Locavesting focuses on investing in local businesses and projects to stimulate community economic growth and enhance regional sustainability. Cooperative financing involves pooling resources among members to fund initiatives democratically while sharing risks and benefits equally. Explore how these approaches reshape economic landscapes and empower communities.

Why it is important

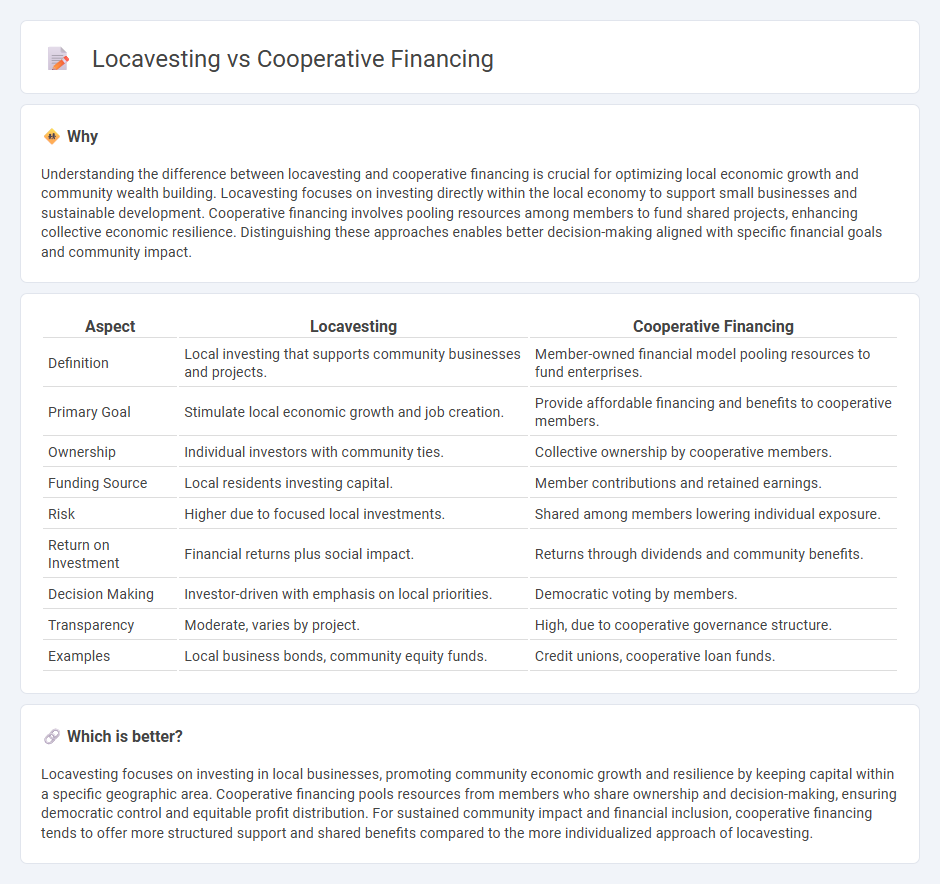

Understanding the difference between locavesting and cooperative financing is crucial for optimizing local economic growth and community wealth building. Locavesting focuses on investing directly within the local economy to support small businesses and sustainable development. Cooperative financing involves pooling resources among members to fund shared projects, enhancing collective economic resilience. Distinguishing these approaches enables better decision-making aligned with specific financial goals and community impact.

Comparison Table

| Aspect | Locavesting | Cooperative Financing |

|---|---|---|

| Definition | Local investing that supports community businesses and projects. | Member-owned financial model pooling resources to fund enterprises. |

| Primary Goal | Stimulate local economic growth and job creation. | Provide affordable financing and benefits to cooperative members. |

| Ownership | Individual investors with community ties. | Collective ownership by cooperative members. |

| Funding Source | Local residents investing capital. | Member contributions and retained earnings. |

| Risk | Higher due to focused local investments. | Shared among members lowering individual exposure. |

| Return on Investment | Financial returns plus social impact. | Returns through dividends and community benefits. |

| Decision Making | Investor-driven with emphasis on local priorities. | Democratic voting by members. |

| Transparency | Moderate, varies by project. | High, due to cooperative governance structure. |

| Examples | Local business bonds, community equity funds. | Credit unions, cooperative loan funds. |

Which is better?

Locavesting focuses on investing in local businesses, promoting community economic growth and resilience by keeping capital within a specific geographic area. Cooperative financing pools resources from members who share ownership and decision-making, ensuring democratic control and equitable profit distribution. For sustained community impact and financial inclusion, cooperative financing tends to offer more structured support and shared benefits compared to the more individualized approach of locavesting.

Connection

Locavesting and cooperative financing both emphasize community-driven economic models that prioritize local investment and shared ownership. Locavesting channels capital into local businesses, enhancing regional economic resilience, while cooperative financing pools resources from community members to fund enterprises with democratic control. Together, these approaches strengthen local economies by fostering sustainable growth, increasing financial inclusion, and promoting collective wealth-building.

Key Terms

Collective Ownership

Cooperative financing emphasizes shared ownership and democratic control among members, enabling collective investment in local enterprises and resources. Locavesting directs capital specifically to local businesses to enhance community economic resilience and sustainability through direct financial support. Explore how collective ownership in cooperative financing and locavesting models drives impactful local economic development.

Community Investment

Cooperative financing empowers local communities by pooling resources to fund projects that generate shared economic benefits, enhancing social equity and sustainable development. Locavesting emphasizes investing in nearby businesses or ventures, promoting local economic growth and fostering stronger community ties through targeted financial support. Explore the advantages and methodologies of these community investment models to understand their impact on regional prosperity and social cohesion.

Local Capital

Cooperative financing empowers community members to pool resources for shared economic growth, fostering local ownership and sustainable development. Locavesting emphasizes investing directly in local businesses and projects, keeping capital circulating within the community to boost regional prosperity. Explore how Local Capital leverages these approaches to strengthen community-driven investment and economic resilience.

Source and External Links

Cooperative Finance - Describes how cooperatives use both debt and equity to meet their capital needs, with equity coming from member contributions that provide ownership rights.

Financing Cooperatives - USDA Rural Development - Explains that cooperatives can borrow from traditional and non-traditional sources like commercial banks and specialized institutions, and may use leasing as a financing option.

Financing -- Start.coop - Discusses the challenges of accessing financing for cooperatives, highlighting the role of co-op loan funds and innovations in co-op financing strategies.

dowidth.com

dowidth.com