Shadow bailouts involve indirect government support to struggling financial institutions through covert mechanisms, often avoiding public scrutiny and explicit budgetary impact. Helicopter money refers to direct cash transfers to the public by central banks or governments, aiming to stimulate demand without increasing debt levels. Explore how these distinct economic interventions impact fiscal policy and financial stability.

Why it is important

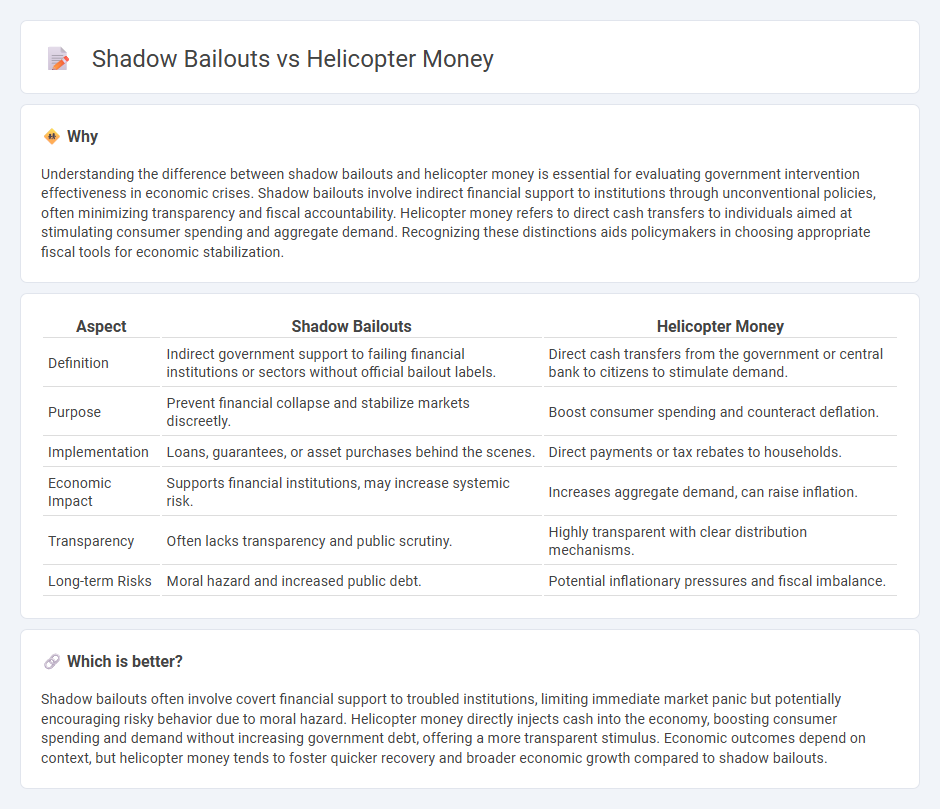

Understanding the difference between shadow bailouts and helicopter money is essential for evaluating government intervention effectiveness in economic crises. Shadow bailouts involve indirect financial support to institutions through unconventional policies, often minimizing transparency and fiscal accountability. Helicopter money refers to direct cash transfers to individuals aimed at stimulating consumer spending and aggregate demand. Recognizing these distinctions aids policymakers in choosing appropriate fiscal tools for economic stabilization.

Comparison Table

| Aspect | Shadow Bailouts | Helicopter Money |

|---|---|---|

| Definition | Indirect government support to failing financial institutions or sectors without official bailout labels. | Direct cash transfers from the government or central bank to citizens to stimulate demand. |

| Purpose | Prevent financial collapse and stabilize markets discreetly. | Boost consumer spending and counteract deflation. |

| Implementation | Loans, guarantees, or asset purchases behind the scenes. | Direct payments or tax rebates to households. |

| Economic Impact | Supports financial institutions, may increase systemic risk. | Increases aggregate demand, can raise inflation. |

| Transparency | Often lacks transparency and public scrutiny. | Highly transparent with clear distribution mechanisms. |

| Long-term Risks | Moral hazard and increased public debt. | Potential inflationary pressures and fiscal imbalance. |

Which is better?

Shadow bailouts often involve covert financial support to troubled institutions, limiting immediate market panic but potentially encouraging risky behavior due to moral hazard. Helicopter money directly injects cash into the economy, boosting consumer spending and demand without increasing government debt, offering a more transparent stimulus. Economic outcomes depend on context, but helicopter money tends to foster quicker recovery and broader economic growth compared to shadow bailouts.

Connection

Shadow bailouts involve covert financial support to prevent economic collapse, often bypassing public scrutiny, while helicopter money directly injects cash into the economy to stimulate demand. Both mechanisms aim to stabilize markets and encourage spending during financial crises without increasing public debt through traditional borrowing. Their connection lies in unconventional monetary interventions designed to sustain economic activity and restore confidence.

Key Terms

Direct monetary stimulus

Direct monetary stimulus, such as helicopter money, involves distributing cash directly to individuals to boost economic activity and increase consumer spending without increasing government debt. Shadow bailouts refer to indirect financial support given to struggling institutions or sectors through mechanisms like central bank asset purchases or guarantees, often opaque and less transparent to the public. Explore how these contrasting approaches impact economic recovery and fiscal policy strategies.

Off-balance-sheet support

Helicopter money involves direct cash transfers to the public to stimulate economic activity, while shadow bailouts refer to off-balance-sheet government guarantees and contingent liabilities supporting troubled financial institutions without immediate fiscal outlays. Off-balance-sheet support includes guarantees, liquidity facilities, and asset purchase commitments that can create hidden fiscal risks not immediately reflected in official debt statistics. Explore the nuances of these financial mechanisms and their impact on economic stability and transparency.

Central bank intervention

Central bank intervention through helicopter money involves direct monetary transfers to the public to stimulate economic activity, while shadow bailouts consist of covert financial support to struggling institutions using off-balance-sheet operations. Helicopter money aims to boost aggregate demand without increasing government debt, contrasting with shadow bailouts that maintain systemic stability but risk moral hazard. Explore how these contrasting strategies impact economic recovery and financial stability in greater detail.

Source and External Links

Helicopter money - Wikipedia - Helicopter money is a proposed unconventional monetary policy where central banks make direct payments to individuals or the public to stimulate the economy, especially during severe recessions when interest rates are near zero, and is often discussed as an alternative to quantitative easing.

What is helicopter money? | Helicopter drop definition | IG International - Helicopter money refers to printing and distributing large sums of new money directly to the public to boost spending and economic activity, typically during a recession or when conventional monetary tools are ineffective.

What is helicopter money? - The World Economic Forum - The concept, popularized by Milton Friedman, involves central banks giving direct cash transfers to citizens to increase inflation and output, with the idea that people will spend more and stimulate broader economic activity.

dowidth.com

dowidth.com