Girl math applies intuitive, everyday logic to budgeting, focusing on perceived value and small savings, while dad math relies on traditional, exact calculations and strict cost analysis. These contrasting approaches reveal how emotional and practical perspectives influence financial decisions within households. Explore the dynamics of girl math versus dad math to understand diverse economic mindsets better.

Why it is important

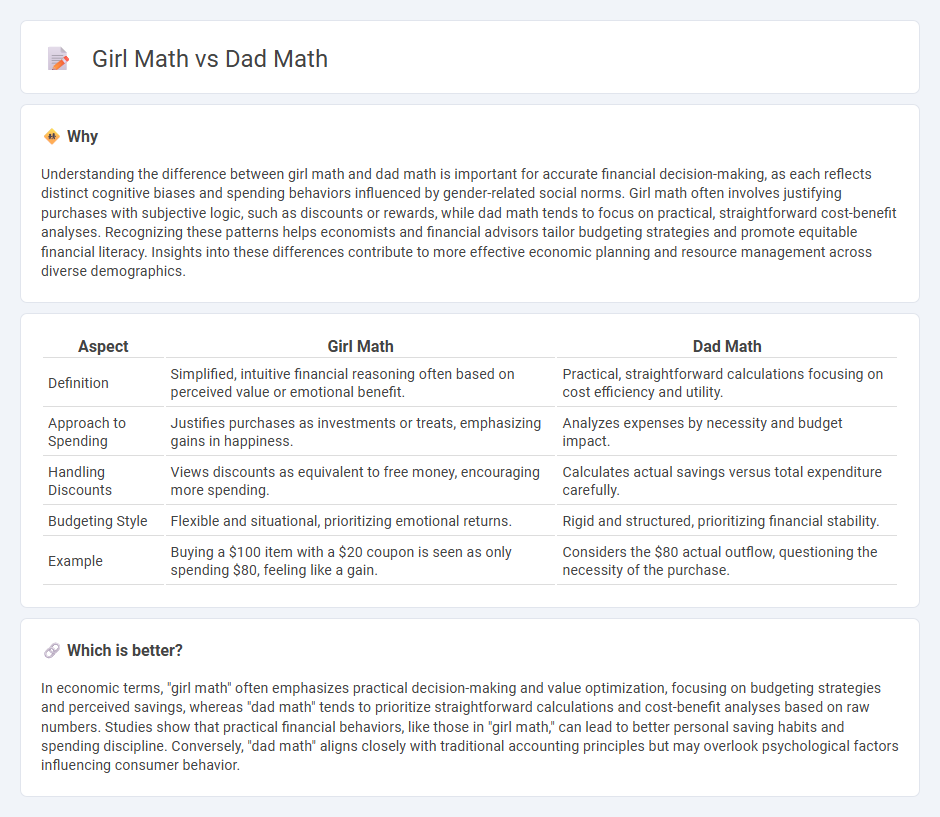

Understanding the difference between girl math and dad math is important for accurate financial decision-making, as each reflects distinct cognitive biases and spending behaviors influenced by gender-related social norms. Girl math often involves justifying purchases with subjective logic, such as discounts or rewards, while dad math tends to focus on practical, straightforward cost-benefit analyses. Recognizing these patterns helps economists and financial advisors tailor budgeting strategies and promote equitable financial literacy. Insights into these differences contribute to more effective economic planning and resource management across diverse demographics.

Comparison Table

| Aspect | Girl Math | Dad Math |

|---|---|---|

| Definition | Simplified, intuitive financial reasoning often based on perceived value or emotional benefit. | Practical, straightforward calculations focusing on cost efficiency and utility. |

| Approach to Spending | Justifies purchases as investments or treats, emphasizing gains in happiness. | Analyzes expenses by necessity and budget impact. |

| Handling Discounts | Views discounts as equivalent to free money, encouraging more spending. | Calculates actual savings versus total expenditure carefully. |

| Budgeting Style | Flexible and situational, prioritizing emotional returns. | Rigid and structured, prioritizing financial stability. |

| Example | Buying a $100 item with a $20 coupon is seen as only spending $80, feeling like a gain. | Considers the $80 actual outflow, questioning the necessity of the purchase. |

Which is better?

In economic terms, "girl math" often emphasizes practical decision-making and value optimization, focusing on budgeting strategies and perceived savings, whereas "dad math" tends to prioritize straightforward calculations and cost-benefit analyses based on raw numbers. Studies show that practical financial behaviors, like those in "girl math," can lead to better personal saving habits and spending discipline. Conversely, "dad math" aligns closely with traditional accounting principles but may overlook psychological factors influencing consumer behavior.

Connection

Girl math and dad math both represent informal, humor-infused approaches to personal finance that often simplify complex economic decisions. They highlight cognitive biases and behavioral economics principles, such as mental accounting and value rationalization, which influence spending and saving habits. Understanding these concepts provides insight into diverse financial behaviors and decision-making strategies within households.

Key Terms

Opportunity Cost

Dad math emphasizes practical calculations rooted in opportunity cost, such as evaluating financial trade-offs like choosing between spending money on immediate wants versus saving for future investments. Girl math often playfully reframes spending logic, highlighting mental accounts and emotional value, sometimes minimizing perceived costs by focusing on future benefits or savings. Explore more to understand how these differing perspectives influence financial decision-making strategies.

Behavioral Economics

Dad math refers to the heuristic-driven calculations often employed by men, emphasizing practicality and cost-saving strategies, whereas girl math highlights the emotionally influenced, value-driven financial decisions often observed in women. Both concepts intersect significantly with Behavioral Economics, which studies the effects of psychological, cognitive, emotional, cultural, and social factors on economic decisions. Explore more to understand how these gendered approaches reflect underlying behavioral economic principles.

Consumption Patterns

Dad math often involves practical cost-saving calculations, such as comparing bulk purchase prices and estimating expenses for future needs while emphasizing efficiency. Girl math tends to highlight emotional spending rationales, crediting small indulgences as earned rewards or strategizing cashback and discounts to maximize perceived value. Explore the nuances of consumption patterns to better understand these distinct financial mindsets.

Source and External Links

Math Dad - An interactive website for students to learn addition, subtraction, multiplication, and division math facts and develop problem-solving skills.

Dad's Worksheets - Offers thousands of free math-related worksheets for practice on various topics like math facts, place value, and more.

Math Worksheet - Provides printable worksheets for one and two-digit operations in addition, subtraction, multiplication, and division.

dowidth.com

dowidth.com