Carbon border adjustments impose fees on imported goods based on their carbon emissions to level the playing field for domestic industries facing strict climate regulations. Climate tariffs similarly tax imports to encourage global emission reductions and prevent carbon leakage but may vary in implementation strategies across countries. Explore the differences and impacts of these mechanisms on international trade and environmental policy.

Why it is important

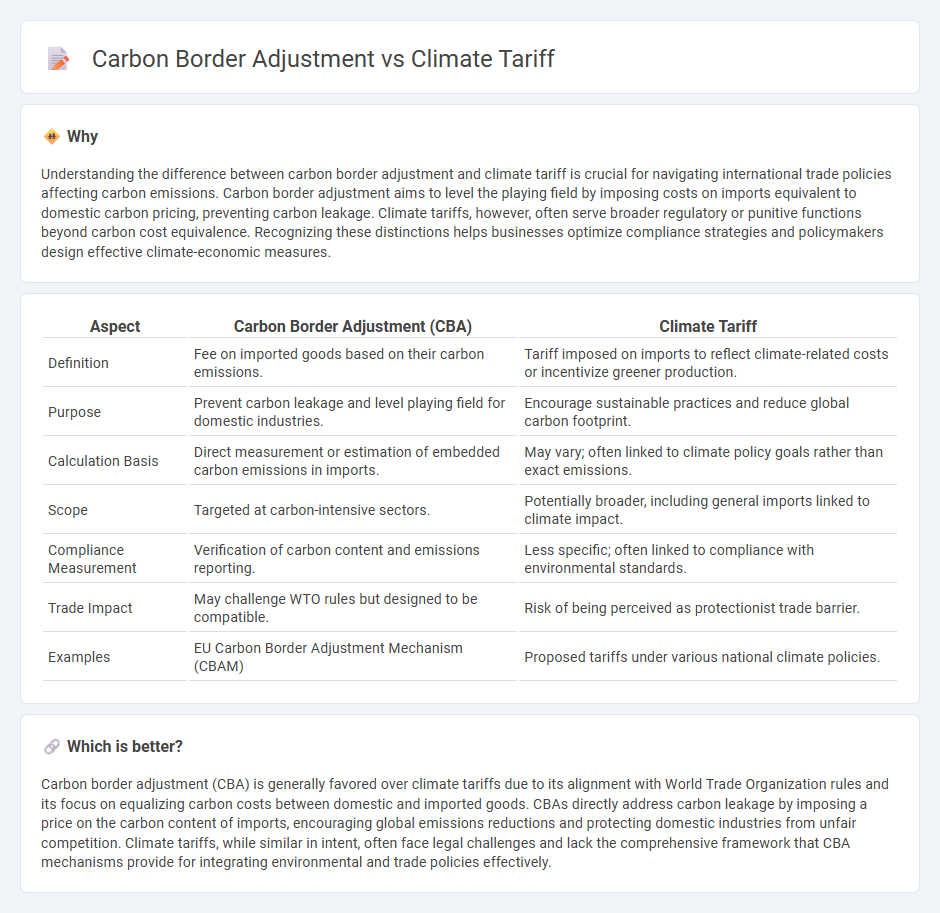

Understanding the difference between carbon border adjustment and climate tariff is crucial for navigating international trade policies affecting carbon emissions. Carbon border adjustment aims to level the playing field by imposing costs on imports equivalent to domestic carbon pricing, preventing carbon leakage. Climate tariffs, however, often serve broader regulatory or punitive functions beyond carbon cost equivalence. Recognizing these distinctions helps businesses optimize compliance strategies and policymakers design effective climate-economic measures.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Climate Tariff |

|---|---|---|

| Definition | Fee on imported goods based on their carbon emissions. | Tariff imposed on imports to reflect climate-related costs or incentivize greener production. |

| Purpose | Prevent carbon leakage and level playing field for domestic industries. | Encourage sustainable practices and reduce global carbon footprint. |

| Calculation Basis | Direct measurement or estimation of embedded carbon emissions in imports. | May vary; often linked to climate policy goals rather than exact emissions. |

| Scope | Targeted at carbon-intensive sectors. | Potentially broader, including general imports linked to climate impact. |

| Compliance Measurement | Verification of carbon content and emissions reporting. | Less specific; often linked to compliance with environmental standards. |

| Trade Impact | May challenge WTO rules but designed to be compatible. | Risk of being perceived as protectionist trade barrier. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM) | Proposed tariffs under various national climate policies. |

Which is better?

Carbon border adjustment (CBA) is generally favored over climate tariffs due to its alignment with World Trade Organization rules and its focus on equalizing carbon costs between domestic and imported goods. CBAs directly address carbon leakage by imposing a price on the carbon content of imports, encouraging global emissions reductions and protecting domestic industries from unfair competition. Climate tariffs, while similar in intent, often face legal challenges and lack the comprehensive framework that CBA mechanisms provide for integrating environmental and trade policies effectively.

Connection

Carbon border adjustments and climate tariffs both aim to reduce carbon emissions by imposing taxes or fees on imported goods based on their carbon footprint. These mechanisms create an economic incentive for foreign producers to adopt greener practices, preventing carbon leakage and leveling the playing field for domestic industries facing stringent environmental regulations. By aligning trade policies with climate goals, they drive global efforts toward sustainable economic development and carbon neutrality.

Key Terms

Carbon Leakage

Climate tariffs and carbon border adjustments both aim to prevent carbon leakage by imposing costs on imported goods based on their carbon content, ensuring fair competition for domestic industries subject to carbon regulations. Carbon border adjustments specifically target emissions associated with imported products, adjusting prices to reflect domestic carbon pricing mechanisms and discouraging companies from relocating production to regions with laxer environmental policies. Explore further to understand how these mechanisms protect climate goals and promote sustainable trade.

Trade Competitiveness

Climate tariffs and carbon border adjustments both aim to protect trade competitiveness by leveling the playing field for domestic industries subject to carbon pricing. Climate tariffs impose fees on imported goods based on their carbon footprint, incentivizing cleaner production methods, while carbon border adjustments adjust import prices to reflect the carbon costs faced by domestic producers, reducing carbon leakage risks. Explore the nuances and impact of these mechanisms on global trade competitiveness to understand their role in climate policy.

Emissions Pricing

Climate tariffs and carbon border adjustments both target emissions pricing by imposing costs on imported goods based on their carbon footprint, aiming to level the playing field for domestic industries subject to stricter regulations. Climate tariffs focus broadly on environmental impacts, while carbon border adjustments specifically adjust import prices to reflect the carbon price paid domestically. Explore the differences and implications of these instruments to understand their role in global emissions reduction strategies.

Source and External Links

Carbon Tariffs: The Future of Climate Policy - Perry World House - Climate tariffs, or Border Carbon Adjustments (BCAs), are fees on foreign imports based on their carbon emissions to prevent carbon leakage and align prices of domestic and imported goods while addressing environmental, economic, and national security concerns.

Carbon tariffs are coming. Here's how the U.S. is preparing - The U.S. is monitoring and adapting to carbon border fees, which expand sectors covered by tariffs to include chemicals and polymers, impacting a large portion of exports to regions like the EU.

Carbon tariffs: an instrument for tackling climate change? - Carbon tariffs aim to tax carbon-intensive imports and can be coupled with revenue recycling to support climate mitigation and economic progress in exporting countries, offering a potential global climate policy consensus.

dowidth.com

dowidth.com