Greenflation refers to rising prices driven by the increased costs of environmentally sustainable production and renewable energy investments, impacting sectors like manufacturing and transportation. Disinflation describes a slowdown in the rate of inflation, indicating a cooling economy where price increases become more moderate. Explore the dynamics between greenflation and disinflation to understand their implications on economic policy and market trends.

Why it is important

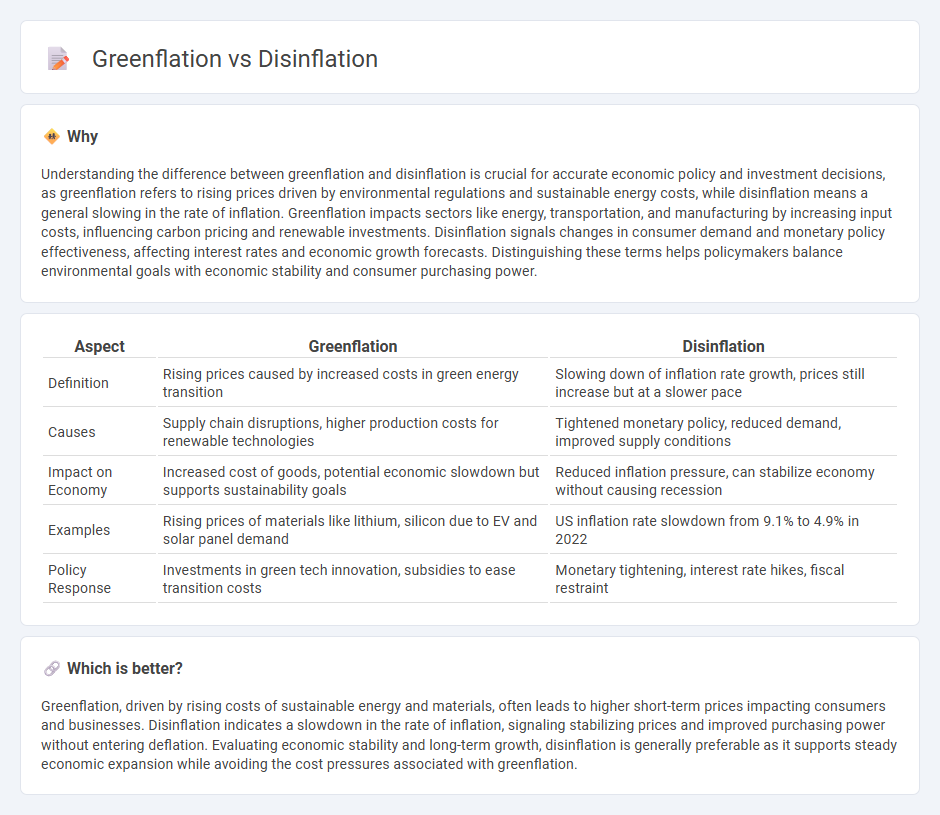

Understanding the difference between greenflation and disinflation is crucial for accurate economic policy and investment decisions, as greenflation refers to rising prices driven by environmental regulations and sustainable energy costs, while disinflation means a general slowing in the rate of inflation. Greenflation impacts sectors like energy, transportation, and manufacturing by increasing input costs, influencing carbon pricing and renewable investments. Disinflation signals changes in consumer demand and monetary policy effectiveness, affecting interest rates and economic growth forecasts. Distinguishing these terms helps policymakers balance environmental goals with economic stability and consumer purchasing power.

Comparison Table

| Aspect | Greenflation | Disinflation |

|---|---|---|

| Definition | Rising prices caused by increased costs in green energy transition | Slowing down of inflation rate growth, prices still increase but at a slower pace |

| Causes | Supply chain disruptions, higher production costs for renewable technologies | Tightened monetary policy, reduced demand, improved supply conditions |

| Impact on Economy | Increased cost of goods, potential economic slowdown but supports sustainability goals | Reduced inflation pressure, can stabilize economy without causing recession |

| Examples | Rising prices of materials like lithium, silicon due to EV and solar panel demand | US inflation rate slowdown from 9.1% to 4.9% in 2022 |

| Policy Response | Investments in green tech innovation, subsidies to ease transition costs | Monetary tightening, interest rate hikes, fiscal restraint |

Which is better?

Greenflation, driven by rising costs of sustainable energy and materials, often leads to higher short-term prices impacting consumers and businesses. Disinflation indicates a slowdown in the rate of inflation, signaling stabilizing prices and improved purchasing power without entering deflation. Evaluating economic stability and long-term growth, disinflation is generally preferable as it supports steady economic expansion while avoiding the cost pressures associated with greenflation.

Connection

Greenflation, driven by rising costs in renewable energy technologies and carbon regulations, contributes to higher production expenses across various sectors, which can slow economic growth and reduce consumer demand. This reduced demand initiates disinflation, characterized by a slowdown in the rate of inflation despite still rising prices. The interplay between greenflation-induced cost pressures and subsequent disinflation signals a complex balance between sustainable policy implementation and broader economic stability.

Key Terms

Price Levels

Disinflation refers to a slowdown in the rate of inflation where price levels continue to rise but at a diminished pace, while greenflation describes rising prices driven by the increasing costs of environmentally sustainable goods and services due to supply chain adjustments and regulatory changes. The dynamics of greenflation challenge traditional inflation control as the transition to green energy and sustainable resources intersects with fiscal policies and market demand. Explore the evolving impact of these phenomena on global price levels and economic stability for deeper insights.

Carbon Pricing

Disinflation refers to a slowdown in the rate of inflation, often signaling reduced consumer price increases, while greenflation specifically relates to rising costs driven by environmental policies and green technologies. Carbon pricing, through mechanisms like carbon taxes or cap-and-trade systems, directly impacts greenflation by increasing production costs for carbon-intensive goods and incentivizing cleaner alternatives. Explore the nuances of how carbon pricing shapes economic trends and sustainability goals to understand its complex role in global markets.

Monetary Policy

Disinflation refers to a slowdown in the rate of inflation, signaling reduced price pressures, which allows central banks to adopt a more accommodative monetary policy stance without the immediate risk of overheating the economy. Greenflation, driven by the rising costs of green energy technologies and carbon reduction measures, challenges traditional monetary policy as it may cause persistent price increases despite efforts to tighten. Explore the nuances of how central banks balance these dynamics to maintain economic stability and support sustainable growth.

Source and External Links

Disinflation - Definition, How It Works, Examples - Disinflation is the slowing of the rate of inflation, meaning prices are still rising but at a decreasing rate, which differs from deflation where prices actually decline.

Disinflation - Disinflation refers to a decrease in the inflation rate, or a slowdown in how fast prices increase over time, and if inflation is already low, it can potentially lead to deflation.

Lessons from History for Successful Disinflation - The success of reducing inflation through disinflation largely depends on the strength and commitment of the Federal Reserve's policies designed to slow inflation.

dowidth.com

dowidth.com