Locavesting focuses on directing personal investments to local businesses and projects, promoting regional economic growth by keeping capital within the community. Community development finance involves providing financial services and credit to underserved areas to stimulate economic empowerment and infrastructure improvements. Explore how each approach uniquely impacts economic resilience and local prosperity.

Why it is important

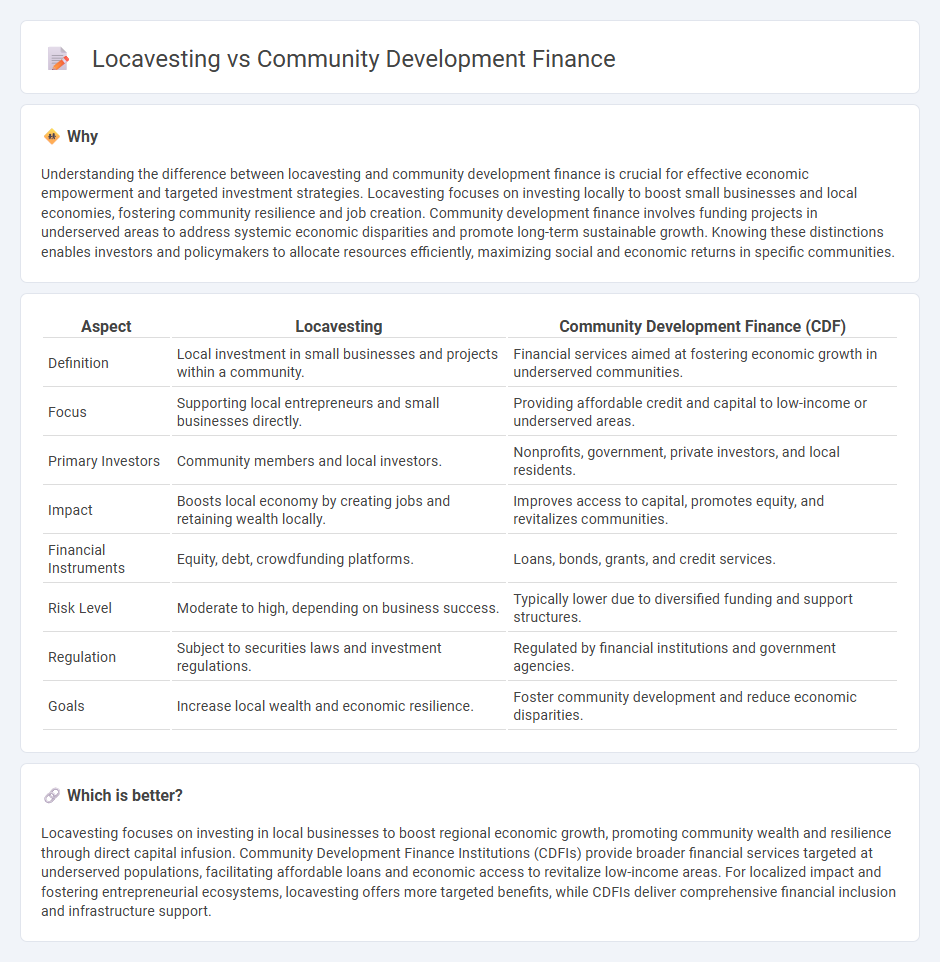

Understanding the difference between locavesting and community development finance is crucial for effective economic empowerment and targeted investment strategies. Locavesting focuses on investing locally to boost small businesses and local economies, fostering community resilience and job creation. Community development finance involves funding projects in underserved areas to address systemic economic disparities and promote long-term sustainable growth. Knowing these distinctions enables investors and policymakers to allocate resources efficiently, maximizing social and economic returns in specific communities.

Comparison Table

| Aspect | Locavesting | Community Development Finance (CDF) |

|---|---|---|

| Definition | Local investment in small businesses and projects within a community. | Financial services aimed at fostering economic growth in underserved communities. |

| Focus | Supporting local entrepreneurs and small businesses directly. | Providing affordable credit and capital to low-income or underserved areas. |

| Primary Investors | Community members and local investors. | Nonprofits, government, private investors, and local residents. |

| Impact | Boosts local economy by creating jobs and retaining wealth locally. | Improves access to capital, promotes equity, and revitalizes communities. |

| Financial Instruments | Equity, debt, crowdfunding platforms. | Loans, bonds, grants, and credit services. |

| Risk Level | Moderate to high, depending on business success. | Typically lower due to diversified funding and support structures. |

| Regulation | Subject to securities laws and investment regulations. | Regulated by financial institutions and government agencies. |

| Goals | Increase local wealth and economic resilience. | Foster community development and reduce economic disparities. |

Which is better?

Locavesting focuses on investing in local businesses to boost regional economic growth, promoting community wealth and resilience through direct capital infusion. Community Development Finance Institutions (CDFIs) provide broader financial services targeted at underserved populations, facilitating affordable loans and economic access to revitalize low-income areas. For localized impact and fostering entrepreneurial ecosystems, locavesting offers more targeted benefits, while CDFIs deliver comprehensive financial inclusion and infrastructure support.

Connection

Locavesting and community development finance both focus on channeling investments into local economies to stimulate job creation and sustainable growth. Locavesting emphasizes investing in nearby businesses to strengthen community wealth, while community development finance provides affordable capital to underserved areas, bridging financial gaps. Together, they promote economic resilience by empowering local enterprises and fostering equitable access to financial resources.

Key Terms

**Community Development Finance:**

Community Development Finance focuses on channeling capital to underserved communities through institutions such as community development financial institutions (CDFIs), credit unions, and microfinance organizations. This approach aims to promote economic growth, affordable housing, and small business expansion by providing accessible loans and investments tailored to local needs. Explore how community development finance empowers neighborhoods and creates sustainable economic opportunities.

Community Development Financial Institutions (CDFIs)

Community Development Financial Institutions (CDFIs) play a pivotal role in community development finance by providing accessible loans, investments, and financial services to underserved communities, fostering economic growth and social equity. Locavesting emphasizes investing local capital to support regional businesses and projects, but CDFIs offer structured financing solutions with an emphasis on impact and accountability in economically disadvantaged areas. Explore how CDFIs uniquely drive inclusive economic development and empower communities through targeted financial strategies.

Financial Inclusion

Community development finance prioritizes financial inclusion by channeling investments into underserved neighborhoods through community banks, credit unions, and impact funds that provide affordable loans and support local businesses. Locavesting emphasizes investing directly in local ventures, fostering economic empowerment within specific geographic areas by promoting transparency and resident participation. Explore the distinct approaches of both models in advancing financial inclusion and driving equitable growth.

Source and External Links

Community Development Finance - Federal Reserve - Community development finance involves diverse funding sources supporting low- and moderate-income communities through public, private, and philanthropic resources, with the Federal Reserve aiding organizations to access technical and financial resources for complex community investments.

CDFI Overview - FDIC - Community Development Financial Institutions (CDFIs) are specialized lenders serving underserved markets by providing financial products and services, supported by the U.S. Treasury's CDFI Fund through monetary awards, tax credits, and capacity-building initiatives.

What is a Community Development Financial Institution (CDFI)? - JPMorgan - CDFIs are mission-driven local financial institutions that provide flexible financing, financial education, and technical assistance to underserved communities, helping to stimulate affordable housing, small businesses, and neighborhood development while leveraging federal resources to attract private investments.

dowidth.com

dowidth.com