The shrinking middle class reflects growing income inequality, creating pressure for tax redistribution policies to promote economic equity and social stability. Progressive taxation redistributes wealth by increasing tax rates on higher incomes, funding social programs that support lower and middle-income households. Explore how these fiscal strategies impact economic mobility and the broader economy.

Why it is important

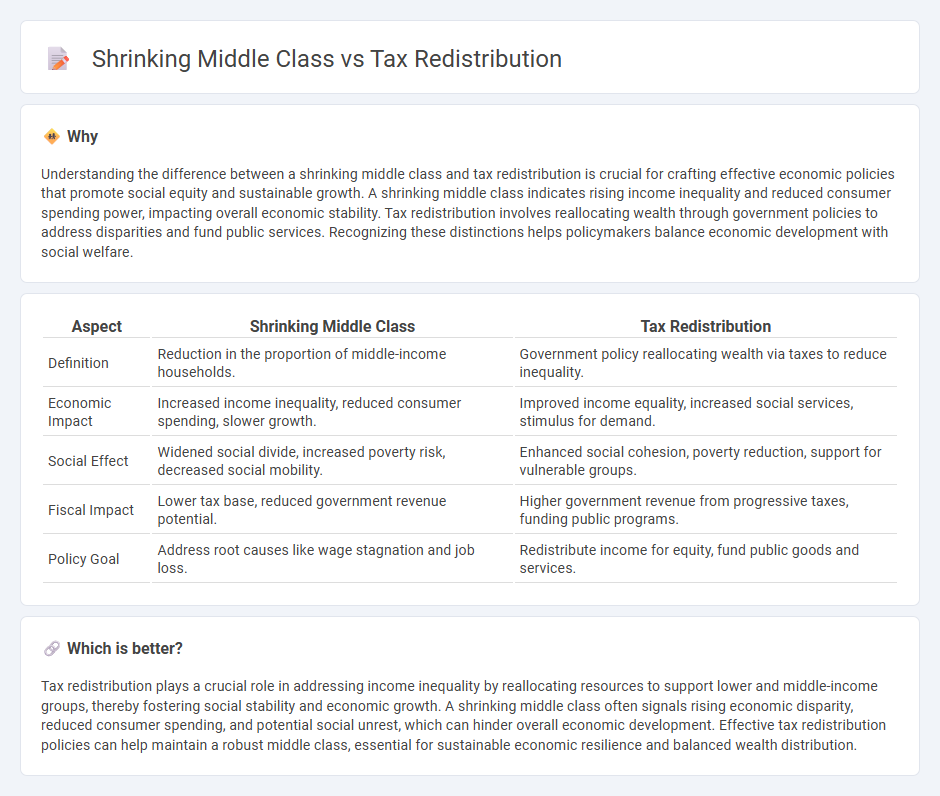

Understanding the difference between a shrinking middle class and tax redistribution is crucial for crafting effective economic policies that promote social equity and sustainable growth. A shrinking middle class indicates rising income inequality and reduced consumer spending power, impacting overall economic stability. Tax redistribution involves reallocating wealth through government policies to address disparities and fund public services. Recognizing these distinctions helps policymakers balance economic development with social welfare.

Comparison Table

| Aspect | Shrinking Middle Class | Tax Redistribution |

|---|---|---|

| Definition | Reduction in the proportion of middle-income households. | Government policy reallocating wealth via taxes to reduce inequality. |

| Economic Impact | Increased income inequality, reduced consumer spending, slower growth. | Improved income equality, increased social services, stimulus for demand. |

| Social Effect | Widened social divide, increased poverty risk, decreased social mobility. | Enhanced social cohesion, poverty reduction, support for vulnerable groups. |

| Fiscal Impact | Lower tax base, reduced government revenue potential. | Higher government revenue from progressive taxes, funding public programs. |

| Policy Goal | Address root causes like wage stagnation and job loss. | Redistribute income for equity, fund public goods and services. |

Which is better?

Tax redistribution plays a crucial role in addressing income inequality by reallocating resources to support lower and middle-income groups, thereby fostering social stability and economic growth. A shrinking middle class often signals rising economic disparity, reduced consumer spending, and potential social unrest, which can hinder overall economic development. Effective tax redistribution policies can help maintain a robust middle class, essential for sustainable economic resilience and balanced wealth distribution.

Connection

Shrinking middle class reduces consumer spending, which constrains economic growth and limits tax revenue. Tax redistribution policies aim to address income inequality by reallocating wealth from higher-income groups to support social programs benefiting the middle and lower classes. Effective redistribution can stabilize demand and promote a more balanced economy by enhancing purchasing power within the shrinking middle class.

Key Terms

Progressive Taxation

Progressive taxation aims to reduce income inequality by imposing higher tax rates on the wealthy, thereby redistributing wealth to support social programs and public services that benefit lower- and middle-income groups. This mechanism counters the shrinking middle class by funding education, healthcare, and social safety nets, which enhance economic mobility and stabilize consumer spending. Explore how progressive tax policies can reshape economic structures and fortify the middle class further.

Income Inequality

Tax redistribution plays a critical role in addressing income inequality by reallocating wealth from higher earners to lower-income groups, thereby reducing the income gap and supporting economic stability. The shrinking middle class exacerbates social stratification and limits economic mobility, as fewer households maintain stable incomes and access to resources. Explore data-driven insights on how policy reforms can balance tax redistribution and bolster the middle class to promote equitable growth.

Wealth Gap

Tax redistribution policies aim to reduce income inequality by reallocating resources from the wealthy to lower-income groups, addressing the growing wealth gap exacerbated by a shrinking middle class. As middle-class incomes stagnate or decline, tax structures that favor the affluent can deepen economic disparities, hindering social mobility and economic stability. Explore how targeted tax reforms can promote equity and revitalize the middle class through sustainable wealth distribution.

Source and External Links

Rethinking Redistribution - Discusses how progressive taxation redistributes income from the rich to the poor and among the non-poor in the U.S.

U.S. Tax Progressivity and Redistribution - Analyzes the increase in U.S. tax progressivity and its redistributive effects since 1979.

Government Redistribution and Development - Examines the global role of taxes and transfers in reducing inequality, with a focus on how transfers dominate redistributive effects.

dowidth.com

dowidth.com