Rentvesting allows individuals to invest in property while renting a home in a desirable location, optimizing financial flexibility and potential equity growth. House hacking involves living in a property while renting out portions, reducing living expenses and building wealth through real estate ownership. Explore these strategies to understand how they impact investment potential and lifestyle choices in the housing market.

Why it is important

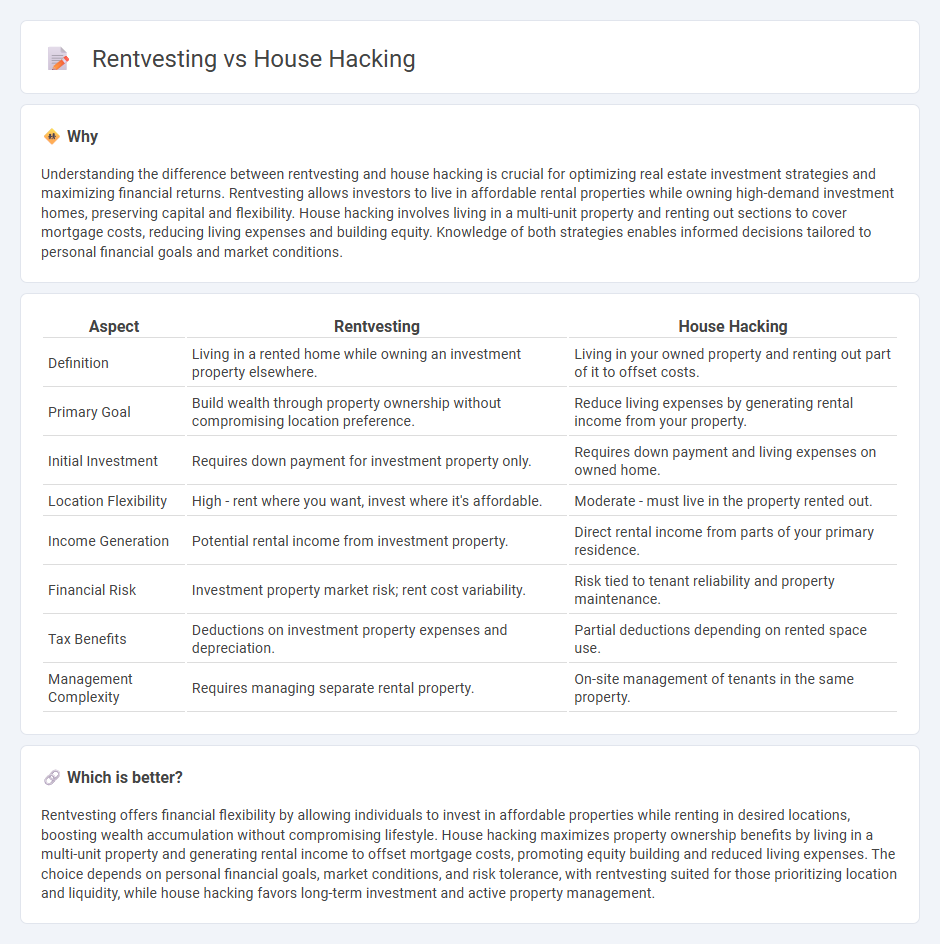

Understanding the difference between rentvesting and house hacking is crucial for optimizing real estate investment strategies and maximizing financial returns. Rentvesting allows investors to live in affordable rental properties while owning high-demand investment homes, preserving capital and flexibility. House hacking involves living in a multi-unit property and renting out sections to cover mortgage costs, reducing living expenses and building equity. Knowledge of both strategies enables informed decisions tailored to personal financial goals and market conditions.

Comparison Table

| Aspect | Rentvesting | House Hacking |

|---|---|---|

| Definition | Living in a rented home while owning an investment property elsewhere. | Living in your owned property and renting out part of it to offset costs. |

| Primary Goal | Build wealth through property ownership without compromising location preference. | Reduce living expenses by generating rental income from your property. |

| Initial Investment | Requires down payment for investment property only. | Requires down payment and living expenses on owned home. |

| Location Flexibility | High - rent where you want, invest where it's affordable. | Moderate - must live in the property rented out. |

| Income Generation | Potential rental income from investment property. | Direct rental income from parts of your primary residence. |

| Financial Risk | Investment property market risk; rent cost variability. | Risk tied to tenant reliability and property maintenance. |

| Tax Benefits | Deductions on investment property expenses and depreciation. | Partial deductions depending on rented space use. |

| Management Complexity | Requires managing separate rental property. | On-site management of tenants in the same property. |

Which is better?

Rentvesting offers financial flexibility by allowing individuals to invest in affordable properties while renting in desired locations, boosting wealth accumulation without compromising lifestyle. House hacking maximizes property ownership benefits by living in a multi-unit property and generating rental income to offset mortgage costs, promoting equity building and reduced living expenses. The choice depends on personal financial goals, market conditions, and risk tolerance, with rentvesting suited for those prioritizing location and liquidity, while house hacking favors long-term investment and active property management.

Connection

Rentvesting and house hacking are connected through their shared strategy of leveraging real estate to build wealth while minimizing personal living expenses. Both approaches involve purchasing investment properties to generate rental income, allowing occupants to either rent out parts of their primary residence or live in a rental while owning real estate elsewhere. This synergy enables individuals to enter the property market with lower upfront costs and optimize cash flow for long-term financial growth.

Key Terms

Cash Flow

House hacking maximizes cash flow by allowing homeowners to live in a property while renting out portions to cover mortgage costs, often resulting in reduced housing expenses. Rentvesting generates positive cash flow by investing in rental properties in affordable markets while living in higher-cost areas, leveraging rental income to build wealth. Explore detailed strategies and financial comparisons to optimize your cash flow through house hacking or rentvesting.

Equity

House hacking builds equity by allowing homeowners to live in a property while renting out portions to cover mortgage costs, accelerating wealth accumulation through principal reduction. Rentvesting involves purchasing rental properties in more affordable markets while renting in desired locations, generating equity remotely without owner occupancy. Explore detailed strategies to maximize equity growth through both house hacking and rentvesting.

Leverage

House hacking leverages personal living space to offset mortgage costs by renting out portions of the property, maximizing financial efficiency and building equity faster. Rentvesting employs leverage by owning rental properties in more affordable markets while living in a preferred location, allowing investors to benefit from property appreciation and rental income simultaneously. Explore deeper insights into how leveraging strategies can optimize your real estate investment returns.

Source and External Links

What Is House Hacking In Real Estate? - House hacking is a real estate strategy where you generate passive income by renting out a part of your property while living there yourself, such as by leasing spare rooms, units in a multifamily property, or an accessory dwelling unit.

What is house hacking and is it worth it? - House hacking allows you to reduce or offset your living expenses by sharing your home with housemates, splitting costs, and potentially building an accessory dwelling unit for additional rental income.

What is House Hacking? Definition and Strategies - House hacking most commonly involves buying a multi-family property, living in one unit, and renting out the others so that tenants cover your mortgage, making it a popular path to homeownership for younger generations.

dowidth.com

dowidth.com