Rentvesting allows individuals to build property wealth by renting where they want to live while investing in more affordable real estate markets. Investing in property typically involves owning and living in the same home, which may limit portfolio diversification and capital growth potential. Explore the strategic benefits and financial implications of rentvesting versus traditional investing to make informed decisions in today's economy.

Why it is important

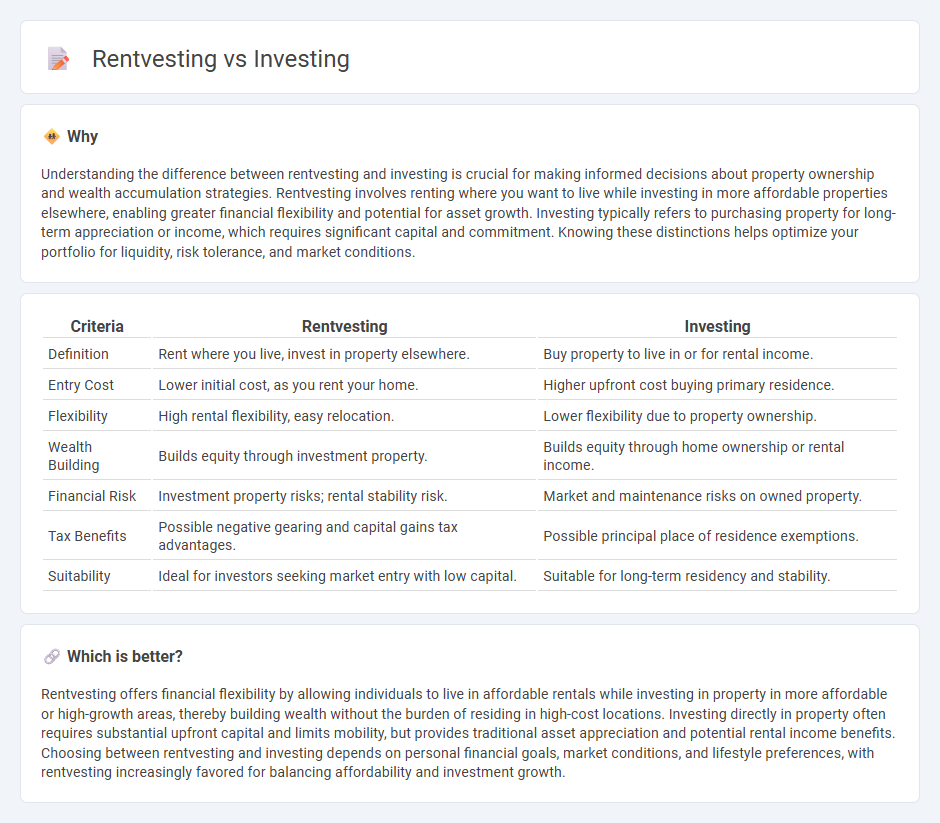

Understanding the difference between rentvesting and investing is crucial for making informed decisions about property ownership and wealth accumulation strategies. Rentvesting involves renting where you want to live while investing in more affordable properties elsewhere, enabling greater financial flexibility and potential for asset growth. Investing typically refers to purchasing property for long-term appreciation or income, which requires significant capital and commitment. Knowing these distinctions helps optimize your portfolio for liquidity, risk tolerance, and market conditions.

Comparison Table

| Criteria | Rentvesting | Investing |

|---|---|---|

| Definition | Rent where you live, invest in property elsewhere. | Buy property to live in or for rental income. |

| Entry Cost | Lower initial cost, as you rent your home. | Higher upfront cost buying primary residence. |

| Flexibility | High rental flexibility, easy relocation. | Lower flexibility due to property ownership. |

| Wealth Building | Builds equity through investment property. | Builds equity through home ownership or rental income. |

| Financial Risk | Investment property risks; rental stability risk. | Market and maintenance risks on owned property. |

| Tax Benefits | Possible negative gearing and capital gains tax advantages. | Possible principal place of residence exemptions. |

| Suitability | Ideal for investors seeking market entry with low capital. | Suitable for long-term residency and stability. |

Which is better?

Rentvesting offers financial flexibility by allowing individuals to live in affordable rentals while investing in property in more affordable or high-growth areas, thereby building wealth without the burden of residing in high-cost locations. Investing directly in property often requires substantial upfront capital and limits mobility, but provides traditional asset appreciation and potential rental income benefits. Choosing between rentvesting and investing depends on personal financial goals, market conditions, and lifestyle preferences, with rentvesting increasingly favored for balancing affordability and investment growth.

Connection

Rentvesting allows individuals to invest in property while renting their own residence, maximizing capital allocation and building long-term wealth. This strategy connects to investing by enabling property accumulation without immediate homeownership, increasing portfolio diversification. By leveraging rental income and market appreciation, rentvesting enhances overall investment returns and financial flexibility.

Key Terms

Capital Growth

Investing in property prioritizes capital growth by purchasing homes in areas with high long-term value appreciation potential, while rentvesting allows individuals to rent where they want to live and invest in properties with stronger capital growth prospects elsewhere. Rentvesting often suits those unable to afford homes in prime locations, enabling wealth building through strategic property investment. Explore more about how these strategies can impact your financial future and capital growth opportunities.

Cash Flow

Investing in property typically demands significant upfront capital but can generate steady rental income and potential asset appreciation, optimizing long-term cash flow. Rentvesting allows individuals to live in affordable rental homes while investing in properties in high-growth areas, maximizing liquidity and diversifying income streams. Explore the benefits of each strategy to enhance your financial growth and cash flow management.

Opportunity Cost

Investing in property requires significant upfront capital and long-term commitment, which can limit liquidity and diversification opportunities, while rentvesting allows individuals to rent where they want to live and invest in more affordable locations, maximizing potential returns. The opportunity cost of renting is the foregone equity buildup and property appreciation, whereas rentvesting minimizes this by leveraging rental payments to fund asset growth elsewhere. Explore further to understand which strategy aligns best with your financial goals and market conditions.

Source and External Links

Fidelity Investments - Retirement Plans, Investing, Brokerage ... - Fidelity offers $0 account fees, $0 commissions, and tools to invest in stocks, ETFs, mutual funds, and retirement accounts for both self-guided and advisor-supported investing.

Introduction to Investing | Investor.gov - This government site provides unbiased facts on investment products, retirement planning, and tips to avoid fraud for U.S. investors.

Charles Schwab | A Modern Approach to Investing and Retirement ... - Schwab provides brokerage and retirement accounts, diversified investment products, and easy account transfer services with integrated banking options.

dowidth.com

dowidth.com