Neobank stacking leverages digital platforms to offer seamless, cost-effective financial services by integrating multiple fintech solutions into one user-friendly app, enhancing convenience and accessibility. Community banks prioritize personalized customer relationships and local economic support through traditional in-person services, fostering trust and community development. Explore how these contrasting models shape the future of banking and meet diverse consumer needs.

Why it is important

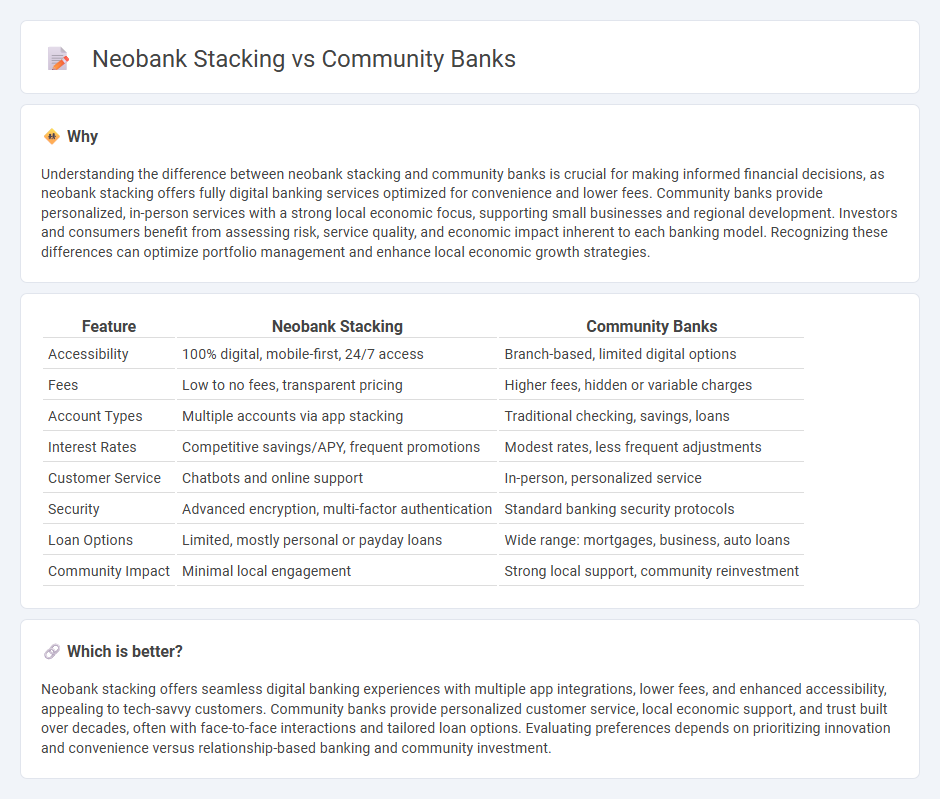

Understanding the difference between neobank stacking and community banks is crucial for making informed financial decisions, as neobank stacking offers fully digital banking services optimized for convenience and lower fees. Community banks provide personalized, in-person services with a strong local economic focus, supporting small businesses and regional development. Investors and consumers benefit from assessing risk, service quality, and economic impact inherent to each banking model. Recognizing these differences can optimize portfolio management and enhance local economic growth strategies.

Comparison Table

| Feature | Neobank Stacking | Community Banks |

|---|---|---|

| Accessibility | 100% digital, mobile-first, 24/7 access | Branch-based, limited digital options |

| Fees | Low to no fees, transparent pricing | Higher fees, hidden or variable charges |

| Account Types | Multiple accounts via app stacking | Traditional checking, savings, loans |

| Interest Rates | Competitive savings/APY, frequent promotions | Modest rates, less frequent adjustments |

| Customer Service | Chatbots and online support | In-person, personalized service |

| Security | Advanced encryption, multi-factor authentication | Standard banking security protocols |

| Loan Options | Limited, mostly personal or payday loans | Wide range: mortgages, business, auto loans |

| Community Impact | Minimal local engagement | Strong local support, community reinvestment |

Which is better?

Neobank stacking offers seamless digital banking experiences with multiple app integrations, lower fees, and enhanced accessibility, appealing to tech-savvy customers. Community banks provide personalized customer service, local economic support, and trust built over decades, often with face-to-face interactions and tailored loan options. Evaluating preferences depends on prioritizing innovation and convenience versus relationship-based banking and community investment.

Connection

Neobank stacking and community banks are interconnected through the complementary roles they play in modern financial ecosystems, where neobanks leverage digital platforms to offer seamless services and community banks provide localized, personalized banking experiences. Neobank stacking enables users to aggregate multiple neobank accounts, enhancing financial management and increasing access to diverse financial products, which community banks often support through partnerships or by offering competitive alternatives. This synergy fosters innovation, financial inclusion, and diversification in banking services, aligning with consumer demand for both convenience and community-centric trust.

Key Terms

Deposits

Community banks hold approximately 30% of U.S. deposits, emphasizing personalized service and local relationship building, while neobanks have rapidly grown their deposit base by offering seamless digital experiences and competitive interest rates. Deposits in neobanks tend to attract younger, tech-savvy customers through budgeting tools and no-fee accounts, contrasting with community banks' reliance on traditional branch networks. Explore how shifting deposit trends are reshaping the banking landscape and what it means for consumer financial choices.

Digital infrastructure

Community banks often rely on legacy systems with limited digital infrastructure, resulting in slower integration of new technologies and less seamless customer experiences. Neobanks leverage cloud-native architectures, APIs, and modern fintech stacks to offer highly scalable, user-friendly platforms with real-time transaction processing and personalized services. Explore how the contrasting digital infrastructures shape the future of banking innovation and customer engagement.

Regulation

Community banks operate under strict regulatory frameworks imposed by federal and state agencies, ensuring robust consumer protections and capital requirements. Neobanks, often relying on partnerships with traditional banks, navigate a complex regulatory landscape but typically face less direct oversight, enabling faster innovation in digital financial services. Explore how regulatory differences shape the competitive dynamics between community banks and neobanks.

Source and External Links

About Community Banking - ICBA - Community banks are locally focused financial institutions that reinvest in their communities, prioritize personal relationships with customers, and are known for their leadership in small business lending and timely, local decision-making.

Community bank - Wikipedia - Community banks are typically locally owned and operated, focusing on serving the needs of local businesses and families, with lending decisions made by people familiar with the community and its unique characteristics.

Proudly Serving Northeast Illinois | American Community Bank - American Community Bank & Trust, founded by local business leaders, emphasizes personal attention, creative solutions, and long-term relationships for both businesses and individual customers in its service area.

dowidth.com

dowidth.com