Shrinkflation occurs when companies reduce product sizes or quantities while maintaining prices, effectively increasing the cost per unit for consumers. Devaluation involves a deliberate reduction in a country's currency value, impacting import prices and inflation rates. Explore these economic concepts to understand their distinct effects on consumer purchasing power and market dynamics.

Why it is important

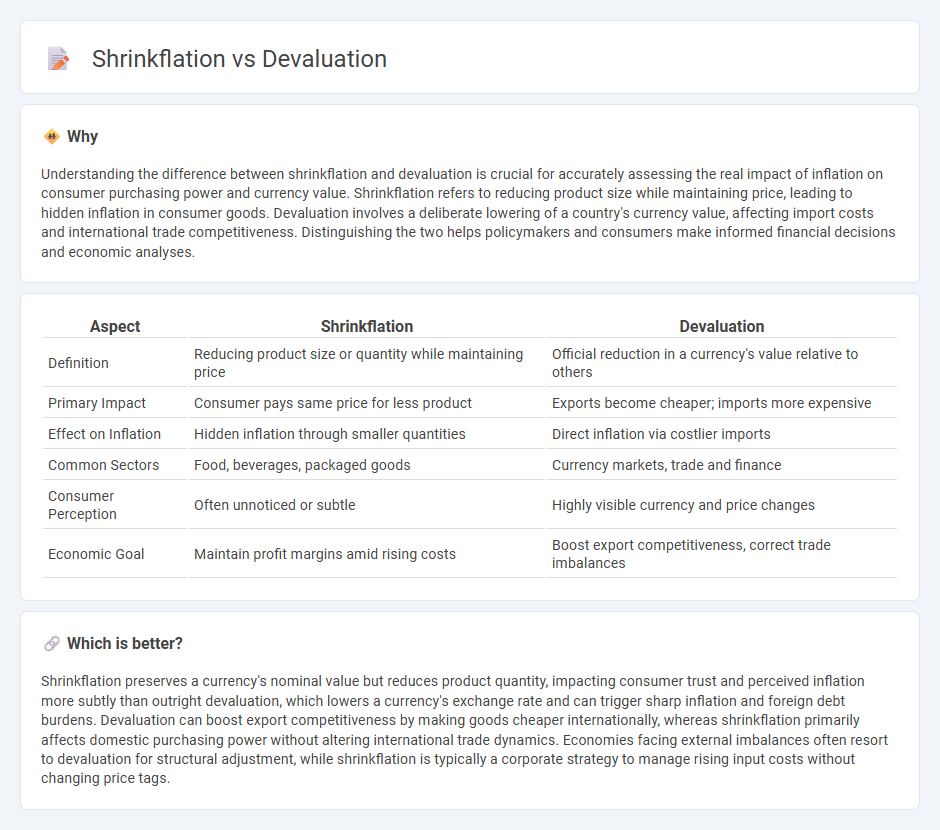

Understanding the difference between shrinkflation and devaluation is crucial for accurately assessing the real impact of inflation on consumer purchasing power and currency value. Shrinkflation refers to reducing product size while maintaining price, leading to hidden inflation in consumer goods. Devaluation involves a deliberate lowering of a country's currency value, affecting import costs and international trade competitiveness. Distinguishing the two helps policymakers and consumers make informed financial decisions and economic analyses.

Comparison Table

| Aspect | Shrinkflation | Devaluation |

|---|---|---|

| Definition | Reducing product size or quantity while maintaining price | Official reduction in a currency's value relative to others |

| Primary Impact | Consumer pays same price for less product | Exports become cheaper; imports more expensive |

| Effect on Inflation | Hidden inflation through smaller quantities | Direct inflation via costlier imports |

| Common Sectors | Food, beverages, packaged goods | Currency markets, trade and finance |

| Consumer Perception | Often unnoticed or subtle | Highly visible currency and price changes |

| Economic Goal | Maintain profit margins amid rising costs | Boost export competitiveness, correct trade imbalances |

Which is better?

Shrinkflation preserves a currency's nominal value but reduces product quantity, impacting consumer trust and perceived inflation more subtly than outright devaluation, which lowers a currency's exchange rate and can trigger sharp inflation and foreign debt burdens. Devaluation can boost export competitiveness by making goods cheaper internationally, whereas shrinkflation primarily affects domestic purchasing power without altering international trade dynamics. Economies facing external imbalances often resort to devaluation for structural adjustment, while shrinkflation is typically a corporate strategy to manage rising input costs without changing price tags.

Connection

Shrinkflation and devaluation are interconnected economic phenomena where devaluation reduces the currency's purchasing power, leading manufacturers to employ shrinkflation by decreasing product sizes instead of raising prices immediately. This strategy helps businesses maintain profit margins in an environment of rising import costs and inflation triggered by currency devaluation. Consumers often perceive shrinkflation less directly than price hikes, masking the real impact of devaluation on their effective expenses.

Key Terms

Currency Exchange Rate

Devaluation refers to the deliberate downward adjustment of a country's currency value relative to other currencies, impacting import costs and export competitiveness. Shrinkflation occurs when product sizes decrease while prices remain stable, indirectly affecting purchasing power without changing currency exchange rates. Discover how these distinct economic phenomena influence your financial decisions and international trade dynamics.

Purchasing Power

Devaluation reduces a currency's value relative to others, directly diminishing purchasing power by making imports more expensive and inflation more likely. Shrinkflation subtly lowers purchasing power as products maintain prices but decrease in size or quantity, misleading consumers about the real cost. Explore the detailed impacts of these economic phenomena on consumer finances and market behavior.

Product Size Reduction

Devaluation affects currency value, leading to higher import costs and inflation, whereas shrinkflation involves reducing product size while maintaining price, effectively increasing the unit cost for consumers without overt price hikes. Product size reduction is a strategic tactic in shrinkflation to maintain profit margins amid rising production expenses. Discover the nuanced impacts of shrinkflation on consumer perception and market dynamics.

Source and External Links

Devaluation - Overview, Pros and Cons, and Examples - Devaluation is a downward adjustment to a country's currency value relative to a foreign currency, used to make exports cheaper and more competitive while making imports more expensive, helping reduce trade deficits and stimulate the domestic economy.

What is devaluation and how does it affect my finances? - Devaluation is a deliberate reduction in a currency's value which generally lowers purchasing power, can cause inflation, but also benefits exporters and industries reliant on foreign currency income by improving exchange rates.

Devaluation - Wikipedia - Devaluation in a fixed exchange-rate system lowers the domestic currency's value relative to others to boost exports and reduce imports, improving trade balance but potentially causing inflation, wage pressures, and economic instability.

dowidth.com

dowidth.com