Excess savings occur when households and businesses accumulate more funds than they spend, often leading to reduced consumption and investment. This phenomenon can contribute to deflation, characterized by falling prices and decreased economic activity, as lower demand pressures sellers to reduce costs. Explore deeper insights into how excess savings intertwine with deflation and impact overall economic stability.

Why it is important

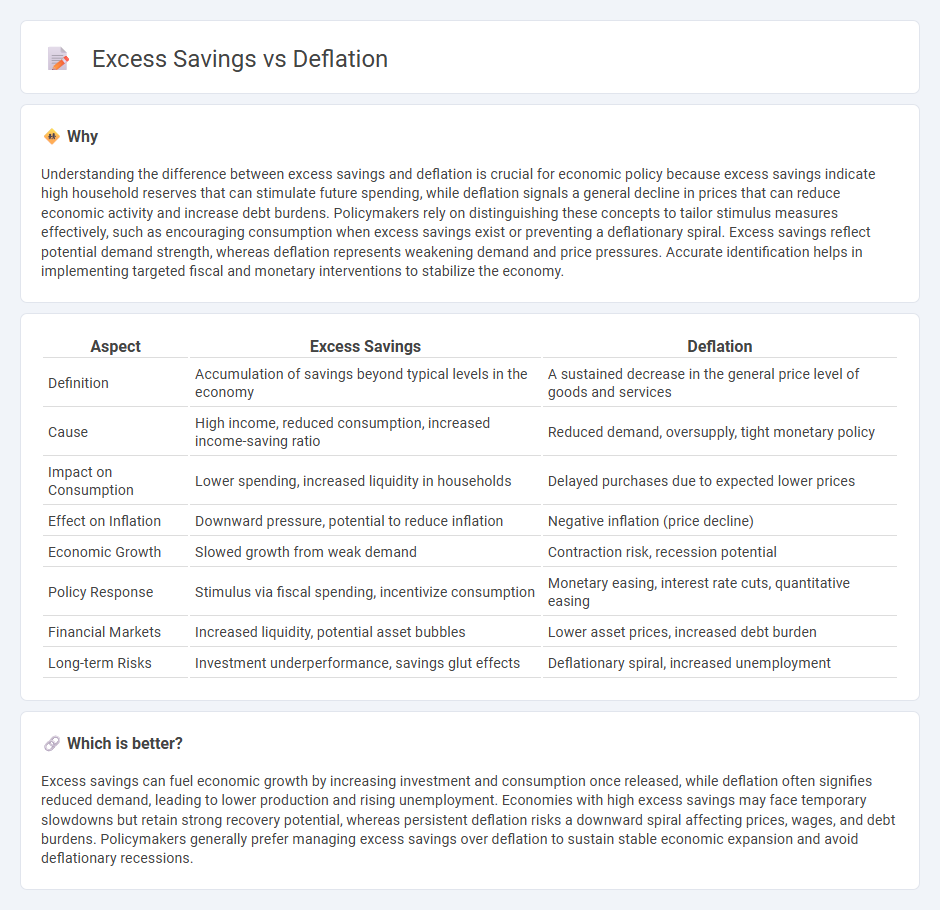

Understanding the difference between excess savings and deflation is crucial for economic policy because excess savings indicate high household reserves that can stimulate future spending, while deflation signals a general decline in prices that can reduce economic activity and increase debt burdens. Policymakers rely on distinguishing these concepts to tailor stimulus measures effectively, such as encouraging consumption when excess savings exist or preventing a deflationary spiral. Excess savings reflect potential demand strength, whereas deflation represents weakening demand and price pressures. Accurate identification helps in implementing targeted fiscal and monetary interventions to stabilize the economy.

Comparison Table

| Aspect | Excess Savings | Deflation |

|---|---|---|

| Definition | Accumulation of savings beyond typical levels in the economy | A sustained decrease in the general price level of goods and services |

| Cause | High income, reduced consumption, increased income-saving ratio | Reduced demand, oversupply, tight monetary policy |

| Impact on Consumption | Lower spending, increased liquidity in households | Delayed purchases due to expected lower prices |

| Effect on Inflation | Downward pressure, potential to reduce inflation | Negative inflation (price decline) |

| Economic Growth | Slowed growth from weak demand | Contraction risk, recession potential |

| Policy Response | Stimulus via fiscal spending, incentivize consumption | Monetary easing, interest rate cuts, quantitative easing |

| Financial Markets | Increased liquidity, potential asset bubbles | Lower asset prices, increased debt burden |

| Long-term Risks | Investment underperformance, savings glut effects | Deflationary spiral, increased unemployment |

Which is better?

Excess savings can fuel economic growth by increasing investment and consumption once released, while deflation often signifies reduced demand, leading to lower production and rising unemployment. Economies with high excess savings may face temporary slowdowns but retain strong recovery potential, whereas persistent deflation risks a downward spiral affecting prices, wages, and debt burdens. Policymakers generally prefer managing excess savings over deflation to sustain stable economic expansion and avoid deflationary recessions.

Connection

Excess savings contribute to deflation by reducing aggregate demand, leading to lower prices and slower economic growth. When households and businesses hoard funds instead of spending or investing, decreased consumption pressures prices downward. Prolonged deflation further encourages saving over spending, creating a self-reinforcing economic cycle detrimental to recovery.

Key Terms

Aggregate Demand

Deflation significantly reduces aggregate demand by lowering consumer spending and business investment due to expectations of falling prices. Excess savings, when not translated into consumption or investment, suppress aggregate demand further, exacerbating economic stagnation. Explore how managing the balance between savings and spending can revitalize aggregate demand and economic growth.

Price Level

Deflation occurs when the overall price level declines, often driven by reduced consumer demand or increased savings that exceed spending, causing a contraction in economic activity. Excess savings reduce aggregate demand, exerting downward pressure on prices and potentially leading to prolonged deflationary environments. Explore more to understand how these dynamics influence monetary policy and economic stability.

Liquidity Trap

Deflation occurs when prices fall persistently, increasing the real value of money and discouraging spending, while excess savings reduce consumer demand and investment, both contributing to a liquidity trap where monetary policy loses effectiveness as interest rates approach zero. In a liquidity trap, individuals prefer holding cash over bonds or risky assets, making traditional central bank measures insufficient to stimulate economic growth. Explore more about how deflation and excess savings intertwine to deepen liquidity traps and challenge economic recovery efforts.

Source and External Links

Deflation | EBSCO Research Starters - Deflation is a decrease in the supply of money or credit causing a general drop in prices, often signaling deeper economic problems like recession, with severe consequences such as job losses, wage cuts, and increased business failures.

Deflation - Wikipedia - Deflation is the decline in general price levels resulting in a negative inflation rate, increasing the currency's value but raising the real burden of debt and potentially leading to a deflationary spiral during economic downturns.

Inflation, Disinflation and Deflation: What Do They All Mean? - Deflation is defined as a sustained decrease in prices of goods and services where the inflation rate falls below zero, distinct from disinflation, which is simply a slower positive inflation rate.

dowidth.com

dowidth.com