Funflation describes rising prices driven by increased demand for leisure and entertainment activities, reflecting shifts in consumer spending patterns, while hyperinflation represents an extreme and rapid increase in prices, often exceeding 50% per month, leading to currency devaluation and economic instability. Understanding these distinct inflationary phenomena helps clarify how different economic forces impact markets and living costs. Explore further to grasp the implications of funflation and hyperinflation on global economies.

Why it is important

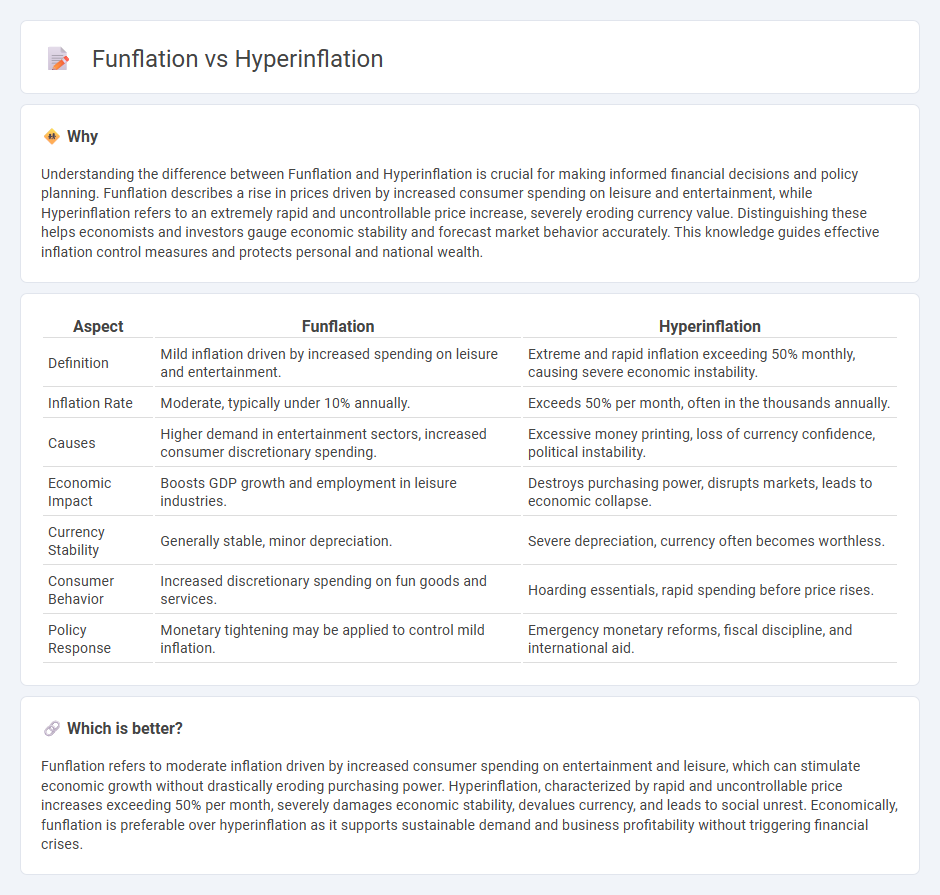

Understanding the difference between Funflation and Hyperinflation is crucial for making informed financial decisions and policy planning. Funflation describes a rise in prices driven by increased consumer spending on leisure and entertainment, while Hyperinflation refers to an extremely rapid and uncontrollable price increase, severely eroding currency value. Distinguishing these helps economists and investors gauge economic stability and forecast market behavior accurately. This knowledge guides effective inflation control measures and protects personal and national wealth.

Comparison Table

| Aspect | Funflation | Hyperinflation |

|---|---|---|

| Definition | Mild inflation driven by increased spending on leisure and entertainment. | Extreme and rapid inflation exceeding 50% monthly, causing severe economic instability. |

| Inflation Rate | Moderate, typically under 10% annually. | Exceeds 50% per month, often in the thousands annually. |

| Causes | Higher demand in entertainment sectors, increased consumer discretionary spending. | Excessive money printing, loss of currency confidence, political instability. |

| Economic Impact | Boosts GDP growth and employment in leisure industries. | Destroys purchasing power, disrupts markets, leads to economic collapse. |

| Currency Stability | Generally stable, minor depreciation. | Severe depreciation, currency often becomes worthless. |

| Consumer Behavior | Increased discretionary spending on fun goods and services. | Hoarding essentials, rapid spending before price rises. |

| Policy Response | Monetary tightening may be applied to control mild inflation. | Emergency monetary reforms, fiscal discipline, and international aid. |

Which is better?

Funflation refers to moderate inflation driven by increased consumer spending on entertainment and leisure, which can stimulate economic growth without drastically eroding purchasing power. Hyperinflation, characterized by rapid and uncontrollable price increases exceeding 50% per month, severely damages economic stability, devalues currency, and leads to social unrest. Economically, funflation is preferable over hyperinflation as it supports sustainable demand and business profitability without triggering financial crises.

Connection

Funflation and hyperinflation both reflect rising price levels, but Funflation indicates increased spending on entertainment and leisure despite inflation, while hyperinflation denotes uncontrollable, rapid inflation severely devaluing currency. The connection lies in consumer behavior and economic stability, where hyperinflation undermines purchasing power causing shifts in spending patterns that may trigger Funflation-like phenomena in specific sectors. Analyzing these inflation types reveals their impact on market dynamics, consumer confidence, and overall economic health.

Key Terms

Purchasing Power

Hyperinflation drastically erodes purchasing power as prices skyrocket uncontrollably, making everyday goods unaffordable and savings worthless. In contrast, funflation refers to price increases driven by enhanced entertainment or luxury experiences, where consumers may perceive added value despite higher costs. Discover how these inflation types differently impact economic behavior and consumer choices.

Price Level

Hyperinflation causes rapid and uncontrollable increases in the price level, eroding currency value and drastically reducing purchasing power within a short period. Funflation, a less severe phenomenon, reflects moderate price rises in entertainment and leisure sectors, impacting consumer budgets but not collapsing the overall economy. Explore detailed analyses to understand how these contrasting inflation types differently affect economic stability and consumer behavior.

Consumer Behavior

Hyperinflation drastically erodes consumer purchasing power, leading to hoarding, reduced discretionary spending, and a shift toward basic necessities. Funflation, characterized by rising prices on entertainment and leisure activities, influences consumer behavior by encouraging budget reallocation from essentials to experiences. Discover how these inflationary trends uniquely reshape market demands and consumer decision-making.

Source and External Links

Hyperinflation | EBSCO Research Starters - Hyperinflation is a severe economic condition where prices increase extraordinarily fast, typically with inflation exceeding 50% per month, caused mainly by excessive money printing without economic growth, leading to currency devaluation and financial panic, as seen in historical cases like post-WWI Germany, Hungary, Zimbabwe, and Venezuela.

Hyperinflation: Definition, Causes, Effects and Examples - NetSuite - Hyperinflation leads to the collapse of currency exchange rates, skyrocketing prices, loss of savings, shortages, and severe social and political consequences, often ending with regime change and economic bailout programs.

Hyperinflation - Definition, Causes and Effects, Example - Hyperinflation occurs when inflation exceeds 50% per month, driven by excessive money supply growth not supported by economic growth, causing rapid currency devaluation, shifts to stable foreign currencies, and changes in consumer behavior toward durable and perishable goods to preserve value.

dowidth.com

dowidth.com