Dollarization stabilizes economies by adopting a foreign currency, often the US dollar, reducing inflation and interest rate volatility. Fixed exchange rate systems tie a nation's currency value to another currency or basket, promoting trade stability and investor confidence while limiting monetary policy flexibility. Explore the impacts of these systems on economic growth and financial stability to understand their practical applications.

Why it is important

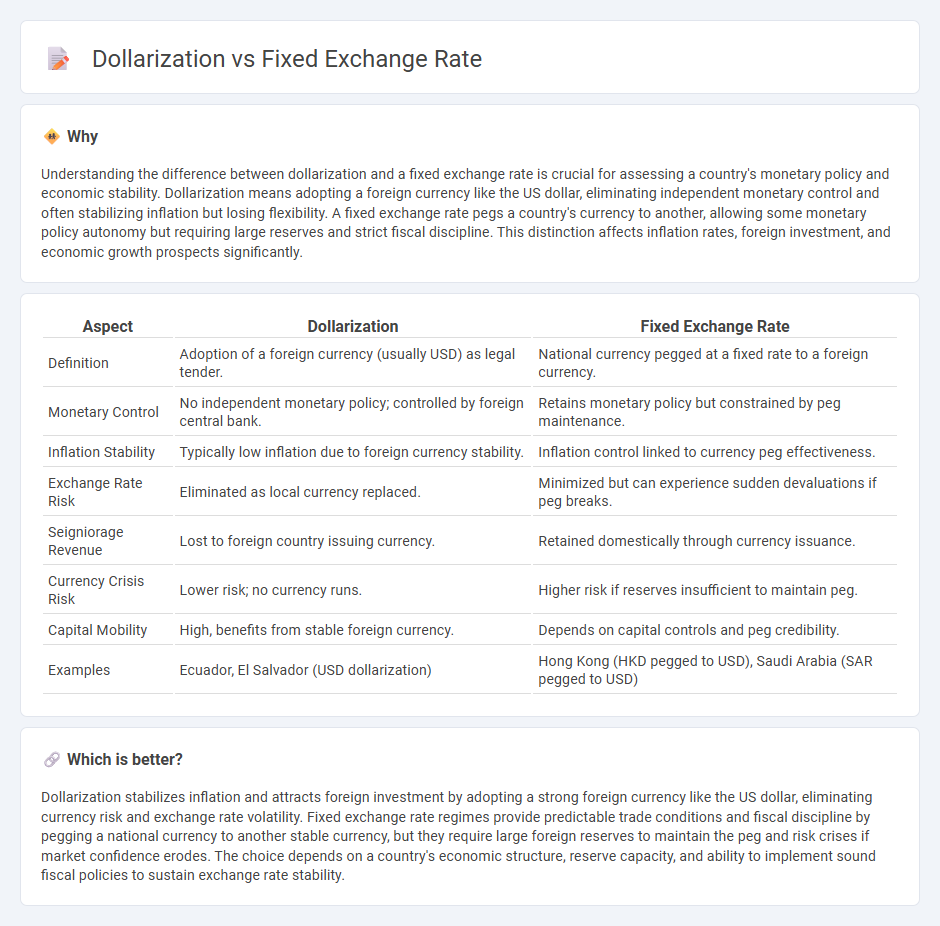

Understanding the difference between dollarization and a fixed exchange rate is crucial for assessing a country's monetary policy and economic stability. Dollarization means adopting a foreign currency like the US dollar, eliminating independent monetary control and often stabilizing inflation but losing flexibility. A fixed exchange rate pegs a country's currency to another, allowing some monetary policy autonomy but requiring large reserves and strict fiscal discipline. This distinction affects inflation rates, foreign investment, and economic growth prospects significantly.

Comparison Table

| Aspect | Dollarization | Fixed Exchange Rate |

|---|---|---|

| Definition | Adoption of a foreign currency (usually USD) as legal tender. | National currency pegged at a fixed rate to a foreign currency. |

| Monetary Control | No independent monetary policy; controlled by foreign central bank. | Retains monetary policy but constrained by peg maintenance. |

| Inflation Stability | Typically low inflation due to foreign currency stability. | Inflation control linked to currency peg effectiveness. |

| Exchange Rate Risk | Eliminated as local currency replaced. | Minimized but can experience sudden devaluations if peg breaks. |

| Seigniorage Revenue | Lost to foreign country issuing currency. | Retained domestically through currency issuance. |

| Currency Crisis Risk | Lower risk; no currency runs. | Higher risk if reserves insufficient to maintain peg. |

| Capital Mobility | High, benefits from stable foreign currency. | Depends on capital controls and peg credibility. |

| Examples | Ecuador, El Salvador (USD dollarization) | Hong Kong (HKD pegged to USD), Saudi Arabia (SAR pegged to USD) |

Which is better?

Dollarization stabilizes inflation and attracts foreign investment by adopting a strong foreign currency like the US dollar, eliminating currency risk and exchange rate volatility. Fixed exchange rate regimes provide predictable trade conditions and fiscal discipline by pegging a national currency to another stable currency, but they require large foreign reserves to maintain the peg and risk crises if market confidence erodes. The choice depends on a country's economic structure, reserve capacity, and ability to implement sound fiscal policies to sustain exchange rate stability.

Connection

Dollarization often involves adopting the US dollar as the official currency, which stabilizes the economy by eliminating exchange rate volatility inherent in fixed exchange rate regimes. Countries with fixed exchange rates may opt for dollarization to anchor their monetary policy to a stable currency, thus enhancing investor confidence and reducing inflation risks. The fixed exchange rate system's constraints on monetary policy encourage dollarization as a credible commitment to economic stability.

Key Terms

Currency Peg

A fixed exchange rate system involves a country pegging its currency to the US dollar at a predetermined rate, allowing for controlled exchange rate fluctuations to stabilize trade and investment. Dollarization refers to a country fully adopting the US dollar as its official currency, eliminating exchange rate risk but sacrificing independent monetary policy. Explore the advantages and drawbacks of currency pegs and dollarization to understand their impacts on economic stability.

Monetary Sovereignty

Fixed exchange rate regimes maintain monetary sovereignty by allowing central banks to control domestic monetary policy while pegging the local currency's value to the dollar, promoting stability without surrendering policy tools. Dollarization, where a country abandons its own currency in favor of the US dollar, sacrifices monetary sovereignty entirely, limiting national control over interest rates and money supply. Explore the implications of these choices to understand their impact on economic stability and policy autonomy.

Legal Tender

A fixed exchange rate system maintains the local currency's value pegged to the US dollar, ensuring legal tender status remains with the domestic currency. Dollarization, in contrast, replaces the domestic currency entirely with the US dollar, removing the local currency's legal tender status and integrating the dollar as the sole medium of exchange. Explore deeper implications of legal tender status in monetary policy and economic stability.

Source and External Links

Fixed exchange rate system - In a fixed exchange rate system, a government directly fixes its currency's value in a predetermined ratio to another currency, usually using open market operations or legal mandates to maintain stability.

Exchange Rates and their Measurement | Explainer - Pegged regimes tie a currency to another nation's currency, requiring the central bank to intervene in foreign exchange markets to keep the rate near its target, limiting monetary policy independence and necessitating large foreign reserves.

Exchange Rate Regimes in an Increasingly Integrated World - The Bretton Woods system exemplified a fixed but adjustable exchange rate framework, aiming to avoid undue volatility while allowing for adjustments when needed, but such regimes require strict monetary discipline and can limit economic flexibility.

dowidth.com

dowidth.com