Unretirement, the trend of returning to work after retirement, contrasts with early retirement, where individuals leave the workforce ahead of the traditional retirement age, often around 55 to 65 years old. Factors driving unretirement include financial needs, desire for social engagement, and personal fulfillment, while early retirement is frequently motivated by financial independence and lifestyle choices. Explore in-depth insights on how unretirement and early retirement shape modern economic behaviors.

Why it is important

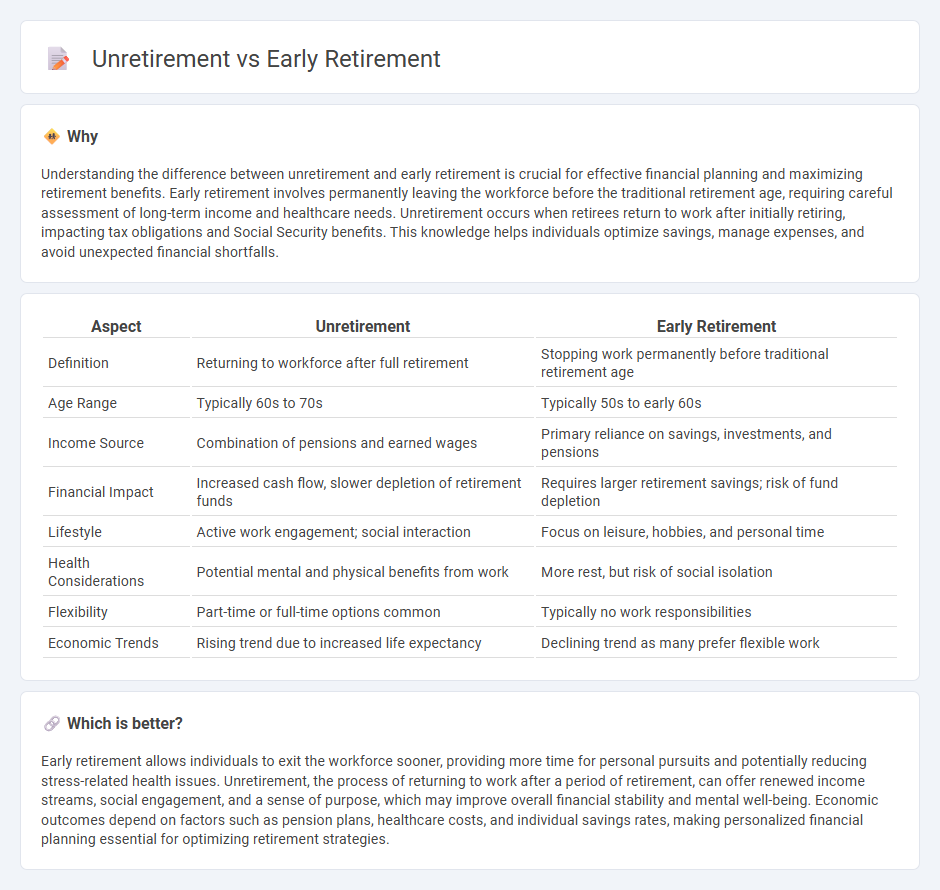

Understanding the difference between unretirement and early retirement is crucial for effective financial planning and maximizing retirement benefits. Early retirement involves permanently leaving the workforce before the traditional retirement age, requiring careful assessment of long-term income and healthcare needs. Unretirement occurs when retirees return to work after initially retiring, impacting tax obligations and Social Security benefits. This knowledge helps individuals optimize savings, manage expenses, and avoid unexpected financial shortfalls.

Comparison Table

| Aspect | Unretirement | Early Retirement |

|---|---|---|

| Definition | Returning to workforce after full retirement | Stopping work permanently before traditional retirement age |

| Age Range | Typically 60s to 70s | Typically 50s to early 60s |

| Income Source | Combination of pensions and earned wages | Primary reliance on savings, investments, and pensions |

| Financial Impact | Increased cash flow, slower depletion of retirement funds | Requires larger retirement savings; risk of fund depletion |

| Lifestyle | Active work engagement; social interaction | Focus on leisure, hobbies, and personal time |

| Health Considerations | Potential mental and physical benefits from work | More rest, but risk of social isolation |

| Flexibility | Part-time or full-time options common | Typically no work responsibilities |

| Economic Trends | Rising trend due to increased life expectancy | Declining trend as many prefer flexible work |

Which is better?

Early retirement allows individuals to exit the workforce sooner, providing more time for personal pursuits and potentially reducing stress-related health issues. Unretirement, the process of returning to work after a period of retirement, can offer renewed income streams, social engagement, and a sense of purpose, which may improve overall financial stability and mental well-being. Economic outcomes depend on factors such as pension plans, healthcare costs, and individual savings rates, making personalized financial planning essential for optimizing retirement strategies.

Connection

Unretirement and early retirement are interconnected trends shaping modern labor markets, where individuals retire early but soon re-enter the workforce due to financial needs or desire for purpose. Early retirement often leads to unretirement as pension shortfalls, rising healthcare costs, or economic instability compel retirees to seek additional income. These dynamics reflect shifting economic conditions impacting retirement planning and labor force participation rates globally.

Key Terms

Financial Independence

Financial Independence enables early retirement by providing sufficient passive income to cover living expenses without work, allowing individuals to leave their careers earlier than traditional retirement age. Unretirement occurs when financially independent individuals resume work for personal fulfillment or additional income, blurring the lines between retirement and employment. Explore strategies for balancing financial security and personal goals in both early retirement and unretirement scenarios.

Pension Systems

Pension systems play a crucial role in both early retirement and unretirement decisions, influencing financial security and benefit eligibility. Early retirement often results in reduced pension benefits due to shorter contribution periods, while unretirement may involve recalculating or reactivating pension entitlements depending on system regulations. Explore how different pension frameworks impact retirement strategies and financial planning.

Labor Force Participation

Early retirement traditionally signifies withdrawing from the labor force before the conventional retirement age, often motivated by financial independence or health considerations. Unretirement involves re-entering the labor force after a period of retirement, driven by financial needs, social engagement, or evolving career interests, leading to increased labor force participation rates among older adults. Explore the dynamics of labor force participation in early retirement and unretirement to better understand these shifting workforce trends.

Source and External Links

How to retire early in 8 steps - Fidelity Investments - Early retirement requires careful planning including estimating retirement expenses, saving aggressively, investing for growth, and considering lifestyle changes to reach your goal sooner.

Types of Retirement - OPM - Voluntary early retirement eligibility depends on age and years of service, with specific minimum requirements such as age 62 with 5 years of service or age 60 with 20 years of service, along with other special provisions for certain jobs.

Can You Afford to Retire Early? - Charles Schwab - Key considerations for early retirement include securing health insurance until Medicare eligibility at 65 and managing a balanced investment portfolio to protect against losses while aiming for growth during a potentially long retirement.

dowidth.com

dowidth.com