Carbon border tax and climate tariffs are emerging economic tools designed to reduce carbon emissions by imposing fees on imported goods based on their carbon footprint. These mechanisms aim to level the playing field for domestic industries adhering to strict environmental regulations while discouraging carbon leakage through cheaper, high-emission imports. Explore the distinctions and impacts of carbon border taxes versus climate tariffs to understand their role in global economic and environmental policy.

Why it is important

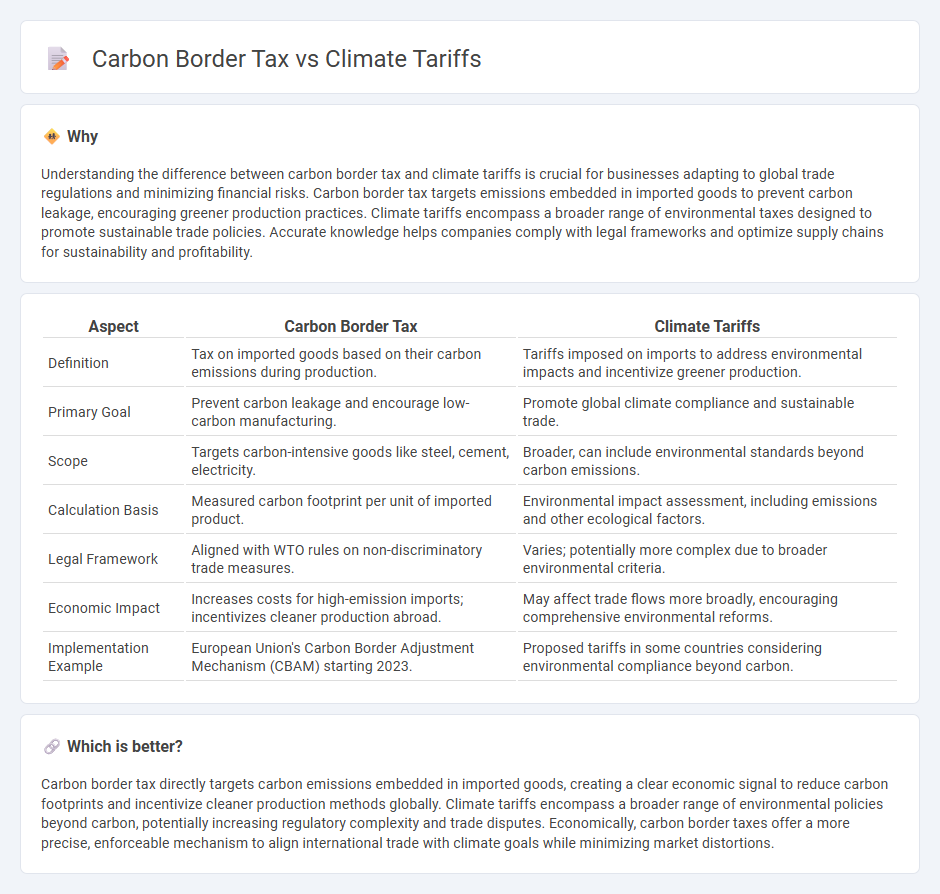

Understanding the difference between carbon border tax and climate tariffs is crucial for businesses adapting to global trade regulations and minimizing financial risks. Carbon border tax targets emissions embedded in imported goods to prevent carbon leakage, encouraging greener production practices. Climate tariffs encompass a broader range of environmental taxes designed to promote sustainable trade policies. Accurate knowledge helps companies comply with legal frameworks and optimize supply chains for sustainability and profitability.

Comparison Table

| Aspect | Carbon Border Tax | Climate Tariffs |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions during production. | Tariffs imposed on imports to address environmental impacts and incentivize greener production. |

| Primary Goal | Prevent carbon leakage and encourage low-carbon manufacturing. | Promote global climate compliance and sustainable trade. |

| Scope | Targets carbon-intensive goods like steel, cement, electricity. | Broader, can include environmental standards beyond carbon emissions. |

| Calculation Basis | Measured carbon footprint per unit of imported product. | Environmental impact assessment, including emissions and other ecological factors. |

| Legal Framework | Aligned with WTO rules on non-discriminatory trade measures. | Varies; potentially more complex due to broader environmental criteria. |

| Economic Impact | Increases costs for high-emission imports; incentivizes cleaner production abroad. | May affect trade flows more broadly, encouraging comprehensive environmental reforms. |

| Implementation Example | European Union's Carbon Border Adjustment Mechanism (CBAM) starting 2023. | Proposed tariffs in some countries considering environmental compliance beyond carbon. |

Which is better?

Carbon border tax directly targets carbon emissions embedded in imported goods, creating a clear economic signal to reduce carbon footprints and incentivize cleaner production methods globally. Climate tariffs encompass a broader range of environmental policies beyond carbon, potentially increasing regulatory complexity and trade disputes. Economically, carbon border taxes offer a more precise, enforceable mechanism to align international trade with climate goals while minimizing market distortions.

Connection

Carbon border tax and climate tariffs both serve to reduce carbon emissions by imposing costs on imported goods based on their carbon footprint, ensuring fair competition between domestic and foreign producers. These mechanisms incentivize countries to adopt greener production methods while preventing carbon leakage, where emissions shift to nations with lax regulations. By integrating environmental costs into trade policies, carbon border taxes and climate tariffs promote sustainable economic growth and support global climate goals.

Key Terms

Border Adjustment Mechanism

Climate tariffs and carbon border taxes both aim to prevent carbon leakage by adjusting import prices based on the carbon content of goods, but climate tariffs tend to be broader trade measures while carbon border taxes specifically target carbon emissions. The Border Adjustment Mechanism (BAM) serves as an instrument within policy frameworks like the EU's Emissions Trading System, applying costs to imported carbon-intensive products to level the playing field for domestic producers subject to emission regulations. Explore how BAM shapes global trade dynamics and enforces carbon accountability to understand its prominent role in environmental policy.

Trade Competitiveness

Climate tariffs and carbon border taxes both aim to level the global playing field by imposing costs on carbon-intensive imports, protecting domestic industries from unfair competition while encouraging greener production. Climate tariffs typically focus on sector-specific emissions and environmental standards compliance, whereas carbon border taxes apply a direct price on embedded carbon content in imported goods. Explore the impacts of these mechanisms on trade competitiveness and global carbon mitigation strategies to understand their economic and environmental implications.

Carbon Leakage

Climate tariffs and carbon border taxes are policy tools designed to combat carbon leakage by imposing costs on imported goods based on their carbon footprint, ensuring domestic industries remain competitive while encouraging greener production practices abroad. Carbon border tax specifically targets emissions embodied in imports to prevent companies from relocating production to low-regulation countries, effectively closing loopholes in climate strategies. Explore further to understand how these measures influence global trade and carbon reduction commitments.

Source and External Links

Carbon Tariffs: The Future of Climate Policy - Perry World House - Carbon tariffs, or Border Carbon Adjustments (BCAs), are fees on foreign imports based on their carbon emissions, aimed at preventing carbon leakage by equalizing costs between domestic and foreign goods while addressing environmental, economic, and national security externalities simultaneously.

Experts: What do Trump's tariffs mean for global climate action? - Carbon Brief - Tariffs on green technologies can raise costs and disrupt global clean technology trade, potentially slowing the US energy transition and harming exporters like India, which are increasing green goods exports to the US.

Carbon tariffs: an instrument for tackling climate change? - AXA Research - Proposals include recycling carbon tariff revenues to exporting countries for climate mitigation and adaptation investments, creating a global consensus solution that balances emissions reduction with economic progress and avoids trade conflicts over carbon pricing.

dowidth.com

dowidth.com