A liquidity crunch occurs when a country faces short-term shortages of cash or liquid assets, limiting its ability to meet immediate financial obligations. A balance of payments crisis involves sustained deficits in a nation's international transactions, leading to depletion of foreign exchange reserves and potential currency devaluation. Explore the intricacies and implications of these economic challenges to understand their impact on financial stability.

Why it is important

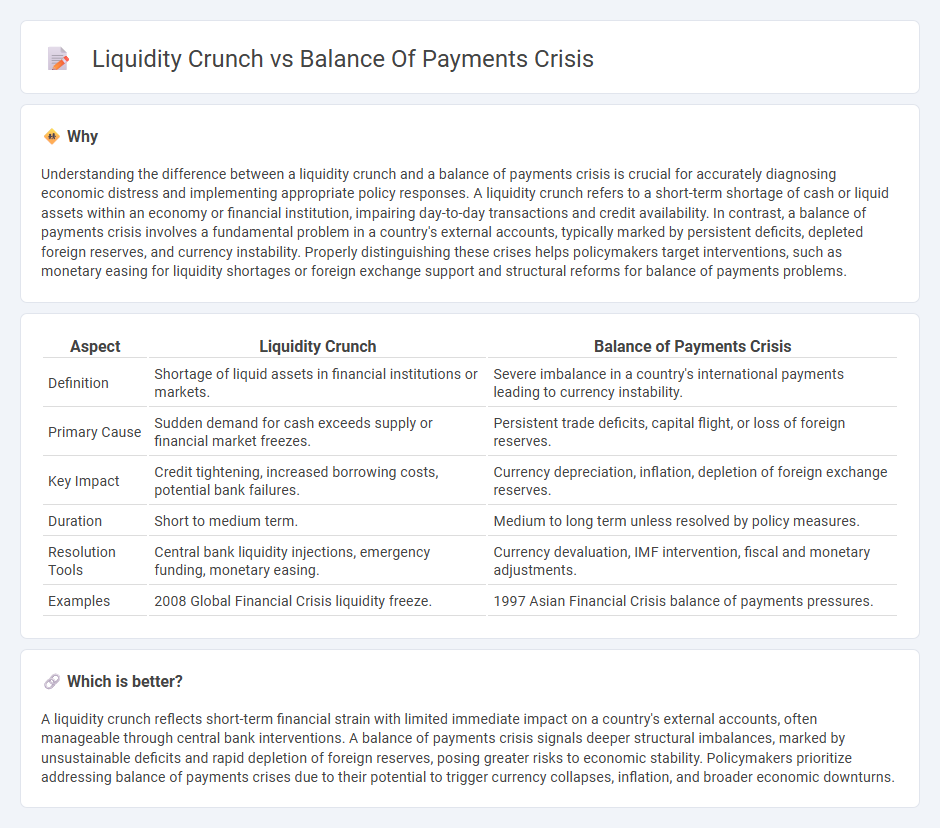

Understanding the difference between a liquidity crunch and a balance of payments crisis is crucial for accurately diagnosing economic distress and implementing appropriate policy responses. A liquidity crunch refers to a short-term shortage of cash or liquid assets within an economy or financial institution, impairing day-to-day transactions and credit availability. In contrast, a balance of payments crisis involves a fundamental problem in a country's external accounts, typically marked by persistent deficits, depleted foreign reserves, and currency instability. Properly distinguishing these crises helps policymakers target interventions, such as monetary easing for liquidity shortages or foreign exchange support and structural reforms for balance of payments problems.

Comparison Table

| Aspect | Liquidity Crunch | Balance of Payments Crisis |

|---|---|---|

| Definition | Shortage of liquid assets in financial institutions or markets. | Severe imbalance in a country's international payments leading to currency instability. |

| Primary Cause | Sudden demand for cash exceeds supply or financial market freezes. | Persistent trade deficits, capital flight, or loss of foreign reserves. |

| Key Impact | Credit tightening, increased borrowing costs, potential bank failures. | Currency depreciation, inflation, depletion of foreign exchange reserves. |

| Duration | Short to medium term. | Medium to long term unless resolved by policy measures. |

| Resolution Tools | Central bank liquidity injections, emergency funding, monetary easing. | Currency devaluation, IMF intervention, fiscal and monetary adjustments. |

| Examples | 2008 Global Financial Crisis liquidity freeze. | 1997 Asian Financial Crisis balance of payments pressures. |

Which is better?

A liquidity crunch reflects short-term financial strain with limited immediate impact on a country's external accounts, often manageable through central bank interventions. A balance of payments crisis signals deeper structural imbalances, marked by unsustainable deficits and rapid depletion of foreign reserves, posing greater risks to economic stability. Policymakers prioritize addressing balance of payments crises due to their potential to trigger currency collapses, inflation, and broader economic downturns.

Connection

A liquidity crunch restricts a country's access to short-term funds, intensifying pressures on its foreign exchange reserves and leading to a balance of payments crisis. Insufficient liquidity limits the ability to finance imports and service external debt, causing deficits in the current and capital accounts. This cyclical interaction exacerbates economic instability, forcing urgent policy interventions to restore financial equilibrium.

Key Terms

**Balance of Payments Crisis:**

A Balance of Payments (BoP) crisis occurs when a country cannot meet its international payment obligations, leading to a sharp depletion of foreign reserves and a collapse in currency value. This crisis often results from persistent trade deficits, sudden capital flight, or loss of investor confidence, severely impacting the country's ability to finance imports and service external debt. Explore detailed causes, effects, and policy responses to balance of payments crises for a deeper understanding.

Current Account Deficit

A balance of payments crisis occurs when a country cannot finance its current account deficit due to insufficient foreign exchange reserves, leading to a sharp devaluation of the currency and loss of investor confidence. In contrast, a liquidity crunch primarily affects the domestic banking system's ability to meet short-term obligations, often without directly impacting the current account but causing credit tightening and economic slowdown. Understanding the distinction helps grasp the macroeconomic implications of a current account deficit; explore further to deepen your insight into international finance dynamics.

Foreign Exchange Reserves

A balance of payments crisis occurs when a country's foreign exchange reserves deplete rapidly due to a persistent deficit in international payments, causing the nation to struggle in meeting its external obligations. A liquidity crunch refers to a short-term shortage of liquid assets, including foreign exchange reserves, that limits a country's ability to finance immediate imports and external debt, often triggered by sudden capital flight or market panic. To understand how foreign exchange reserves function differently in these contexts, explore detailed economic analyses on reserve management strategies.

Source and External Links

Balance of payments (Wikipedia) - A balance of payments crisis occurs when a country can no longer pay for essential imports or service external debts, often triggering a sharp currency devaluation as foreign investors rapidly withdraw capital.

Sudden stops: A primer on balance-of-payments crises (VoxEU) - This type of crisis happens when a sudden stop or reversal of capital flows forces a country to abruptly adjust its external balance, typically leading to recession, higher unemployment, and business failures as the economy contracts.

Currency crisis (Wikipedia) - A currency crisis, closely linked to a balance of payments crisis, arises from chronic external deficits and culminates in a rapid loss of confidence in a nation's currency, often following a period of excessive capital inflows and subsequent capital flight.

dowidth.com

dowidth.com