Shadow bailouts occur when governments or central banks intervene covertly to stabilize failing financial institutions without public disclosure, contrasting with deposit insurance that guarantees depositor funds up to a specified limit, promoting trust in the banking system. These mechanisms play crucial roles in mitigating systemic risk during financial crises by providing liquidity support and protecting individual savings. Explore the differences and impacts of shadow bailouts and deposit insurance to understand their significance in economic stability.

Why it is important

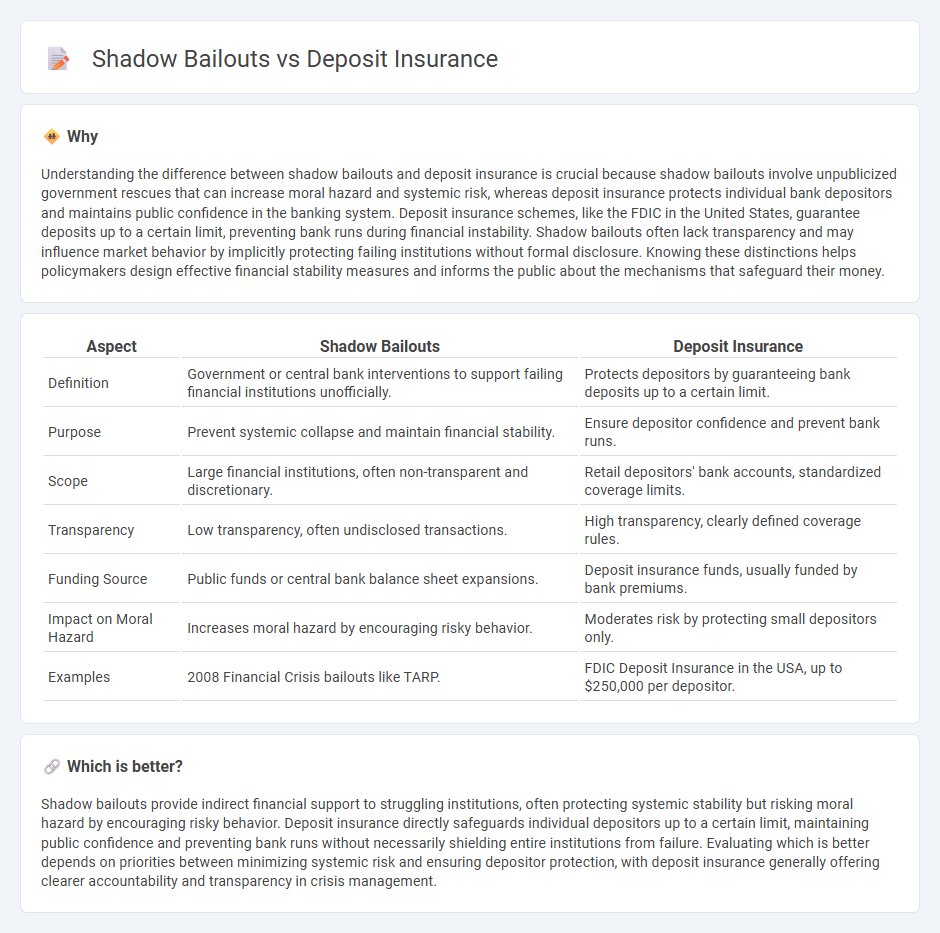

Understanding the difference between shadow bailouts and deposit insurance is crucial because shadow bailouts involve unpublicized government rescues that can increase moral hazard and systemic risk, whereas deposit insurance protects individual bank depositors and maintains public confidence in the banking system. Deposit insurance schemes, like the FDIC in the United States, guarantee deposits up to a certain limit, preventing bank runs during financial instability. Shadow bailouts often lack transparency and may influence market behavior by implicitly protecting failing institutions without formal disclosure. Knowing these distinctions helps policymakers design effective financial stability measures and informs the public about the mechanisms that safeguard their money.

Comparison Table

| Aspect | Shadow Bailouts | Deposit Insurance |

|---|---|---|

| Definition | Government or central bank interventions to support failing financial institutions unofficially. | Protects depositors by guaranteeing bank deposits up to a certain limit. |

| Purpose | Prevent systemic collapse and maintain financial stability. | Ensure depositor confidence and prevent bank runs. |

| Scope | Large financial institutions, often non-transparent and discretionary. | Retail depositors' bank accounts, standardized coverage limits. |

| Transparency | Low transparency, often undisclosed transactions. | High transparency, clearly defined coverage rules. |

| Funding Source | Public funds or central bank balance sheet expansions. | Deposit insurance funds, usually funded by bank premiums. |

| Impact on Moral Hazard | Increases moral hazard by encouraging risky behavior. | Moderates risk by protecting small depositors only. |

| Examples | 2008 Financial Crisis bailouts like TARP. | FDIC Deposit Insurance in the USA, up to $250,000 per depositor. |

Which is better?

Shadow bailouts provide indirect financial support to struggling institutions, often protecting systemic stability but risking moral hazard by encouraging risky behavior. Deposit insurance directly safeguards individual depositors up to a certain limit, maintaining public confidence and preventing bank runs without necessarily shielding entire institutions from failure. Evaluating which is better depends on priorities between minimizing systemic risk and ensuring depositor protection, with deposit insurance generally offering clearer accountability and transparency in crisis management.

Connection

Shadow bailouts and deposit insurance intersect in safeguarding financial stability by mitigating systemic risk during banking crises. Shadow bailouts involve covert government interventions to support failing institutions without public disclosure, while deposit insurance guarantees depositors' funds up to a specified limit, preventing bank runs and preserving consumer confidence. Both mechanisms function as implicit or explicit safety nets that influence moral hazard and regulatory policies within the financial sector.

Key Terms

Moral Hazard

Deposit insurance safeguards bank customers by guaranteeing funds, reducing the risk of bank runs but potentially encouraging reckless risk-taking due to moral hazard. Shadow bailouts, often unannounced government interventions in troubled financial institutions, further amplify moral hazard by signaling implicit support without regulatory transparency. Explore deeper to understand the complex impact of these mechanisms on financial stability and regulatory policies.

Financial Stability

Deposit insurance strengthens financial stability by protecting depositor funds and preventing bank runs, ensuring confidence in the banking system. Shadow bailouts, often informal and unregulated government interventions, can distort market discipline and potentially increase systemic risk in financial markets. Explore the differences and impacts of these mechanisms to understand their roles in maintaining financial stability.

Regulatory Arbitrage

Deposit insurance protects bank customers by guaranteeing their deposits up to a certain limit, reducing the risk of bank runs and promoting financial stability. Shadow bailouts occur when regulators or governments provide implicit support to non-deposit financial entities, creating opportunities for regulatory arbitrage where institutions exploit gaps between insured and uninsured sectors. Explore how regulatory arbitrage shapes financial risk and influences policy effectiveness.

Source and External Links

Deposit insurance - Wikipedia - Deposit insurance is a system implemented worldwide to protect bank depositors from losses caused by a bank's failure to pay its debts, ensuring financial stability by promoting confidence in banks and preventing bank runs, usually managed by government-established institutions or authorities.

Federal Deposit Insurance - PNC Bank - In the U.S., FDIC deposit insurance covers up to $250,000 per depositor, per institution, across various account types such as checking, savings, money market accounts, and CDs, with coverage possible to exceed $250,000 through different ownership categories.

Federal Deposit Insurance Corporation (FDIC) | Wex | US Law - The FDIC is a U.S. government agency insuring deposits up to $250,000 per depositor at insured banks, funded by premiums paid by banks, and plays a critical role in maintaining depositor confidence by reimbursing depositors if their bank fails.

dowidth.com

dowidth.com