Polycrisis occurs when multiple global economic disruptions converge, intensifying financial instability and complicating recovery efforts. Structural adjustment refers to policy reforms implemented by governments, often guided by international financial institutions, aimed at stabilizing economies through fiscal austerity and market liberalization. Explore the dynamics between polycrisis and structural adjustment to understand their impacts on global economic resilience.

Why it is important

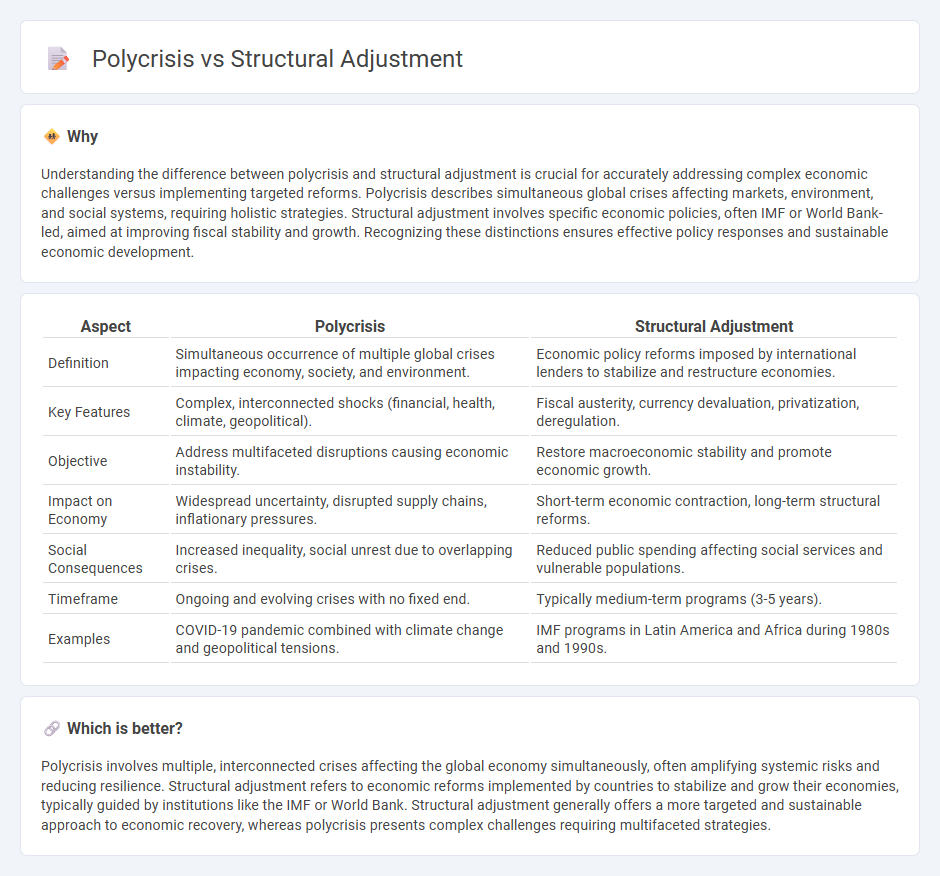

Understanding the difference between polycrisis and structural adjustment is crucial for accurately addressing complex economic challenges versus implementing targeted reforms. Polycrisis describes simultaneous global crises affecting markets, environment, and social systems, requiring holistic strategies. Structural adjustment involves specific economic policies, often IMF or World Bank-led, aimed at improving fiscal stability and growth. Recognizing these distinctions ensures effective policy responses and sustainable economic development.

Comparison Table

| Aspect | Polycrisis | Structural Adjustment |

|---|---|---|

| Definition | Simultaneous occurrence of multiple global crises impacting economy, society, and environment. | Economic policy reforms imposed by international lenders to stabilize and restructure economies. |

| Key Features | Complex, interconnected shocks (financial, health, climate, geopolitical). | Fiscal austerity, currency devaluation, privatization, deregulation. |

| Objective | Address multifaceted disruptions causing economic instability. | Restore macroeconomic stability and promote economic growth. |

| Impact on Economy | Widespread uncertainty, disrupted supply chains, inflationary pressures. | Short-term economic contraction, long-term structural reforms. |

| Social Consequences | Increased inequality, social unrest due to overlapping crises. | Reduced public spending affecting social services and vulnerable populations. |

| Timeframe | Ongoing and evolving crises with no fixed end. | Typically medium-term programs (3-5 years). |

| Examples | COVID-19 pandemic combined with climate change and geopolitical tensions. | IMF programs in Latin America and Africa during 1980s and 1990s. |

Which is better?

Polycrisis involves multiple, interconnected crises affecting the global economy simultaneously, often amplifying systemic risks and reducing resilience. Structural adjustment refers to economic reforms implemented by countries to stabilize and grow their economies, typically guided by institutions like the IMF or World Bank. Structural adjustment generally offers a more targeted and sustainable approach to economic recovery, whereas polycrisis presents complex challenges requiring multifaceted strategies.

Connection

Polycrisis intensifies economic vulnerabilities by exposing interconnected financial, social, and environmental shocks, necessitating structural adjustment programs to restore macroeconomic stability and promote sustainable growth. Structural adjustment often involves policy reforms such as fiscal austerity, privatization, and market liberalization aimed at addressing imbalances revealed by overlapping crises. These adjustments influence economic recovery trajectories by reshaping public spending, investment priorities, and regulatory frameworks in response to multifaceted crisis pressures.

Key Terms

**Structural Adjustment:**

Structural adjustment refers to economic policies implemented by countries, often under the guidance of institutions like the IMF and World Bank, aimed at stabilizing and reforming economies through measures such as reducing fiscal deficits, privatization, and trade liberalization. These policies intend to promote long-term growth but can lead to social challenges like increased poverty and inequality if not carefully managed. Explore deeper insights on how structural adjustment impacts global development and social dynamics.

Conditionality

Structural adjustment programs (SAPs) impose conditionality on borrowing countries, requiring economic reforms such as fiscal austerity, deregulation, and privatization to qualify for financial aid, often leading to social and economic challenges. Polycrisis refers to the simultaneous occurrence of multiple global crises--economic, environmental, health, and geopolitical--that interact and exacerbate vulnerabilities, complicating traditional conditionality approaches. Explore how evolving conditionality frameworks address the complexities of polycrisis for sustainable development goals.

Liberalization

Structural adjustment policies prioritize economic liberalization through deregulation, privatization, and reducing state intervention to foster market efficiency and attract foreign investment. In contrast, a polycrisis intertwines multiple systemic challenges, such as economic instability, social unrest, and environmental threats, complicating liberalization efforts and requiring multifaceted responses. Explore how liberalization strategies differ in addressing these complex economic scenarios.

Source and External Links

Poverty and Structural Adjustment - Structural adjustment programs aim to increase efficiency and restore growth in developing countries, often through exchange rate reforms, trade liberalization, and public sector restructuring, but their effects on poverty are complex and sometimes criticized for harming the poor.

structural adjustment programmes - Structural Adjustment Programmes (SAPs) are economic policies promoted by the World Bank and IMF, involving loans conditional on economic reforms such as reducing government controls and increasing market competition, as part of a broader neoliberal agenda.

Structural adjustment - SAPs consist of loans provided by the IMF and World Bank to countries in financial crisis, requiring them to implement economic reforms, and became widespread in Latin America and Sub-Saharan Africa during the 1980s debt crisis.

dowidth.com

dowidth.com