Neobanks leverage cutting-edge digital platforms to offer streamlined financial services, reshaping traditional banking landscapes dominated by central banks. Central banks retain control over monetary policy and financial stability, while neobanks focus on consumer-centric innovations and accessibility. Discover how neobank stacking is transforming economic systems beyond the conventional central banking model.

Why it is important

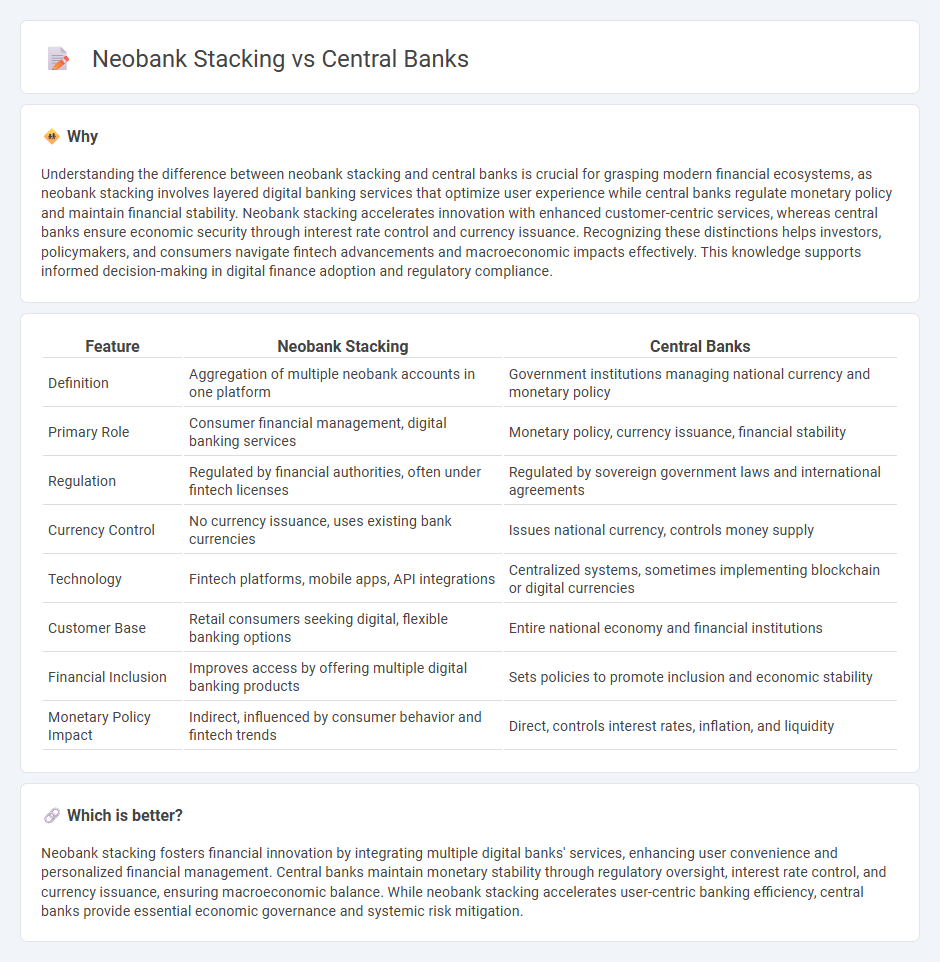

Understanding the difference between neobank stacking and central banks is crucial for grasping modern financial ecosystems, as neobank stacking involves layered digital banking services that optimize user experience while central banks regulate monetary policy and maintain financial stability. Neobank stacking accelerates innovation with enhanced customer-centric services, whereas central banks ensure economic security through interest rate control and currency issuance. Recognizing these distinctions helps investors, policymakers, and consumers navigate fintech advancements and macroeconomic impacts effectively. This knowledge supports informed decision-making in digital finance adoption and regulatory compliance.

Comparison Table

| Feature | Neobank Stacking | Central Banks |

|---|---|---|

| Definition | Aggregation of multiple neobank accounts in one platform | Government institutions managing national currency and monetary policy |

| Primary Role | Consumer financial management, digital banking services | Monetary policy, currency issuance, financial stability |

| Regulation | Regulated by financial authorities, often under fintech licenses | Regulated by sovereign government laws and international agreements |

| Currency Control | No currency issuance, uses existing bank currencies | Issues national currency, controls money supply |

| Technology | Fintech platforms, mobile apps, API integrations | Centralized systems, sometimes implementing blockchain or digital currencies |

| Customer Base | Retail consumers seeking digital, flexible banking options | Entire national economy and financial institutions |

| Financial Inclusion | Improves access by offering multiple digital banking products | Sets policies to promote inclusion and economic stability |

| Monetary Policy Impact | Indirect, influenced by consumer behavior and fintech trends | Direct, controls interest rates, inflation, and liquidity |

Which is better?

Neobank stacking fosters financial innovation by integrating multiple digital banks' services, enhancing user convenience and personalized financial management. Central banks maintain monetary stability through regulatory oversight, interest rate control, and currency issuance, ensuring macroeconomic balance. While neobank stacking accelerates user-centric banking efficiency, central banks provide essential economic governance and systemic risk mitigation.

Connection

Neobank stacking leverages digital banking platforms to enhance financial accessibility, driving increased transaction volumes that central banks monitor for monetary policy adjustments. Central banks analyze data from neobank activities to assess liquidity flow and economic trends, influencing interest rate decisions and regulatory frameworks. This interplay supports a modernized financial ecosystem where central bank oversight ensures stability amid the rapid growth of digital banking services.

Key Terms

Monetary Policy

Central banks control monetary policy through traditional instruments like interest rates and reserve requirements to regulate inflation and economic growth, ensuring financial stability at a macro level. Neobank stacking leverages digital platforms to provide personalized banking services, but lacks direct influence on broader monetary policy mechanisms. Explore how these distinct roles shape the financial ecosystem in more detail.

Digital Banking Infrastructure

Central banks play a crucial role in regulating and supporting digital banking infrastructure by ensuring financial stability and enforcing compliance standards. Neobanks rely on modern, cloud-based technologies and APIs to create agile, customer-centric digital banking platforms that often integrate multiple financial services in one app. Explore deeper insights into how these differing infrastructures impact the future of digital banking innovation and security.

Regulatory Framework

Central banks operate under stringent regulatory frameworks designed to maintain financial stability, enforce monetary policy, and protect consumer interests. Neobanks, often emerging under lighter regulatory oversight, prioritize agility and innovation but face evolving compliance standards, including KYC, AML, and data protection laws. Explore the detailed regulatory distinctions between central banks and neobanks to understand their impacts on the digital finance landscape.

Source and External Links

A Brief History of Central Banks - Federal Reserve Bank of Cleveland - Central banks are authorities that manage a country's supply of money and credit using monetary policy tools to achieve goals like price stability, economic growth, and financial stability.

Central bank - Wikipedia - Central banks often operate independently from governments to implement monetary policy focused on long-term economic health, with governance structures ensuring limited political interference.

Monetary Policy and Central Banking - IMF - Central banks use monetary policy to manage economic fluctuations, ensure price stability, and promote financial stability, employing unconventional tools during crises and independent macroprudential policies.

dowidth.com

dowidth.com