De-dollarization refers to reducing reliance on the US dollar in international trade and domestic transactions, promoting national currencies instead. Currency substitution occurs when residents prefer foreign currencies over the local one, often due to inflation or instability, undermining monetary policy effectiveness. Explore further to understand the impacts of these currency dynamics on global and local economies.

Why it is important

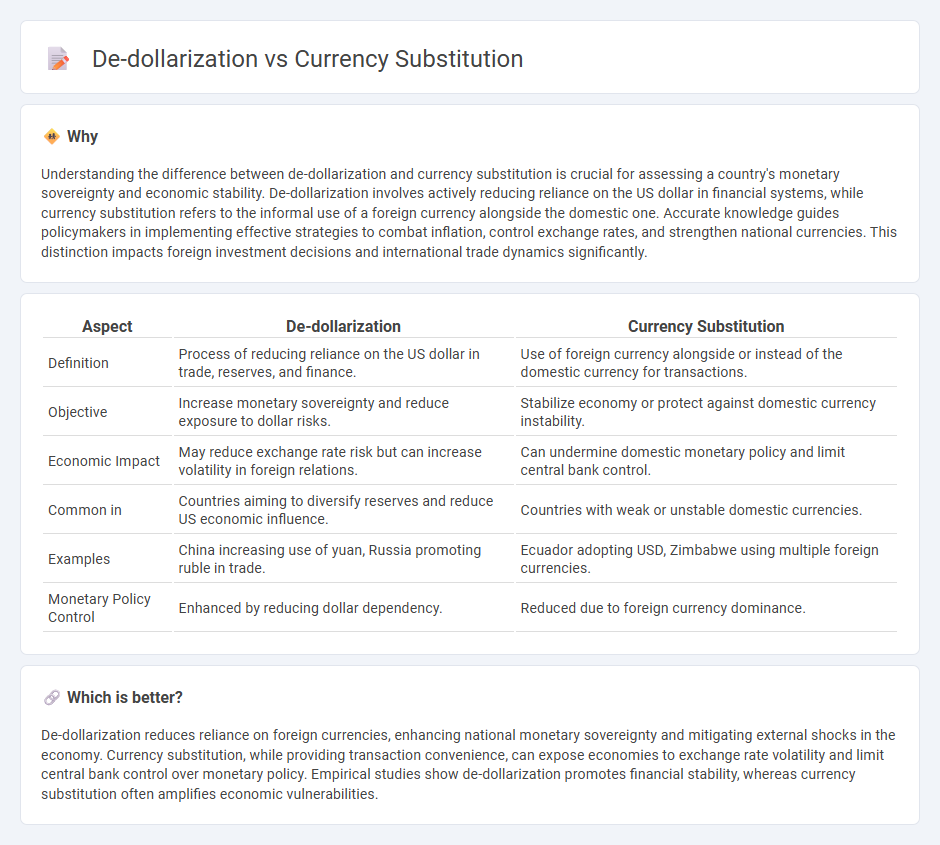

Understanding the difference between de-dollarization and currency substitution is crucial for assessing a country's monetary sovereignty and economic stability. De-dollarization involves actively reducing reliance on the US dollar in financial systems, while currency substitution refers to the informal use of a foreign currency alongside the domestic one. Accurate knowledge guides policymakers in implementing effective strategies to combat inflation, control exchange rates, and strengthen national currencies. This distinction impacts foreign investment decisions and international trade dynamics significantly.

Comparison Table

| Aspect | De-dollarization | Currency Substitution |

|---|---|---|

| Definition | Process of reducing reliance on the US dollar in trade, reserves, and finance. | Use of foreign currency alongside or instead of the domestic currency for transactions. |

| Objective | Increase monetary sovereignty and reduce exposure to dollar risks. | Stabilize economy or protect against domestic currency instability. |

| Economic Impact | May reduce exchange rate risk but can increase volatility in foreign relations. | Can undermine domestic monetary policy and limit central bank control. |

| Common in | Countries aiming to diversify reserves and reduce US economic influence. | Countries with weak or unstable domestic currencies. |

| Examples | China increasing use of yuan, Russia promoting ruble in trade. | Ecuador adopting USD, Zimbabwe using multiple foreign currencies. |

| Monetary Policy Control | Enhanced by reducing dollar dependency. | Reduced due to foreign currency dominance. |

Which is better?

De-dollarization reduces reliance on foreign currencies, enhancing national monetary sovereignty and mitigating external shocks in the economy. Currency substitution, while providing transaction convenience, can expose economies to exchange rate volatility and limit central bank control over monetary policy. Empirical studies show de-dollarization promotes financial stability, whereas currency substitution often amplifies economic vulnerabilities.

Connection

De-dollarization involves reducing reliance on the US dollar in domestic and international transactions, while currency substitution occurs when residents use a foreign currency alongside or instead of the local currency. Both phenomena reflect shifts in economic confidence and monetary sovereignty, often triggered by inflation, exchange rate instability, or geopolitical pressures. Together, they impact monetary policy effectiveness, foreign exchange reserves, and can reshape trade and investment patterns.

Key Terms

Exchange Rate Regime

Currency substitution involves using a foreign currency alongside or instead of the domestic currency, often leading to a de facto dollarized exchange rate regime with limited monetary policy control. De-dollarization efforts aim to reduce reliance on foreign currencies by promoting the domestic currency through tighter regulations and incentives, impacting the exchange rate regime by increasing currency flexibility and strengthening monetary sovereignty. Explore the mechanisms behind exchange rate adjustments in currency substitution and de-dollarization to deepen understanding of their economic implications.

Monetary Sovereignty

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, eroding monetary sovereignty by limiting the central bank's control over money supply and interest rates. De-dollarization is a deliberate policy aimed at reducing the reliance on foreign currencies, particularly the U.S. dollar, to restore monetary sovereignty and strengthen national financial stability. Explore the dynamics and policy tools involved in enhancing monetary sovereignty through effective de-dollarization strategies.

Reserve Currency

Currency substitution occurs when a country uses a foreign currency, often the US dollar, alongside or instead of its own for domestic transactions, primarily to stabilize the economy or curb inflation. De-dollarization refers to policies aimed at reducing the dominance of the US dollar as the reserve currency in international trade, promoting alternatives like the euro or Chinese yuan to enhance monetary sovereignty. Explore the dynamics of reserve currency shifts and their impact on global financial stability.

Source and External Links

Currency Substitution - Pros and Cons - Economics Help - Currency substitution occurs when an economy uses an alternative currency, often a major international one like the US dollar or euro, either alongside or in place of the domestic currency, typically to stabilize against inflation or loss of confidence in local money.

Currency Substitution in High Inflation Countries - IMF eLibrary - In countries with high inflation, currency substitution can weaken the domestic currency's role as a nominal anchor, making monetary policy less effective and potentially increasing exchange rate volatility, especially under floating exchange rate regimes.

Currency Substitution under Transaction Costs - AEA Papers and Proceedings - The choice between using domestic or foreign currency for transactions is influenced by relative transaction costs, with agents more likely to adopt the currency that minimizes their costs, potentially leading to equilibrium where both currencies circulate but one dominates depending on these costs.

dowidth.com

dowidth.com