The gig economy is characterized by short-term, flexible jobs often facilitated through digital platforms, enabling workers to engage in freelance or contract work with varying degrees of autonomy. In contrast, the informal economy encompasses unregulated, cash-based activities that typically lack formal contracts, social protections, or legal oversight, often operating outside government taxation and labor regulations. Explore the distinctions, impacts, and growth trends of both economic models to understand their roles in modern labor markets.

Why it is important

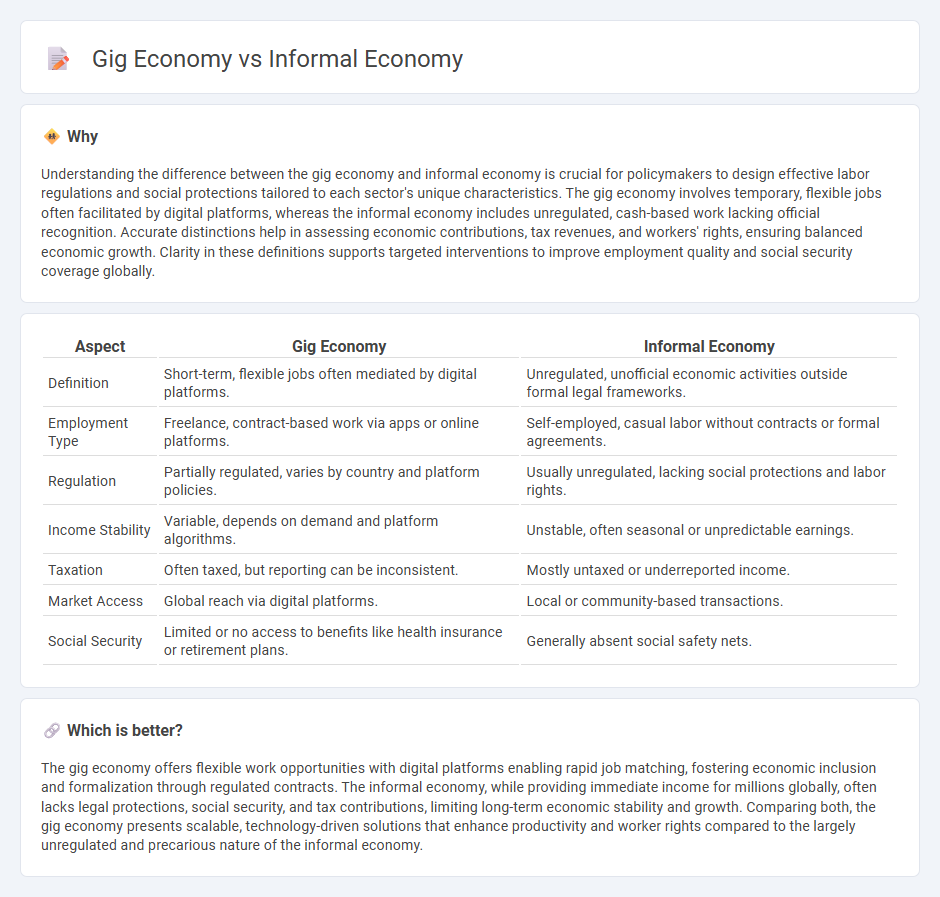

Understanding the difference between the gig economy and informal economy is crucial for policymakers to design effective labor regulations and social protections tailored to each sector's unique characteristics. The gig economy involves temporary, flexible jobs often facilitated by digital platforms, whereas the informal economy includes unregulated, cash-based work lacking official recognition. Accurate distinctions help in assessing economic contributions, tax revenues, and workers' rights, ensuring balanced economic growth. Clarity in these definitions supports targeted interventions to improve employment quality and social security coverage globally.

Comparison Table

| Aspect | Gig Economy | Informal Economy |

|---|---|---|

| Definition | Short-term, flexible jobs often mediated by digital platforms. | Unregulated, unofficial economic activities outside formal legal frameworks. |

| Employment Type | Freelance, contract-based work via apps or online platforms. | Self-employed, casual labor without contracts or formal agreements. |

| Regulation | Partially regulated, varies by country and platform policies. | Usually unregulated, lacking social protections and labor rights. |

| Income Stability | Variable, depends on demand and platform algorithms. | Unstable, often seasonal or unpredictable earnings. |

| Taxation | Often taxed, but reporting can be inconsistent. | Mostly untaxed or underreported income. |

| Market Access | Global reach via digital platforms. | Local or community-based transactions. |

| Social Security | Limited or no access to benefits like health insurance or retirement plans. | Generally absent social safety nets. |

Which is better?

The gig economy offers flexible work opportunities with digital platforms enabling rapid job matching, fostering economic inclusion and formalization through regulated contracts. The informal economy, while providing immediate income for millions globally, often lacks legal protections, social security, and tax contributions, limiting long-term economic stability and growth. Comparing both, the gig economy presents scalable, technology-driven solutions that enhance productivity and worker rights compared to the largely unregulated and precarious nature of the informal economy.

Connection

The gig economy and informal economy are interconnected through their flexible, on-demand work structures that often operate outside traditional labor regulations. Both sectors rely heavily on digital platforms and freelance opportunities, facilitating income generation without formal employment contracts. This overlap influences labor market dynamics, tax revenue, and social security systems worldwide.

Key Terms

Regulation

The informal economy operates largely outside formal regulatory frameworks, lacking legal protections and formal employment benefits, while the gig economy, although often classified as part of the informal sector, involves digital platforms that have prompted new regulatory measures targeting worker classification, tax obligations, and platform accountability. Regulatory approaches for the gig economy vary widely, with some jurisdictions implementing laws to secure minimum wages, social security, and dispute resolution mechanisms for gig workers. Explore evolving regulatory landscapes to understand how governments balance innovation with worker rights in the gig and informal economies.

Flexibility

The informal economy thrives on unregulated, often cash-based activities offering workers flexible schedules but minimal legal protections or benefits. Gig economy platforms like Uber and Fiverr provide digital tools that enable on-demand, task-based work with enhanced transparency, payment tracking, and some control over working hours. Explore how differing levels of flexibility impact income stability and worker rights in both economic models.

Employment status

The informal economy consists of unregulated, often cash-based jobs without formal employment contracts, providing opportunities primarily for marginalized workers lacking social protections. The gig economy, characterized by digital platforms, offers flexible, task-based gigs where workers are typically considered independent contractors without traditional benefits or job security. Explore the distinctions between these employment statuses to understand their implications on labor rights and economic inclusion.

Source and External Links

Informal Economy | EBSCO Research Starters - The informal economy includes economic activities outside formal regulations and taxes, providing significant employment and goods but lacking job security and legal protections, playing a vital role in both developed and developing countries.

The Informal Economy: Definitions, Theories and Policies - The informal economy is a major global labor sector, historically recognized for its income-generating capacity for marginalized workers and its potential to reduce poverty despite limited formal employment opportunities.

Informal economy - Wikipedia - The informal economy consists of unregulated and untaxed economic activities that have expanded since the 1960s, often due to insufficient formal job creation and globalization, resulting in a large share of economic activity and employment in many regions.

dowidth.com

dowidth.com