Carbon border adjustment (CBA) imposes fees on imported goods based on their carbon emissions to level the playing field for domestic producers facing stringent environmental regulations. Import quotas limit the quantity of certain goods entering a country, often aiming to protect local industries or control trade deficits. Explore the economic impacts and policy implications of these measures to understand their role in global trade dynamics.

Why it is important

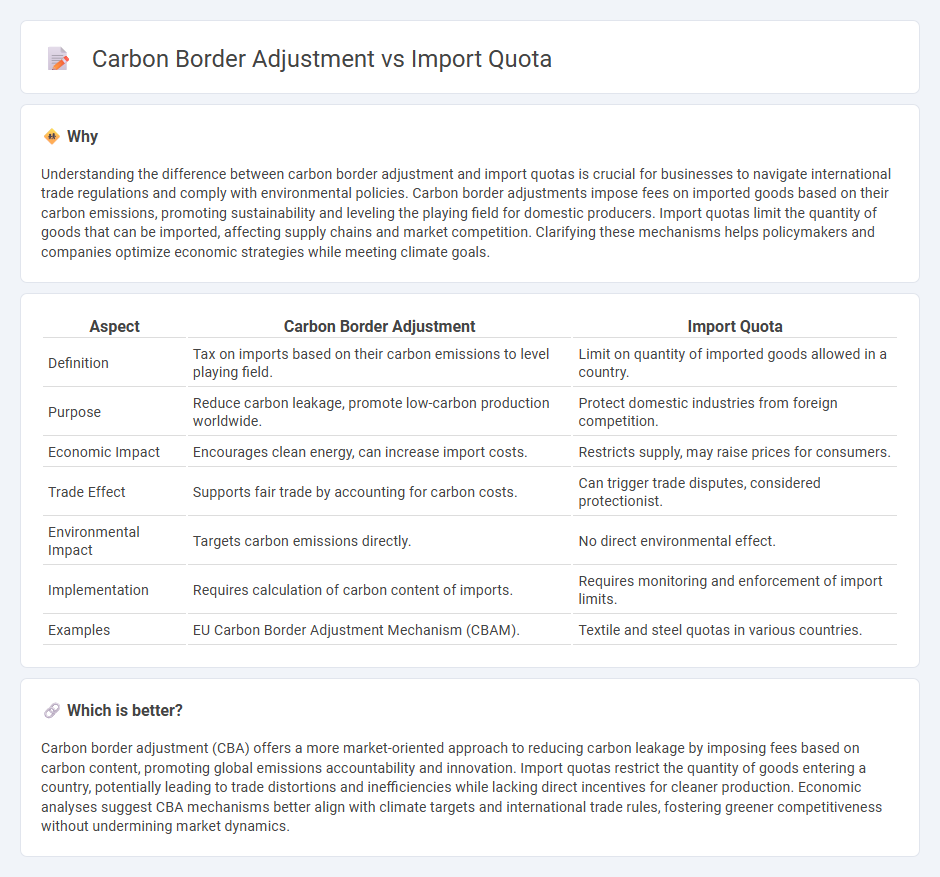

Understanding the difference between carbon border adjustment and import quotas is crucial for businesses to navigate international trade regulations and comply with environmental policies. Carbon border adjustments impose fees on imported goods based on their carbon emissions, promoting sustainability and leveling the playing field for domestic producers. Import quotas limit the quantity of goods that can be imported, affecting supply chains and market competition. Clarifying these mechanisms helps policymakers and companies optimize economic strategies while meeting climate goals.

Comparison Table

| Aspect | Carbon Border Adjustment | Import Quota |

|---|---|---|

| Definition | Tax on imports based on their carbon emissions to level playing field. | Limit on quantity of imported goods allowed in a country. |

| Purpose | Reduce carbon leakage, promote low-carbon production worldwide. | Protect domestic industries from foreign competition. |

| Economic Impact | Encourages clean energy, can increase import costs. | Restricts supply, may raise prices for consumers. |

| Trade Effect | Supports fair trade by accounting for carbon costs. | Can trigger trade disputes, considered protectionist. |

| Environmental Impact | Targets carbon emissions directly. | No direct environmental effect. |

| Implementation | Requires calculation of carbon content of imports. | Requires monitoring and enforcement of import limits. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | Textile and steel quotas in various countries. |

Which is better?

Carbon border adjustment (CBA) offers a more market-oriented approach to reducing carbon leakage by imposing fees based on carbon content, promoting global emissions accountability and innovation. Import quotas restrict the quantity of goods entering a country, potentially leading to trade distortions and inefficiencies while lacking direct incentives for cleaner production. Economic analyses suggest CBA mechanisms better align with climate targets and international trade rules, fostering greener competitiveness without undermining market dynamics.

Connection

Carbon border adjustments and import quotas both serve as trade policy tools aimed at reducing carbon emissions by influencing international market dynamics. Carbon border adjustment imposes tariffs on imported goods based on their carbon footprint, encouraging cleaner production methods globally. Import quotas restrict the quantity of goods imported, which can limit carbon-intensive products' entry, indirectly supporting emissions reduction goals.

Key Terms

Trade Restriction

Import quotas limit the quantity of goods entering a country, directly restricting trade volume to protect domestic industries. Carbon Border Adjustments (CBAs) impose taxes on imported goods based on their carbon emissions, aiming to equalize environmental costs and prevent carbon leakage without limiting trade quantities. Explore how these mechanisms impact international trade policies and environmental goals in more depth.

Emissions Regulation

Import quotas restrict the volume of goods entering a country, indirectly limiting emissions by capping production output, whereas Carbon Border Adjustment Mechanisms (CBAM) directly impose fees on imports based on their carbon footprint, encouraging cleaner supply chains. Emissions regulations embedded in CBAM align with global climate targets by internalizing environmental costs and promoting low-carbon technologies. Discover how these regulatory tools shape sustainable trade policies and drive global emission reductions.

Tariff

Import quotas limit the quantity of specific goods allowed into a country, directly restricting supply and potentially increasing prices, whereas carbon border adjustments (CBAs) impose tariffs based on the carbon emissions associated with imported products, incentivizing cleaner production methods. Tariffs under CBAs are designed to level the playing field by accounting for carbon costs embedded in imports, encouraging global emission reduction efforts without quantity restrictions. Explore further to understand how these trade policies impact international markets and environmental goals.

Source and External Links

Import Quota | EBSCO Research Starters - An import quota is a government-imposed limit on the quantity of a specific good that can be imported into a country within a set time frame, with two main types: absolute quotas, which set a strict maximum quantity, and tariff rate quotas, which allow imports beyond a threshold but impose a higher tariff rate on the excess.

Quota Administration | U.S. Customs and Border Protection - Import quotas in the U.S. control the volume of certain commodities imported during specific periods and are enforced as absolute or tariff rate quotas, with administration shared between U.S. Customs and Border Protection and other government agencies.

Import Quotas - Definition, Types, Examples, Benefits - Import quotas protect domestic industries by limiting foreign goods that can be imported, thus restricting supply, raising prices, and shielding local producers, although they may harm consumers by reducing access to lower-priced imports.

dowidth.com

dowidth.com