Carbon border adjustment mechanisms aim to tax imports based on their carbon emissions to level the playing field for domestic industries adhering to climate policies, while fossil fuel subsidy reform seeks to eliminate government financial support that distorts energy markets and encourages pollution. Both strategies address climate change by incentivizing cleaner production and consumption, yet they target different points in the economic supply chain. Explore these approaches further to understand how they reshape global trade and environmental policy.

Why it is important

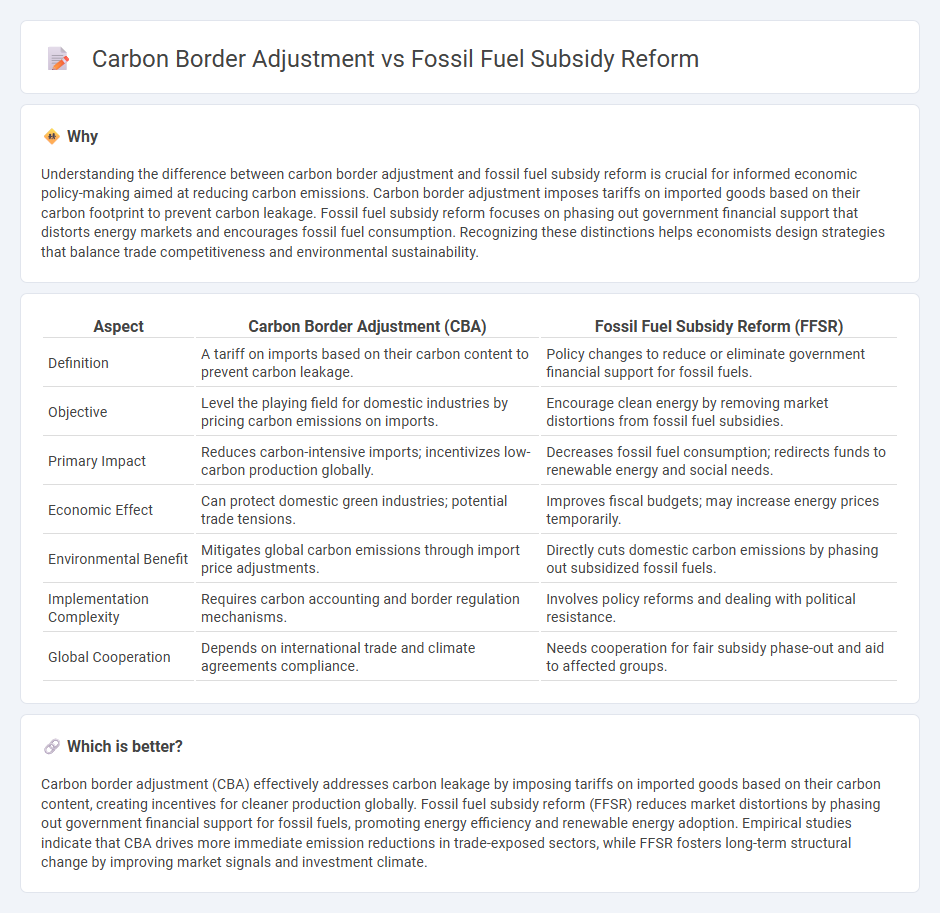

Understanding the difference between carbon border adjustment and fossil fuel subsidy reform is crucial for informed economic policy-making aimed at reducing carbon emissions. Carbon border adjustment imposes tariffs on imported goods based on their carbon footprint to prevent carbon leakage. Fossil fuel subsidy reform focuses on phasing out government financial support that distorts energy markets and encourages fossil fuel consumption. Recognizing these distinctions helps economists design strategies that balance trade competitiveness and environmental sustainability.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Fossil Fuel Subsidy Reform (FFSR) |

|---|---|---|

| Definition | A tariff on imports based on their carbon content to prevent carbon leakage. | Policy changes to reduce or eliminate government financial support for fossil fuels. |

| Objective | Level the playing field for domestic industries by pricing carbon emissions on imports. | Encourage clean energy by removing market distortions from fossil fuel subsidies. |

| Primary Impact | Reduces carbon-intensive imports; incentivizes low-carbon production globally. | Decreases fossil fuel consumption; redirects funds to renewable energy and social needs. |

| Economic Effect | Can protect domestic green industries; potential trade tensions. | Improves fiscal budgets; may increase energy prices temporarily. |

| Environmental Benefit | Mitigates global carbon emissions through import price adjustments. | Directly cuts domestic carbon emissions by phasing out subsidized fossil fuels. |

| Implementation Complexity | Requires carbon accounting and border regulation mechanisms. | Involves policy reforms and dealing with political resistance. |

| Global Cooperation | Depends on international trade and climate agreements compliance. | Needs cooperation for fair subsidy phase-out and aid to affected groups. |

Which is better?

Carbon border adjustment (CBA) effectively addresses carbon leakage by imposing tariffs on imported goods based on their carbon content, creating incentives for cleaner production globally. Fossil fuel subsidy reform (FFSR) reduces market distortions by phasing out government financial support for fossil fuels, promoting energy efficiency and renewable energy adoption. Empirical studies indicate that CBA drives more immediate emission reductions in trade-exposed sectors, while FFSR fosters long-term structural change by improving market signals and investment climate.

Connection

Carbon border adjustment mechanisms (CBAM) and fossil fuel subsidy reform both target reducing greenhouse gas emissions by addressing economic distortions in energy markets. CBAM imposes tariffs on imported goods based on their carbon content, incentivizing cleaner production methods internationally, while fossil fuel subsidy reform eliminates government financial support that artificially lowers the cost of fossil fuels, promoting renewable energy competitiveness. Together, these policies enhance global climate efforts by aligning trade practices with sustainable energy economics and reducing carbon leakage.

Key Terms

Price Distortion

Fossil fuel subsidy reform directly addresses price distortion by reducing artificially low energy costs that encourage excessive fossil fuel consumption and greenhouse gas emissions. Carbon border adjustment mechanisms aim to correct market imbalances by imposing tariffs on imported goods based on their carbon content, thereby leveling the playing field for domestic industries complying with carbon pricing. Explore the comparative impacts of these policies on price signals and environmental outcomes to understand their roles in climate strategy.

Carbon Leakage

Fossil fuel subsidy reform aims to reduce carbon leakage by eliminating financial support that lowers fossil fuel costs, thereby reducing emissions and leveling the playing field for cleaner energy sources. In contrast, carbon border adjustment mechanisms (CBAM) prevent carbon leakage by imposing tariffs on imports from countries with lax climate policies, encouraging global emission reductions. Explore further to understand how these strategies complement each other in combating carbon leakage and promoting sustainable trade.

Competitiveness

Fossil fuel subsidy reform directly reduces market distortions by eliminating financial advantages for carbon-intensive industries, enhancing competitiveness through fairer pricing and encouraging cleaner technologies. Carbon border adjustment mechanisms level the playing field by imposing tariffs on imports from countries with lax carbon regulations, protecting domestic industries from unfair competition and incentivizing global emission reductions. Explore further insights on how these policies reshape industrial competitiveness in the transition to a low-carbon economy.

Source and External Links

Fossil Fuel Subsidy Reform - This policy note highlights the role of finance ministries in phasing out inefficient fossil fuel subsidies to promote sustainable development and reduce emissions.

Policy Monitor--Principles for Designing Effective Fossil Fuel Subsidy Reform - This article discusses key principles for designing effective fossil fuel subsidy reforms, emphasizing thorough preparation and social protection measures.

Background Note on Fossil Fuel Subsidy Reform - This note provides an overview of the rationale and international initiatives for reforming fossil fuel subsidies, addressing their environmental and trade impacts.

dowidth.com

dowidth.com