Scrap metal arbitrage exploits price differences in recyclable metals across local and international markets, leveraging fluctuations in supply chains and transportation costs. Commodity arbitrage, on the other hand, involves trading raw materials like oil, gold, or agricultural products by capitalizing on global price disparities driven by geopolitical events and market demand. Explore deeper strategies and market dynamics to understand the nuances shaping these arbitrage opportunities.

Why it is important

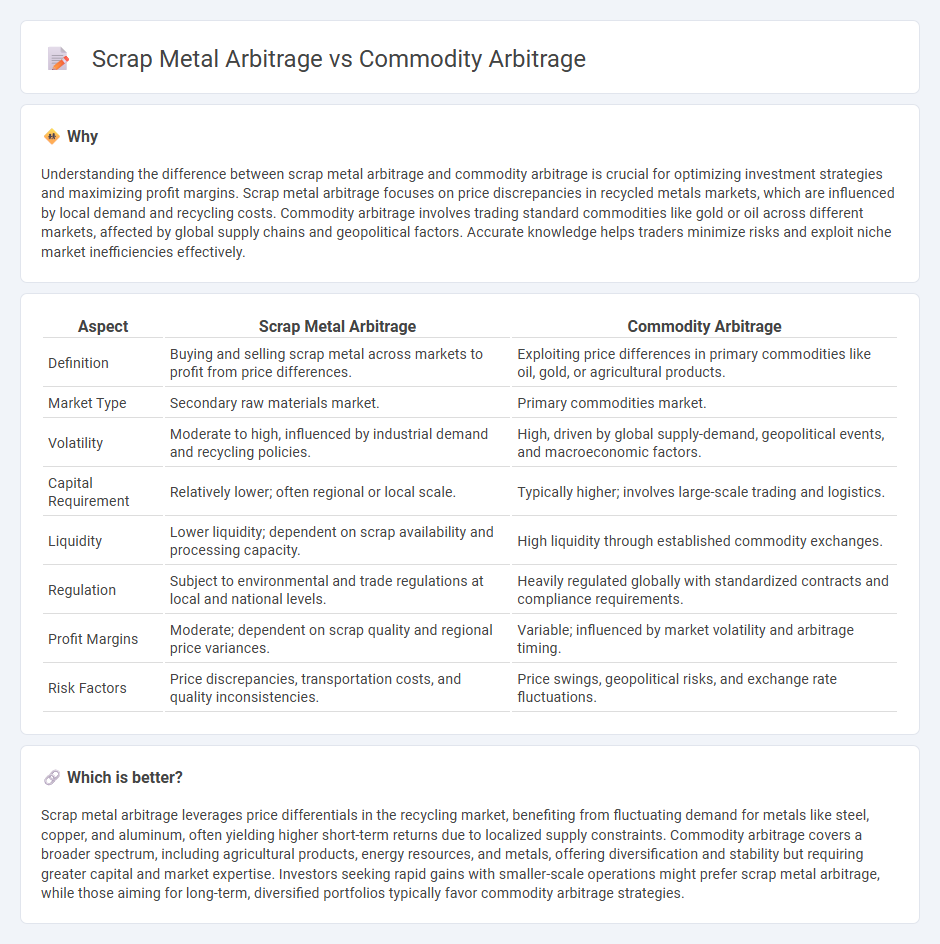

Understanding the difference between scrap metal arbitrage and commodity arbitrage is crucial for optimizing investment strategies and maximizing profit margins. Scrap metal arbitrage focuses on price discrepancies in recycled metals markets, which are influenced by local demand and recycling costs. Commodity arbitrage involves trading standard commodities like gold or oil across different markets, affected by global supply chains and geopolitical factors. Accurate knowledge helps traders minimize risks and exploit niche market inefficiencies effectively.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Commodity Arbitrage |

|---|---|---|

| Definition | Buying and selling scrap metal across markets to profit from price differences. | Exploiting price differences in primary commodities like oil, gold, or agricultural products. |

| Market Type | Secondary raw materials market. | Primary commodities market. |

| Volatility | Moderate to high, influenced by industrial demand and recycling policies. | High, driven by global supply-demand, geopolitical events, and macroeconomic factors. |

| Capital Requirement | Relatively lower; often regional or local scale. | Typically higher; involves large-scale trading and logistics. |

| Liquidity | Lower liquidity; dependent on scrap availability and processing capacity. | High liquidity through established commodity exchanges. |

| Regulation | Subject to environmental and trade regulations at local and national levels. | Heavily regulated globally with standardized contracts and compliance requirements. |

| Profit Margins | Moderate; dependent on scrap quality and regional price variances. | Variable; influenced by market volatility and arbitrage timing. |

| Risk Factors | Price discrepancies, transportation costs, and quality inconsistencies. | Price swings, geopolitical risks, and exchange rate fluctuations. |

Which is better?

Scrap metal arbitrage leverages price differentials in the recycling market, benefiting from fluctuating demand for metals like steel, copper, and aluminum, often yielding higher short-term returns due to localized supply constraints. Commodity arbitrage covers a broader spectrum, including agricultural products, energy resources, and metals, offering diversification and stability but requiring greater capital and market expertise. Investors seeking rapid gains with smaller-scale operations might prefer scrap metal arbitrage, while those aiming for long-term, diversified portfolios typically favor commodity arbitrage strategies.

Connection

Scrap metal arbitrage and commodity arbitrage are interconnected through the exploitation of price differentials in global markets, where traders capitalize on discrepancies between local scrap metal prices and worldwide commodity values. Both practices involve analyzing supply chain inefficiencies, transportation costs, and market demand variations to generate profit by buying low in one region and selling high in another. The correlation between scrap metal prices and commodity futures further amplifies opportunities for arbitrageurs to leverage market volatility and optimize investment returns in the economy.

Key Terms

Price differential

Commodity arbitrage exploits price differentials between markets for raw materials like oil, gold, and agricultural products, capitalizing on global supply-demand imbalances. Scrap metal arbitrage specifically targets discrepancies in scrap metal prices across regions or recycling centers, influenced by local demand, processing costs, and export regulations. Explore detailed strategies and market insights to maximize profits in both commodity and scrap metal arbitrage.

Market efficiency

Commodity arbitrage exploits price differences of raw materials like oil, gold, and agricultural products across global markets to ensure market efficiency by balancing supply and demand. Scrap metal arbitrage involves the trade of recyclable metals such as steel, aluminum, and copper, optimizing regional price disparities and reducing waste in the circular economy. Explore detailed strategies and market impacts of commodity and scrap metal arbitrage to deepen your understanding of efficient trade practices.

Transaction costs

Commodity arbitrage involves buying and selling bulk goods like oil, gold, or agricultural products across different markets to capitalize on price differences, where transaction costs include brokerage fees, transportation, and storage expenses. Scrap metal arbitrage, on the other hand, focuses on purchasing recyclable metals such as steel, aluminum, or copper from various sources and reselling them, with transaction costs heavily impacted by recycling fees, quality grading, and local regulatory compliance. Explore more about how transaction costs influence profitability in different arbitrage markets.

Source and External Links

What is Commodity Arbitrage and How Does it Work - Motilal Oswal - Commodity arbitrage is the practice of buying and selling commodities in different markets or at different times to profit from price differences, with examples including spatial arbitrage (across locations) and temporal arbitrage (over time).

Commodity Futures and the Limits to Arbitrage - SSRN - This study analyzes how increased financial activity and institutional investors can introduce distortions in commodity futures term premiums that are not fully eliminated by arbitrage, especially in contracts far from expiration.

A Look at Arbitrage in Agricultural Commodity Markets - Nasdaq - Arbitrage in commodity markets focuses on relative value differences between markets rather than the absolute price of the commodity itself.

dowidth.com

dowidth.com