Funflation describes rising prices in leisure and entertainment sectors, driven by increased consumer spending on experiences. Core inflation excludes volatile food and energy prices, providing a clearer measure of long-term price trends. Explore how these inflation types affect economic policy and everyday life.

Why it is important

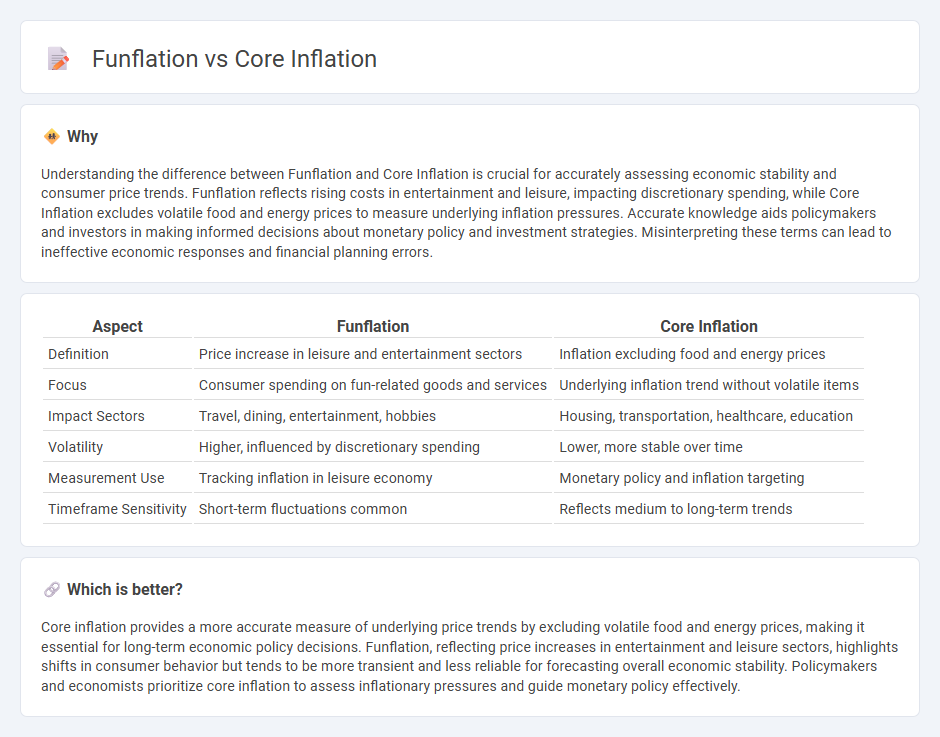

Understanding the difference between Funflation and Core Inflation is crucial for accurately assessing economic stability and consumer price trends. Funflation reflects rising costs in entertainment and leisure, impacting discretionary spending, while Core Inflation excludes volatile food and energy prices to measure underlying inflation pressures. Accurate knowledge aids policymakers and investors in making informed decisions about monetary policy and investment strategies. Misinterpreting these terms can lead to ineffective economic responses and financial planning errors.

Comparison Table

| Aspect | Funflation | Core Inflation |

|---|---|---|

| Definition | Price increase in leisure and entertainment sectors | Inflation excluding food and energy prices |

| Focus | Consumer spending on fun-related goods and services | Underlying inflation trend without volatile items |

| Impact Sectors | Travel, dining, entertainment, hobbies | Housing, transportation, healthcare, education |

| Volatility | Higher, influenced by discretionary spending | Lower, more stable over time |

| Measurement Use | Tracking inflation in leisure economy | Monetary policy and inflation targeting |

| Timeframe Sensitivity | Short-term fluctuations common | Reflects medium to long-term trends |

Which is better?

Core inflation provides a more accurate measure of underlying price trends by excluding volatile food and energy prices, making it essential for long-term economic policy decisions. Funflation, reflecting price increases in entertainment and leisure sectors, highlights shifts in consumer behavior but tends to be more transient and less reliable for forecasting overall economic stability. Policymakers and economists prioritize core inflation to assess inflationary pressures and guide monetary policy effectively.

Connection

Funflation, driven by increased spending on entertainment and leisure activities, contributes to rising demand in non-essential sectors, thereby influencing core inflation metrics that exclude volatile food and energy prices. The interplay between funflation and core inflation highlights how persistent consumer enthusiasm for experiences can sustain upward pressure on overall price levels. Monitoring funflation trends provides valuable insights into underlying inflationary pressures affecting housing, transportation, and healthcare costs central to core inflation calculations.

Key Terms

Price Stability

Core inflation excludes volatile food and energy prices, providing a clearer measure of long-term price stability and underlying inflation trends essential for economic policy decisions. Funflation refers to the rising costs associated with entertainment, leisure, and lifestyle activities, impacting consumer spending but less relevant to traditional inflation metrics. Explore how these concepts influence inflation targeting and economic strategies for a comprehensive understanding of price stability.

Consumer Price Index (CPI)

Core inflation measures underlying price changes by excluding volatile items like food and energy from the Consumer Price Index (CPI), providing a clearer view of long-term price trends. Funflation, a recent term, describes price increases in entertainment and leisure sectors within the CPI, highlighting how discretionary spending impacts inflation differently than essential goods. Explore how these CPI components affect economic policy and consumer behavior in depth.

Demand-driven Spending

Core inflation reflects sustained price increases in essential goods and services, excluding volatile items like food and energy, driven by persistent demand and supply factors. Funflation, characterized by rapid price hikes in leisure and entertainment sectors, results primarily from surge in discretionary consumer spending during economic recoveries. Explore how demand-driven spending patterns influence these inflation dynamics for deeper economic insights.

Source and External Links

Core inflation - Wikipedia - Core inflation measures the underlying long-run trend in aggregate price levels by excluding volatile items like food and energy, making it a key indicator for long-term inflation trends and economic policy decisions.

United States Core Inflation Rate - Trading Economics - The U.S. core inflation rate, which excludes food and energy prices, was 2.9% in June 2025 and is expected to trend around 2.6% in 2026 and 2.3% in 2027.

Core inflation: a measure of inflation for policy purposes - BIS - Core inflation is useful for policymakers as it filters out short-term price fluctuations to better reflect persistent inflation trends that inform monetary policy decisions.

dowidth.com

dowidth.com