Rentvesting allows individuals to invest in property while renting their primary residence, optimizing financial flexibility and potential wealth growth. Owner-occupying traditionally involves purchasing a home to live in, building home equity over time but often limiting liquidity. Explore the advantages and considerations of rentvesting versus owner-occupying to make informed financial decisions.

Why it is important

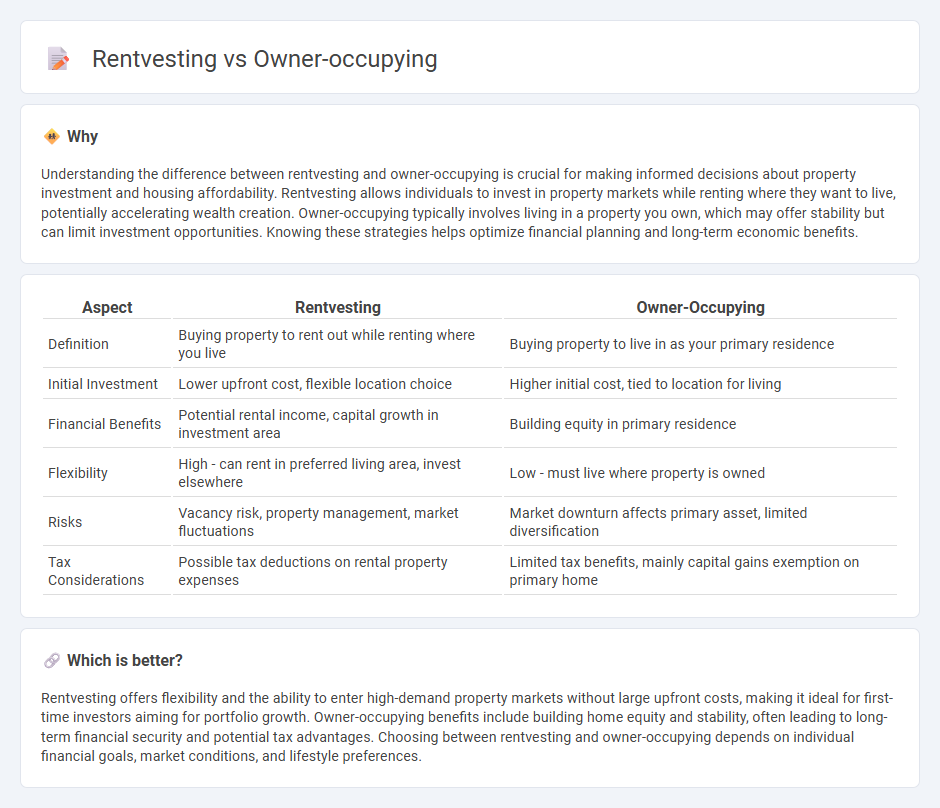

Understanding the difference between rentvesting and owner-occupying is crucial for making informed decisions about property investment and housing affordability. Rentvesting allows individuals to invest in property markets while renting where they want to live, potentially accelerating wealth creation. Owner-occupying typically involves living in a property you own, which may offer stability but can limit investment opportunities. Knowing these strategies helps optimize financial planning and long-term economic benefits.

Comparison Table

| Aspect | Rentvesting | Owner-Occupying |

|---|---|---|

| Definition | Buying property to rent out while renting where you live | Buying property to live in as your primary residence |

| Initial Investment | Lower upfront cost, flexible location choice | Higher initial cost, tied to location for living |

| Financial Benefits | Potential rental income, capital growth in investment area | Building equity in primary residence |

| Flexibility | High - can rent in preferred living area, invest elsewhere | Low - must live where property is owned |

| Risks | Vacancy risk, property management, market fluctuations | Market downturn affects primary asset, limited diversification |

| Tax Considerations | Possible tax deductions on rental property expenses | Limited tax benefits, mainly capital gains exemption on primary home |

Which is better?

Rentvesting offers flexibility and the ability to enter high-demand property markets without large upfront costs, making it ideal for first-time investors aiming for portfolio growth. Owner-occupying benefits include building home equity and stability, often leading to long-term financial security and potential tax advantages. Choosing between rentvesting and owner-occupying depends on individual financial goals, market conditions, and lifestyle preferences.

Connection

Rentvesting and owner-occupying are connected through their shared goal of property investment and homeownership, allowing individuals to build equity while managing housing costs. Rentvesting involves purchasing an investment property in an affordable location while renting where one wants to live, whereas owner-occupying means living in the property one owns. Both strategies influence housing market dynamics, affordability, and personal financial planning within the economy.

Key Terms

Equity

Owner-occupying allows homeowners to build equity directly by residing in and paying off their primary property, which generally appreciates over time. Rentvesting offers a strategic approach where individuals rent their living space while investing in property elsewhere, potentially accelerating equity growth through rental income and capital gains in more affordable or high-growth markets. Explore how these two strategies impact your equity accumulation and long-term financial goals in property investment.

Cash Flow

Owner-occupying involves living in a property you own, which often limits cash flow due to mortgage and maintenance expenses, while rentvesting allows individuals to rent their living space and invest in property elsewhere, potentially generating positive cash flow through rental income. Rentvesting offers more flexibility and diversification, helping to build wealth by leveraging rental yields and capital growth on investment properties. Discover how these strategies impact your financial goals and cash flow management by exploring detailed comparisons.

Capital Growth

Owner-occupying properties typically offer stable capital growth due to personal use and long-term investment, while rentvesting allows investors to enter high-growth markets by renting where they want to live and owning investment properties elsewhere. Rentvesting leverages diversified property portfolios to maximize capital appreciation potential and tax benefits. Explore the strategic advantages of owner-occupying versus rentvesting to optimize your capital growth strategy.

Source and External Links

Owner-Occupied Investment Property 101 - Explains the concept of owner-occupied property and its benefits, including lower borrowing risks and tax advantages.

What Qualifies as Owner-Occupied in California - Discusses how owner-occupied status applies to primary residences and multifamily properties with specific loan options in California.

Understanding Owner-Occupied Properties - Provides an overview of owner-occupied properties, highlighting their use as real estate investments with potential rental income.

dowidth.com

dowidth.com