Supercore inflation measures core inflation by excluding volatile food and energy prices, providing a stable gauge of persistent price changes. Chain-weighted inflation uses a dynamic basket of goods that adjusts over time to reflect consumer spending patterns, offering a more accurate measure of cost-of-living changes. Explore how these two inflation metrics impact economic policy and decision-making.

Why it is important

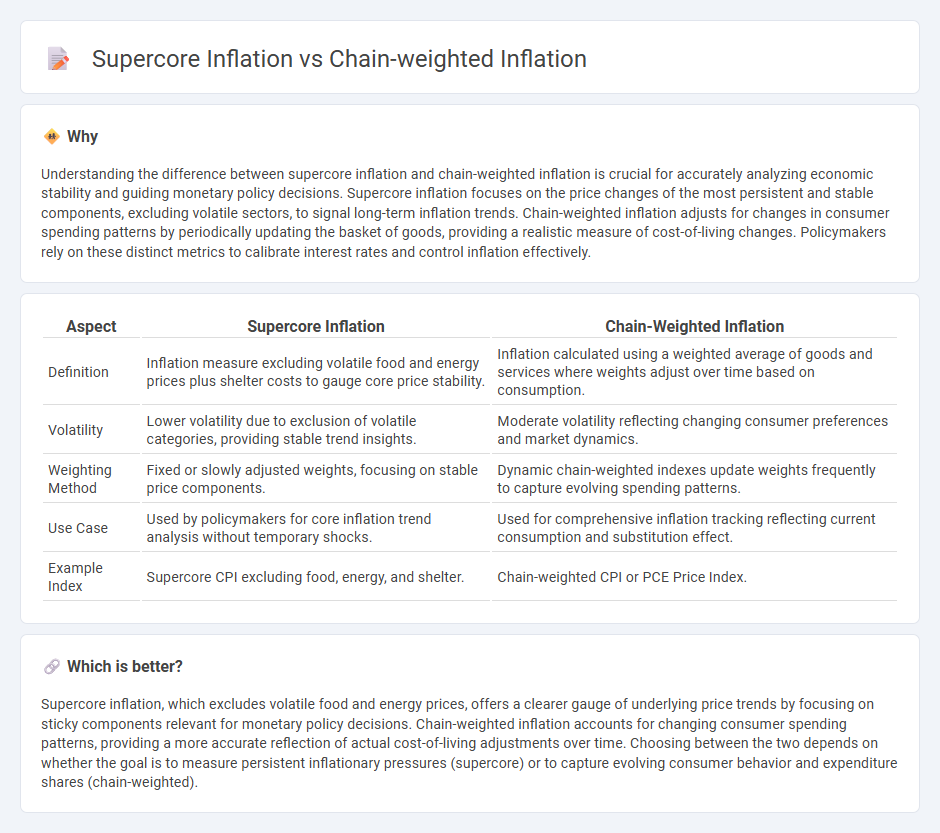

Understanding the difference between supercore inflation and chain-weighted inflation is crucial for accurately analyzing economic stability and guiding monetary policy decisions. Supercore inflation focuses on the price changes of the most persistent and stable components, excluding volatile sectors, to signal long-term inflation trends. Chain-weighted inflation adjusts for changes in consumer spending patterns by periodically updating the basket of goods, providing a realistic measure of cost-of-living changes. Policymakers rely on these distinct metrics to calibrate interest rates and control inflation effectively.

Comparison Table

| Aspect | Supercore Inflation | Chain-Weighted Inflation |

|---|---|---|

| Definition | Inflation measure excluding volatile food and energy prices plus shelter costs to gauge core price stability. | Inflation calculated using a weighted average of goods and services where weights adjust over time based on consumption. |

| Volatility | Lower volatility due to exclusion of volatile categories, providing stable trend insights. | Moderate volatility reflecting changing consumer preferences and market dynamics. |

| Weighting Method | Fixed or slowly adjusted weights, focusing on stable price components. | Dynamic chain-weighted indexes update weights frequently to capture evolving spending patterns. |

| Use Case | Used by policymakers for core inflation trend analysis without temporary shocks. | Used for comprehensive inflation tracking reflecting current consumption and substitution effect. |

| Example Index | Supercore CPI excluding food, energy, and shelter. | Chain-weighted CPI or PCE Price Index. |

Which is better?

Supercore inflation, which excludes volatile food and energy prices, offers a clearer gauge of underlying price trends by focusing on sticky components relevant for monetary policy decisions. Chain-weighted inflation accounts for changing consumer spending patterns, providing a more accurate reflection of actual cost-of-living adjustments over time. Choosing between the two depends on whether the goal is to measure persistent inflationary pressures (supercore) or to capture evolving consumer behavior and expenditure shares (chain-weighted).

Connection

Supercore inflation, which excludes volatile food and energy prices, provides a clearer view of underlying inflation trends, while chain-weighted inflation reflects changes in consumer spending patterns by using a dynamic basket of goods and services. The connection between the two lies in their ability to measure inflation more accurately by filtering out short-term volatility and incorporating evolving consumption behavior, respectively. Together, they improve economic policy decisions by offering a comprehensive understanding of inflation dynamics beyond headline inflation rates.

Key Terms

Price Index

Chain-weighted inflation measures changes in the price level using a dynamic basket of goods that adjusts for shifts in consumer spending patterns, providing a more accurate reflection of real inflation trends. Supercore inflation isolates the most persistent components of price changes by excluding volatile items, offering insights into underlying inflation pressures within the Price Index. Explore the distinctions and applications of these inflation metrics to better understand economic dynamics.

Core Goods and Services

Chain-weighted inflation measures price changes over time, adjusting for shifting consumer spending patterns and reflecting dynamic Core Goods and Services costs. Supercore inflation isolates persistent price changes within Core Services, emphasizing elements less influenced by volatile goods prices, providing insight into underlying inflation trends. Explore deeper insights into how these metrics shape economic policy and inflation forecasting.

Weights Adjustment

Chain-weighted inflation adjusts price index weights annually to reflect current consumption patterns, improving accuracy in measuring changes in the cost of living. Supercore inflation isolates price changes in sectors with stable demand, such as services, providing a clearer signal of underlying inflation trends unaffected by volatile goods prices. Explore how these weighting methodologies impact inflation measurement and policy decisions further.

Source and External Links

What Is the Chained Consumer Price Index (CPI)? - SmartAsset - The Chained CPI is an inflation measure that accounts for changes in consumer behavior by continuously updating the goods and services included, reflecting substitutions consumers make toward cheaper alternatives, which reduces upward bias in inflation measurement.

United States Chained Consumer Price Index - Wikipedia - The United States Chained CPI (C-CPI-U), or chain-weighted CPI, measures price changes while accounting for consumer substitution between goods when relative prices change, providing a more accurate reflection of living cost changes than the fixed-weight CPI.

The Hutchins Center Explains: The Chained CPI - Brookings Institution - The chained CPI tends to rise more slowly than the traditional CPI because it accounts for consumer substitution away from goods with large price increases, affecting tax bracket adjustments and potentially increasing tax revenues over time.

dowidth.com

dowidth.com