Vibe shifts and macro trend reversals both signal changes in the economy but differ in scale and impact; vibe shifts often reflect evolving consumer attitudes influencing market demand, while macro trend reversals indicate fundamental economic transformations such as shifts in inflation, employment, or monetary policy. Understanding these distinctions helps businesses and investors anticipate market movements and adjust strategies for sustained growth. Explore more to grasp how these dynamics shape economic landscapes.

Why it is important

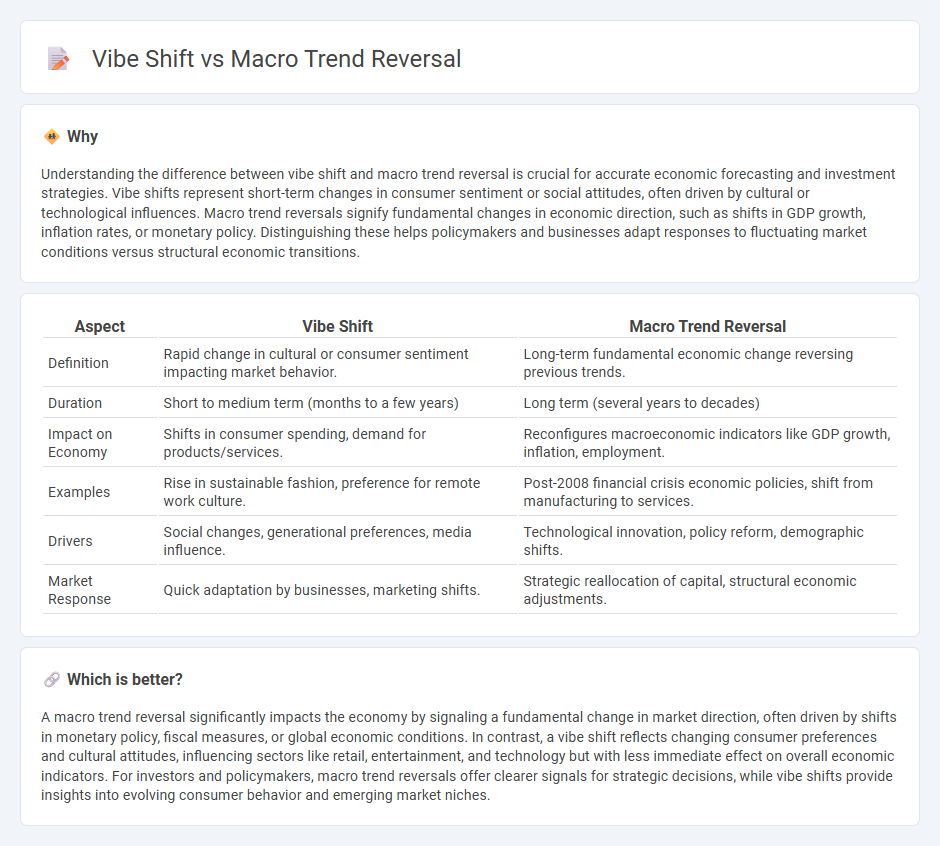

Understanding the difference between vibe shift and macro trend reversal is crucial for accurate economic forecasting and investment strategies. Vibe shifts represent short-term changes in consumer sentiment or social attitudes, often driven by cultural or technological influences. Macro trend reversals signify fundamental changes in economic direction, such as shifts in GDP growth, inflation rates, or monetary policy. Distinguishing these helps policymakers and businesses adapt responses to fluctuating market conditions versus structural economic transitions.

Comparison Table

| Aspect | Vibe Shift | Macro Trend Reversal |

|---|---|---|

| Definition | Rapid change in cultural or consumer sentiment impacting market behavior. | Long-term fundamental economic change reversing previous trends. |

| Duration | Short to medium term (months to a few years) | Long term (several years to decades) |

| Impact on Economy | Shifts in consumer spending, demand for products/services. | Reconfigures macroeconomic indicators like GDP growth, inflation, employment. |

| Examples | Rise in sustainable fashion, preference for remote work culture. | Post-2008 financial crisis economic policies, shift from manufacturing to services. |

| Drivers | Social changes, generational preferences, media influence. | Technological innovation, policy reform, demographic shifts. |

| Market Response | Quick adaptation by businesses, marketing shifts. | Strategic reallocation of capital, structural economic adjustments. |

Which is better?

A macro trend reversal significantly impacts the economy by signaling a fundamental change in market direction, often driven by shifts in monetary policy, fiscal measures, or global economic conditions. In contrast, a vibe shift reflects changing consumer preferences and cultural attitudes, influencing sectors like retail, entertainment, and technology but with less immediate effect on overall economic indicators. For investors and policymakers, macro trend reversals offer clearer signals for strategic decisions, while vibe shifts provide insights into evolving consumer behavior and emerging market niches.

Connection

Vibe shifts reflect changes in societal attitudes and consumer behaviors, often signaling emerging macro trend reversals in the economy. These reversals manifest through altered spending patterns, investment strategies, and market dynamics, influencing sectors like technology, fashion, and finance. Understanding vibe shifts enables economists and businesses to anticipate and adapt to significant economic transformations driven by evolving cultural and social paradigms.

Key Terms

Business Cycle

Macro trend reversal marks a significant change in the long-term economic environment, often driven by shifts in monetary policy, inflation rates, or geopolitical dynamics affecting global markets. Vibe shift, on the other hand, reflects rapid changes in consumer sentiment and cultural preferences that can alter demand patterns within shorter business cycles. Explore how identifying these shifts can enhance strategic decision-making in your business cycle planning.

Sentiment Analysis

Macro trend reversal refers to significant, long-term changes in consumer behavior patterns driven by economic shifts or societal values, while vibe shifts capture shorter-term, cultural mood changes often detected through social media sentiment. Sentiment analysis leverages natural language processing to assess public emotions and opinions, enabling firms to identify emerging macro trends or vibe shifts in real-time by analyzing large volumes of textual data. Explore more about how sentiment analysis deciphers evolving consumer sentiments to anticipate market dynamics and optimize strategic decisions.

Structural Change

Macro trend reversal denotes a fundamental shift in economic, social, or technological frameworks, signaling long-term structural change often driven by systemic factors like policy shifts or market disruptions. Vibe shift emphasizes cultural and behavioral transformations, reflecting evolving consumer attitudes and lifestyle preferences that impact branding and marketing dynamics. Explore the distinctions between macro trend reversals and vibe shifts to better understand their roles in shaping future market landscapes.

Source and External Links

Fundamental Trends and Dislocated Markets - Macro trend reversal involves catching shifts in economic fundamentals that markets initially underreact to, creating opportunities to trade large changes such as the 1992 British pound devaluation or the 2007-08 financial crisis; these reversals stabilize markets by aligning prices with new fundamental values.

Are We Heading for a Market Reversal in 2025? Six Indicators to ... - This webinar discusses six key indicators to monitor for a possible market reversal in 2025, providing insights for anticipating significant macroeconomic trend changes.

Banco Macro (BMA) Loses 15.2% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner - Trend reversal can be identified by technical indicators like the Relative Strength Index (RSI), showing oversold conditions that often precede a price rebound, illustrating how macro trends can shift in specific stocks.

dowidth.com

dowidth.com