Locavesting promotes investing in local businesses to boost regional economic growth and community resilience, while microfinance offers small loans to underserved entrepreneurs to stimulate financial inclusion and poverty alleviation. Both strategies empower grassroots economic development but target different scales and mechanisms of capital distribution. Explore how locavesting and microfinance can reshape sustainable economic frameworks.

Why it is important

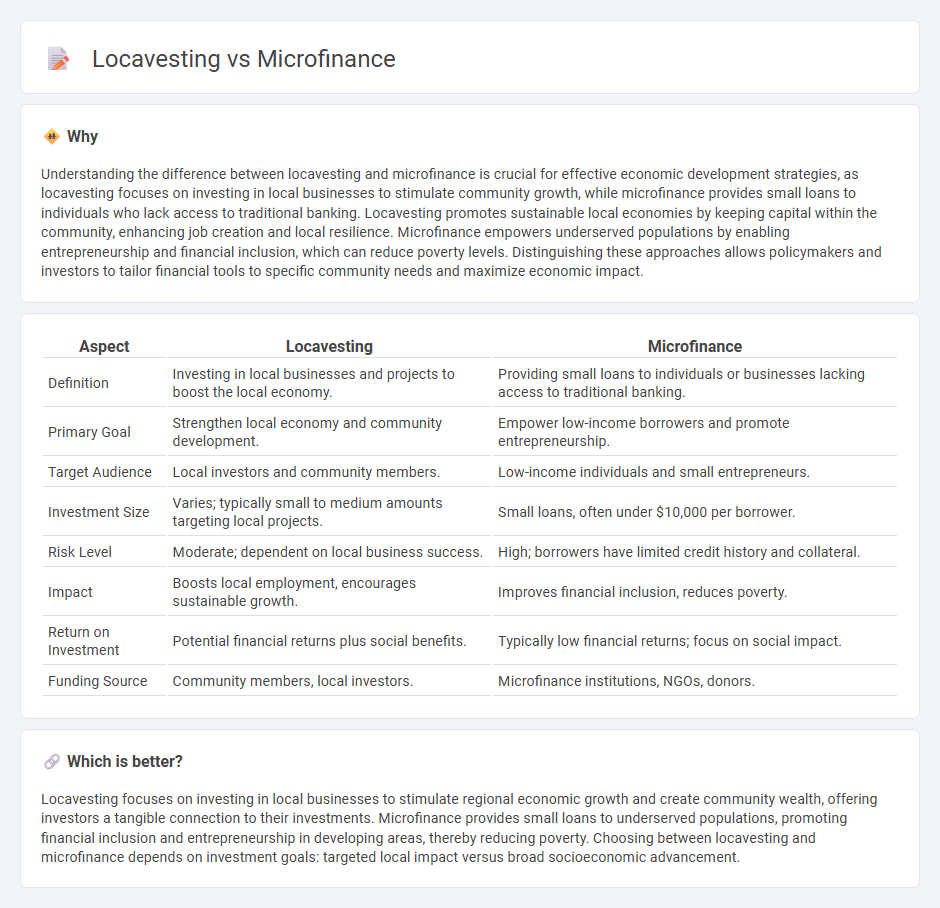

Understanding the difference between locavesting and microfinance is crucial for effective economic development strategies, as locavesting focuses on investing in local businesses to stimulate community growth, while microfinance provides small loans to individuals who lack access to traditional banking. Locavesting promotes sustainable local economies by keeping capital within the community, enhancing job creation and local resilience. Microfinance empowers underserved populations by enabling entrepreneurship and financial inclusion, which can reduce poverty levels. Distinguishing these approaches allows policymakers and investors to tailor financial tools to specific community needs and maximize economic impact.

Comparison Table

| Aspect | Locavesting | Microfinance |

|---|---|---|

| Definition | Investing in local businesses and projects to boost the local economy. | Providing small loans to individuals or businesses lacking access to traditional banking. |

| Primary Goal | Strengthen local economy and community development. | Empower low-income borrowers and promote entrepreneurship. |

| Target Audience | Local investors and community members. | Low-income individuals and small entrepreneurs. |

| Investment Size | Varies; typically small to medium amounts targeting local projects. | Small loans, often under $10,000 per borrower. |

| Risk Level | Moderate; dependent on local business success. | High; borrowers have limited credit history and collateral. |

| Impact | Boosts local employment, encourages sustainable growth. | Improves financial inclusion, reduces poverty. |

| Return on Investment | Potential financial returns plus social benefits. | Typically low financial returns; focus on social impact. |

| Funding Source | Community members, local investors. | Microfinance institutions, NGOs, donors. |

Which is better?

Locavesting focuses on investing in local businesses to stimulate regional economic growth and create community wealth, offering investors a tangible connection to their investments. Microfinance provides small loans to underserved populations, promoting financial inclusion and entrepreneurship in developing areas, thereby reducing poverty. Choosing between locavesting and microfinance depends on investment goals: targeted local impact versus broad socioeconomic advancement.

Connection

Locavesting promotes local economic growth by encouraging investments in nearby small businesses and community projects, aligning closely with microfinance's goal of providing small loans to underserved entrepreneurs. Both concepts empower local entrepreneurs, increasing financial inclusion and fostering sustainable development within communities. By channeling capital into grassroots ventures, locavesting and microfinance collectively stimulate job creation and economic resilience at the local level.

Key Terms

**Microfinance:**

Microfinance provides small loans and financial services to low-income individuals or entrepreneurs who lack access to traditional banking, enabling poverty alleviation and economic empowerment in underserved regions. Locavesting emphasizes investing in local businesses and communities, promoting economic growth and sustainability within a specific geographic area. Explore how microfinance drives global financial inclusion and supports grassroots development initiatives.

Microloans

Microloans in microfinance provide small, accessible credit to underserved entrepreneurs, enabling business growth and poverty alleviation in developing regions. Locavesting emphasizes investing in local businesses, fostering community economic development and transparent financial returns. Explore how microloans empower local economies through targeted financial inclusion by learning more about microfinance and locavesting strategies.

Financial inclusion

Microfinance provides small loans and financial services to underserved populations, enabling entrepreneurship and poverty alleviation in low-income communities. Locavesting focuses on investing in local businesses to stimulate regional economic growth and create sustainable job opportunities within the community. Explore the impact of both approaches on expanding financial inclusion and driving economic empowerment.

Source and External Links

Microfinance 101: All you need to know - Kiva - Microfinance provides financial services like loans and savings to individuals and small businesses lacking access to traditional banking, addressing barriers such as poverty and systemic inequality for over 1.7 billion unbanked adults worldwide.

Microfinancing Basics - My Own Business Institute - Microfinance delivers small loans and increasing savings and insurance to entrepreneurs without access to traditional financial services, helping them create and grow businesses with various lender types and considerations like interest rates and collateral.

Microfinance - What We Do | UNRWA - UNRWA's microfinance program provides credit and financial services to Palestine refugees and marginalized groups to support income generation, job creation, poverty reduction, and empowerment, especially focusing on women and youth.

dowidth.com

dowidth.com