Unretirement refers to the trend of individuals returning to the workforce after retirement, driven by financial needs, personal fulfillment, or evolving career goals. A second career involves transitioning into a new professional field, often unrelated to one's original occupation, to leverage skills or pursue passions. Explore the differences and opportunities of unretirement versus second careers to navigate your economic future effectively.

Why it is important

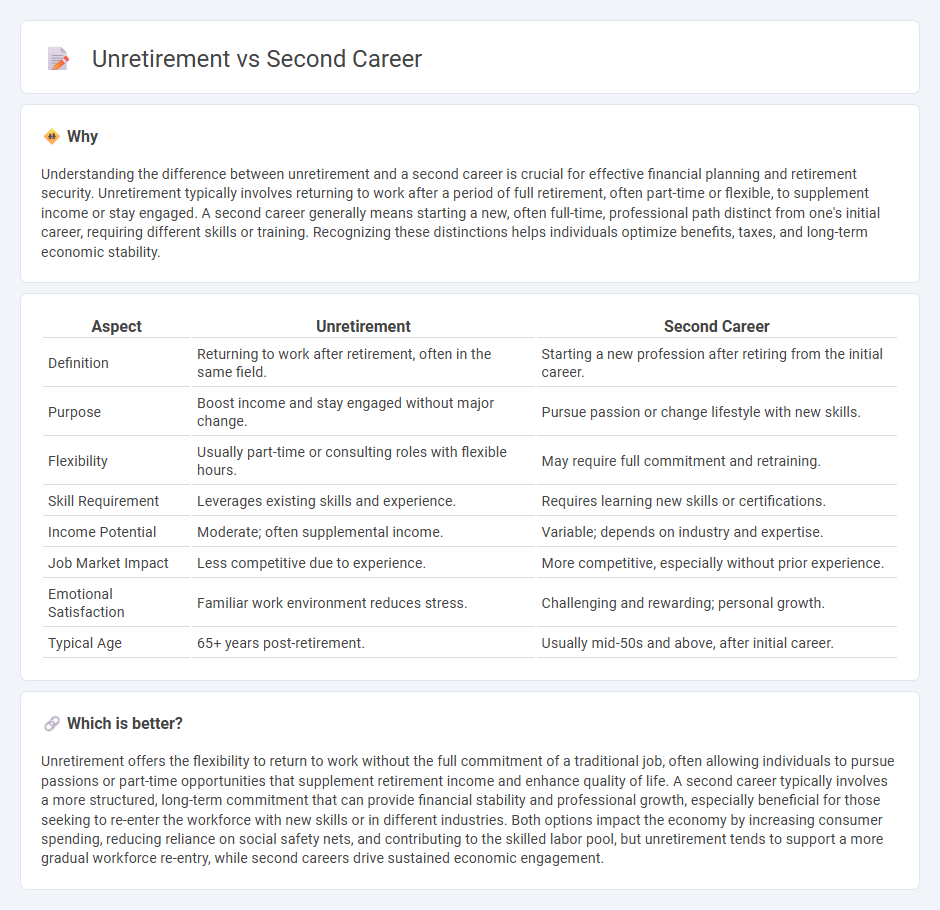

Understanding the difference between unretirement and a second career is crucial for effective financial planning and retirement security. Unretirement typically involves returning to work after a period of full retirement, often part-time or flexible, to supplement income or stay engaged. A second career generally means starting a new, often full-time, professional path distinct from one's initial career, requiring different skills or training. Recognizing these distinctions helps individuals optimize benefits, taxes, and long-term economic stability.

Comparison Table

| Aspect | Unretirement | Second Career |

|---|---|---|

| Definition | Returning to work after retirement, often in the same field. | Starting a new profession after retiring from the initial career. |

| Purpose | Boost income and stay engaged without major change. | Pursue passion or change lifestyle with new skills. |

| Flexibility | Usually part-time or consulting roles with flexible hours. | May require full commitment and retraining. |

| Skill Requirement | Leverages existing skills and experience. | Requires learning new skills or certifications. |

| Income Potential | Moderate; often supplemental income. | Variable; depends on industry and expertise. |

| Job Market Impact | Less competitive due to experience. | More competitive, especially without prior experience. |

| Emotional Satisfaction | Familiar work environment reduces stress. | Challenging and rewarding; personal growth. |

| Typical Age | 65+ years post-retirement. | Usually mid-50s and above, after initial career. |

Which is better?

Unretirement offers the flexibility to return to work without the full commitment of a traditional job, often allowing individuals to pursue passions or part-time opportunities that supplement retirement income and enhance quality of life. A second career typically involves a more structured, long-term commitment that can provide financial stability and professional growth, especially beneficial for those seeking to re-enter the workforce with new skills or in different industries. Both options impact the economy by increasing consumer spending, reducing reliance on social safety nets, and contributing to the skilled labor pool, but unretirement tends to support a more gradual workforce re-entry, while second careers drive sustained economic engagement.

Connection

Unretirement and second careers are closely linked through the growing trend of individuals choosing to reenter the workforce after retirement, driven by financial needs, personal fulfillment, or shifting economic conditions. Statistics show that nearly 40% of retirees pursue part-time or new career opportunities, contributing to economic growth by expanding the labor force participation rate among older adults. This phenomenon influences labor market dynamics, retirement planning models, and policies aimed at supporting flexible work arrangements for aging populations.

Key Terms

Labor Force Participation

Labor force participation rates for second careers show sustained engagement as individuals seek meaningful work beyond initial retirement plans, contrasting with unretirement trends where retirees temporarily re-enter the workforce mainly for financial necessity. Data from the Bureau of Labor Statistics reveal that nearly 30% of workers aged 55-64 pursue second careers, while unretirement typically involves a shorter labor market re-entry with less career change. Explore deeper insights into labor force participation dynamics between second career transitions and unretirement strategies.

Income Security

Second career opportunities provide income security by leveraging existing skills and experience to generate consistent earnings, often in a new industry or role. Unretirement, on the other hand, focuses on re-entering the workforce to supplement retirement savings, offering flexibility and supplemental income without full financial dependence. Explore more to understand which path best enhances your long-term financial stability.

Human Capital

Second career development emphasizes leveraging accrued human capital such as skills, experience, and professional networks to transition into new roles, often within a different industry. Unretirement, by contrast, involves re-entering the workforce post-retirement to utilize existing expertise and maintain economic engagement without necessarily shifting career paths. Explore comprehensive strategies to maximize human capital benefits in both career paradigms for sustained professional fulfillment.

Source and External Links

What Is A Second Career? - Ignite Career Center - A second career allows professionals to shift to a new field or industry, whether for fulfillment, lifestyle change, or to pursue a long-held interest, often after significant time in their first career.

21 Second Careers To Consider (With Salaries) | Indeed.com - A second career typically involves a mid-career change after at least 10 years in one field, offering opportunities in diverse sectors such as healthcare, technology, and education.

10 Second Career Ideas for Retirees - Money | HowStuffWorks - Retirees often choose second careers--sometimes called "encore careers"--to stay active, apply their expertise in new ways, or give back to the community, with options ranging from nonprofits to consulting.

dowidth.com

dowidth.com