |

| Economic Impact | Boosts consumption and short-term economic growth | Promotes long-term financial stability and savings rate |

| Consumer Behavior | Impulse buying and luxury purchases | Budgeting and value-oriented purchases |

| Financial Risk | Higher risk of debt and reduced savings | Lower risk with improved emergency funds |

| Psychological Effect | Temporary satisfaction, potential buyer's remorse | Long-term contentment and financial control |

| Examples | Post-pandemic luxury travel bookings | Increasing emergency savings accounts |

Which is better?

Revenge spending drives economic growth by boosting consumer demand and accelerating market recovery, especially after downturns, while frugality emphasizes saving and cautious expenditure to ensure long-term financial stability and reduce debt. Economies thrive when striking a balance between stimulating consumption through selective spending and maintaining household savings rates to cushion against future uncertainties. Data from post-recession periods often show that moderate consumer spending combined with prudent saving habits yields sustained economic resilience.

Connection

Revenge spending and frugality are intertwined economic behaviors shaped by consumer response to financial stress. During periods of recovery, revenge spending spikes as individuals counterbalance previous austerity by increasing discretionary purchases, fueling economic growth. Conversely, frugality reflects cautious spending patterns that emerge from uncertainty, influencing savings rates and demand for essential goods.

Key Terms

Consumer Behavior

Consumer behavior reveals stark contrasts between frugality and revenge spending, influencing purchasing patterns and financial decision-making. Frugal consumers prioritize saving, value-conscious choices, and long-term financial security, while revenge spenders engage in impulsive, high-expenditure purchases driven by emotional responses and a desire for self-reward after restrictive periods. Explore how these opposing behaviors impact market trends and personal finance strategies to better understand consumer psychology.

Disposable Income

Disposable income plays a crucial role in distinguishing frugality from revenge spending, as frugal individuals allocate surplus funds towards savings and essential needs while those engaging in revenge spending often use it impulsively on luxury or non-essential items to cope with emotional stress. Understanding how disposable income is managed can reveal underlying financial habits and psychological triggers that drive spending behavior. Explore strategies to optimize disposable income for financial well-being and emotional balance.

Economic Cycle

During economic downturns, frugality often increases as consumers prioritize saving and essential spending, reflecting cautious behavior amid financial uncertainty. Conversely, revenge spending tends to surge during economic recoveries when pent-up demand and improved consumer confidence drive increased discretionary purchases. Explore how these contrasting spending behaviors influence market trends throughout economic cycles.

Source and External Links

Frugality - Wikipedia - Frugality is the quality of being frugal, sparing, thrifty, prudent, or economical in the consumption of resources such as food, time, or money, involving avoiding waste, extravagance, and adopting strategies like reducing waste and suppressing instant gratification to achieve longer-term goals.

Understanding Frugality: What It Means to Live Simply - Frugality means being intentional with resources, avoiding unnecessary expenses, and focusing on value to live economically while maintaining life's essentials comfortably, distinct from cheapness by prioritizing quality over merely low cost.

Frugality - Definition, Meaning & Synonyms - Frugality is about the unwillingness to waste rather than unwillingness to spend, often involving resourceful reuse and repurposing of items to save money and reduce waste.

dowidth.com

dowidth.com