De-dollarization represents a strategic shift where countries reduce reliance on the US dollar in international trade and reserves to enhance financial sovereignty and mitigate exposure to dollar-related risks. Currency diversification involves expanding the portfolio of foreign exchange assets to include multiple currencies like the euro, yuan, or yen, aiming to stabilize economic resilience amid global market fluctuations. Explore the impacts and strategies of these trends on modern economic policies here.

Why it is important

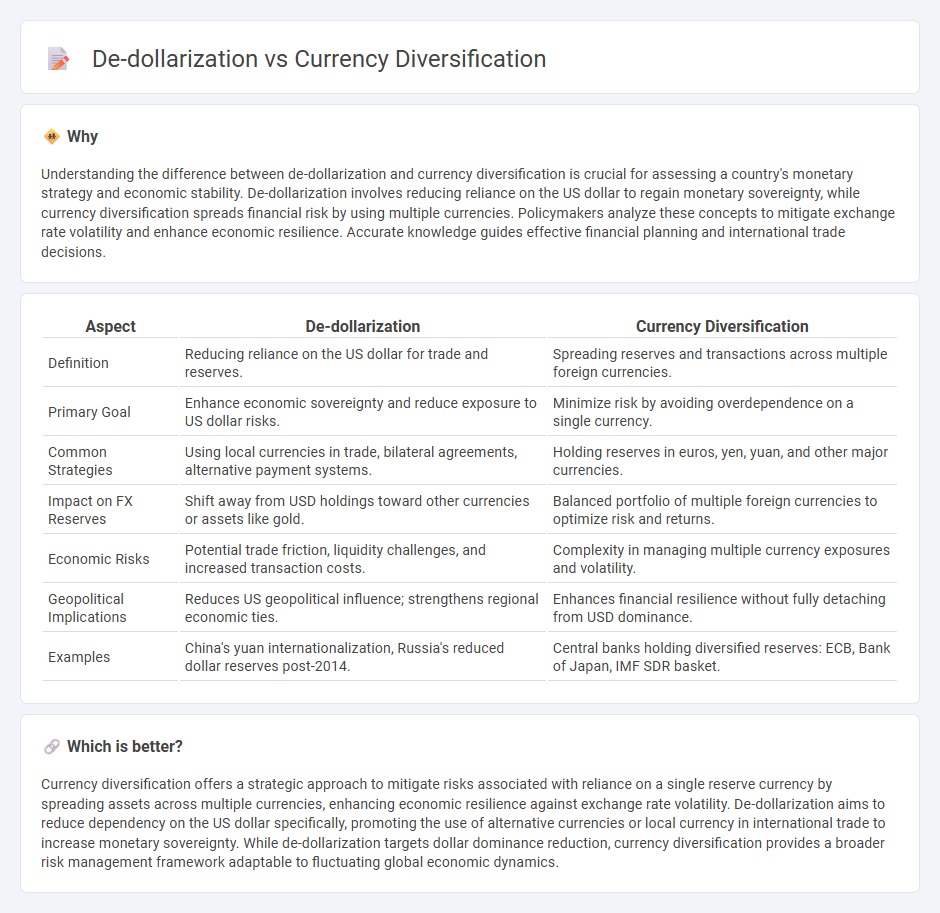

Understanding the difference between de-dollarization and currency diversification is crucial for assessing a country's monetary strategy and economic stability. De-dollarization involves reducing reliance on the US dollar to regain monetary sovereignty, while currency diversification spreads financial risk by using multiple currencies. Policymakers analyze these concepts to mitigate exchange rate volatility and enhance economic resilience. Accurate knowledge guides effective financial planning and international trade decisions.

Comparison Table

| Aspect | De-dollarization | Currency Diversification |

|---|---|---|

| Definition | Reducing reliance on the US dollar for trade and reserves. | Spreading reserves and transactions across multiple foreign currencies. |

| Primary Goal | Enhance economic sovereignty and reduce exposure to US dollar risks. | Minimize risk by avoiding overdependence on a single currency. |

| Common Strategies | Using local currencies in trade, bilateral agreements, alternative payment systems. | Holding reserves in euros, yen, yuan, and other major currencies. |

| Impact on FX Reserves | Shift away from USD holdings toward other currencies or assets like gold. | Balanced portfolio of multiple foreign currencies to optimize risk and returns. |

| Economic Risks | Potential trade friction, liquidity challenges, and increased transaction costs. | Complexity in managing multiple currency exposures and volatility. |

| Geopolitical Implications | Reduces US geopolitical influence; strengthens regional economic ties. | Enhances financial resilience without fully detaching from USD dominance. |

| Examples | China's yuan internationalization, Russia's reduced dollar reserves post-2014. | Central banks holding diversified reserves: ECB, Bank of Japan, IMF SDR basket. |

Which is better?

Currency diversification offers a strategic approach to mitigate risks associated with reliance on a single reserve currency by spreading assets across multiple currencies, enhancing economic resilience against exchange rate volatility. De-dollarization aims to reduce dependency on the US dollar specifically, promoting the use of alternative currencies or local currency in international trade to increase monetary sovereignty. While de-dollarization targets dollar dominance reduction, currency diversification provides a broader risk management framework adaptable to fluctuating global economic dynamics.

Connection

De-dollarization reduces dependence on the US dollar, encouraging countries to diversify their currency reserves and trade settlements. Currency diversification mitigates risks associated with dollar volatility and geopolitical pressures, enhancing economic sovereignty. Both processes strengthen financial stability by promoting alternative currencies and reducing systemic exposure to a single dominant currency.

Key Terms

Foreign Exchange Reserves

Currency diversification in foreign exchange reserves involves holding a mix of currencies such as the euro, yen, and yuan to reduce reliance on the US dollar and mitigate exchange rate risks. De-dollarization seeks to replace the dollar as the dominant reserve currency through strategic shifts toward alternative currencies and assets, impacting global trade and financial stability. Explore how central banks balance these approaches to optimize sovereignty and financial resilience.

Reserve Currency

Currency diversification involves spreading reserve assets across multiple currencies to reduce dependency on a single currency, such as the US dollar. De-dollarization refers to the strategic shift by countries to minimize reliance on the US dollar in their reserves and international trade, promoting alternative currencies like the euro, yuan, or gold. Explore how global economies are reshaping their reserve currency strategies to enhance financial stability and geopolitical influence.

Exchange Rate Risk

Currency diversification involves spreading investments across multiple foreign currencies to reduce exchange rate risk and enhance portfolio stability. De-dollarization refers to reducing reliance on the US dollar in international trade and financial systems, aiming to mitigate vulnerability to dollar fluctuations and geopolitical tensions. Explore more about how these strategies impact exchange rate risk management and global economic stability.

Source and External Links

Why Foreign Currency Diversification Matters for Your Portfolio - FPAM - Currency diversification helps preserve wealth by spreading investment exposure across different currencies, reducing risk from adverse movements in any single currency and maintaining purchasing power over time.

How A Currency Management Strategy Can Work As A Diversifier - A rules-based currency strategy (like ARCS) exposes investors to carry, value, and trend factors, offering portfolio diversification benefits due to low or negative correlation with traditional asset classes.

Currency Diversification: Balance Your Risk and Seize Market Opportunities - Currency diversification balances risk by allowing investors to benefit from low correlations between currencies and other asset classes, helping to protect wealth without requiring speculative trading.

dowidth.com

dowidth.com