Dollarization stabilizes economies by adopting a foreign currency, often the US dollar, reducing inflation and interest rate volatility but limiting monetary policy flexibility. A floating exchange rate allows currency values to fluctuate based on market forces, providing autonomy in monetary policy but exposing economies to exchange rate volatility and speculative attacks. Explore the advantages and challenges of each system to understand their impact on economic stability and growth.

Why it is important

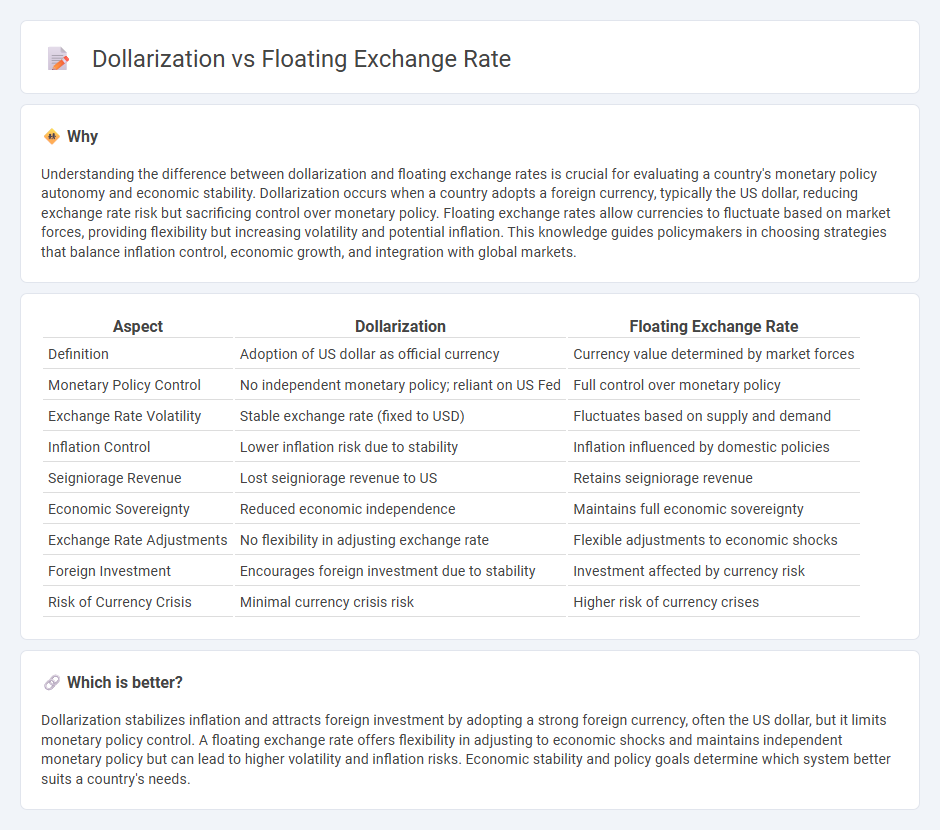

Understanding the difference between dollarization and floating exchange rates is crucial for evaluating a country's monetary policy autonomy and economic stability. Dollarization occurs when a country adopts a foreign currency, typically the US dollar, reducing exchange rate risk but sacrificing control over monetary policy. Floating exchange rates allow currencies to fluctuate based on market forces, providing flexibility but increasing volatility and potential inflation. This knowledge guides policymakers in choosing strategies that balance inflation control, economic growth, and integration with global markets.

Comparison Table

| Aspect | Dollarization | Floating Exchange Rate |

|---|---|---|

| Definition | Adoption of US dollar as official currency | Currency value determined by market forces |

| Monetary Policy Control | No independent monetary policy; reliant on US Fed | Full control over monetary policy |

| Exchange Rate Volatility | Stable exchange rate (fixed to USD) | Fluctuates based on supply and demand |

| Inflation Control | Lower inflation risk due to stability | Inflation influenced by domestic policies |

| Seigniorage Revenue | Lost seigniorage revenue to US | Retains seigniorage revenue |

| Economic Sovereignty | Reduced economic independence | Maintains full economic sovereignty |

| Exchange Rate Adjustments | No flexibility in adjusting exchange rate | Flexible adjustments to economic shocks |

| Foreign Investment | Encourages foreign investment due to stability | Investment affected by currency risk |

| Risk of Currency Crisis | Minimal currency crisis risk | Higher risk of currency crises |

Which is better?

Dollarization stabilizes inflation and attracts foreign investment by adopting a strong foreign currency, often the US dollar, but it limits monetary policy control. A floating exchange rate offers flexibility in adjusting to economic shocks and maintains independent monetary policy but can lead to higher volatility and inflation risks. Economic stability and policy goals determine which system better suits a country's needs.

Connection

Dollarization occurs when a country adopts a foreign currency, often the US dollar, to stabilize its economy and control inflation, which reduces reliance on a fluctuating local currency. A floating exchange rate system, by contrast, lets the market determine currency value based on supply and demand, causing more volatility compared to dollarization. Countries experiencing extreme exchange rate fluctuations may choose dollarization to achieve greater economic stability and reduce uncertainty in trade and investment.

Key Terms

Currency Sovereignty

Floating exchange rates preserve currency sovereignty by allowing exchange rates to fluctuate based on market forces, enabling countries to implement independent monetary policies tailored to their economic conditions. Dollarization, where a country adopts a foreign currency like the U.S. dollar, sacrifices control over monetary policy and exchange rate adjustments, limiting the ability to respond to local economic shocks. Explore the implications of these monetary strategies to understand their impact on national economic stability and policy autonomy.

Monetary Policy

Floating exchange rates allow central banks to adjust monetary policy independently to stabilize inflation and economic growth, as currency value fluctuates based on market forces. Dollarization limits monetary policy options since the local currency is replaced by a foreign currency, often the US dollar, reducing control over interest rates and money supply. Explore the impact of these regimes on economic stability and policy effectiveness to understand their strategic implications.

Exchange Rate Regime

A floating exchange rate allows a country's currency value to fluctuate according to the foreign exchange market, providing flexibility and automatic adjustment to economic conditions. Dollarization occurs when a country officially adopts the US dollar as its legal tender, eliminating exchange rate risk but sacrificing independent monetary policy. Explore the impacts of these exchange rate regimes to understand their advantages and challenges.

Source and External Links

Floating Exchange Rate - Overview, Functions, Benefits, Limitations - A floating exchange rate is determined by supply and demand in the foreign exchange market without fixed limits or constant government control, fluctuating with market conditions and reflecting economic strength and expectations.

What is a floating exchange rate? Explained simply | Western Union - Floating exchange rates vary based on market supply and demand, differ from fixed rates pegged by governments, and provide countries monetary policy independence though with more volatility.

Exchange Rates and their Measurement | Explainer | Education | RBA - Under a floating regime, exchange rates fluctuate according to market supply and demand and economic fundamentals, with central banks rarely intervening except in disorderly conditions.

dowidth.com

dowidth.com