Economic scarring refers to the long-term damage to an economy caused by recessions, including reduced labor market participation and diminished capital investment. The output gap measures the difference between actual economic output and potential GDP, indicating underused resources during downturns. Explore deeper insights into economic scarring and output gap for a comprehensive understanding of recovery challenges.

Why it is important

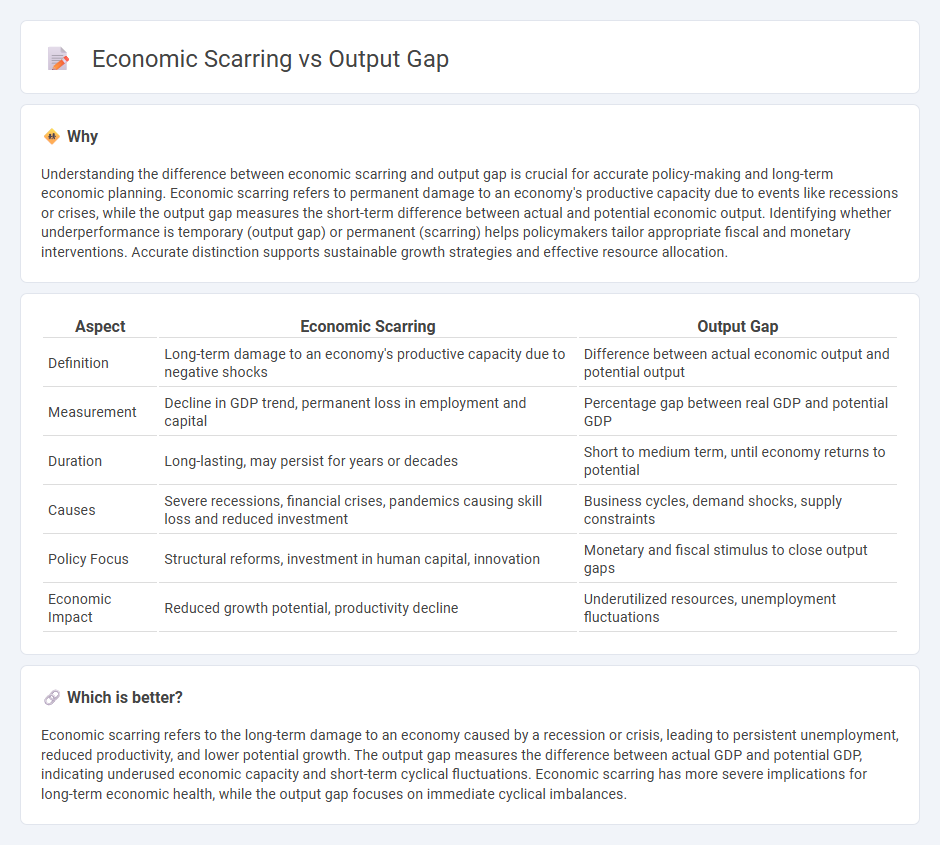

Understanding the difference between economic scarring and output gap is crucial for accurate policy-making and long-term economic planning. Economic scarring refers to permanent damage to an economy's productive capacity due to events like recessions or crises, while the output gap measures the short-term difference between actual and potential economic output. Identifying whether underperformance is temporary (output gap) or permanent (scarring) helps policymakers tailor appropriate fiscal and monetary interventions. Accurate distinction supports sustainable growth strategies and effective resource allocation.

Comparison Table

| Aspect | Economic Scarring | Output Gap |

|---|---|---|

| Definition | Long-term damage to an economy's productive capacity due to negative shocks | Difference between actual economic output and potential output |

| Measurement | Decline in GDP trend, permanent loss in employment and capital | Percentage gap between real GDP and potential GDP |

| Duration | Long-lasting, may persist for years or decades | Short to medium term, until economy returns to potential |

| Causes | Severe recessions, financial crises, pandemics causing skill loss and reduced investment | Business cycles, demand shocks, supply constraints |

| Policy Focus | Structural reforms, investment in human capital, innovation | Monetary and fiscal stimulus to close output gaps |

| Economic Impact | Reduced growth potential, productivity decline | Underutilized resources, unemployment fluctuations |

Which is better?

Economic scarring refers to the long-term damage to an economy caused by a recession or crisis, leading to persistent unemployment, reduced productivity, and lower potential growth. The output gap measures the difference between actual GDP and potential GDP, indicating underused economic capacity and short-term cyclical fluctuations. Economic scarring has more severe implications for long-term economic health, while the output gap focuses on immediate cyclical imbalances.

Connection

Economic scarring refers to the long-term damage to an economy's productive capacity caused by recessions, such as persistent unemployment and reduced investment. The output gap measures the difference between actual GDP and potential GDP, indicating underutilized economic resources. Prolonged economic scarring widens the output gap by lowering potential output and constraining economic recovery.

Key Terms

Potential GDP

The output gap measures the difference between actual GDP and potential GDP, highlighting underutilized economic resources during downturns. Economic scarring refers to long-term damage to potential GDP caused by prolonged recessions, reducing the economy's capacity for growth. Explore how minimizing output gaps can prevent economic scarring and sustain potential GDP growth.

Unemployment

The output gap measures the difference between an economy's actual and potential GDP, often reflecting cyclical unemployment fluctuations. Economic scarring refers to long-term damage, such as persistent unemployment, that reduces workforce skills and labor market participation even after recovery. Explore how these concepts impact unemployment rates and labor market dynamics in depth.

Long-term productivity

The output gap measures the difference between actual and potential economic output, highlighting short-term cyclical fluctuations, while economic scarring refers to the persistent damage to long-term productivity caused by recessions, such as reduced workforce skills and capital investment. Long-term productivity growth is crucial for sustainable economic expansion and can be undermined by prolonged unemployment and diminished innovation capacity. Explore how policymakers balance closing the output gap with mitigating economic scarring to foster resilient economic growth.

Source and External Links

Understanding Potential GDP and the Output Gap | St. Louis Fed - The output gap is the percentage difference between an economy's actual output and its potential output, indicating whether the economy is underperforming (negative gap) or overcapacity (positive gap), a key measure used by policymakers to assess economic health.

What Is the Output Gap? - Back to Basics, IMF - The output gap measures how much actual economic output differs from the maximum possible productive capacity, showing inefficiency when the economy produces above (positive gap) or below (negative gap) its full potential.

Understanding the output gap - Bank of Canada - The output gap quantifies the difference between actual production and the ideal balanced output where supply meets demand, affecting inflation, employment, and pricing pressures in the economy.

dowidth.com

dowidth.com