Carbon border adjustment mechanisms impose tariffs on imported goods based on their carbon emissions to level the playing field for domestic industries adhering to strict environmental regulations. Carbon offsets allow companies or individuals to compensate for their emissions by investing in projects that reduce or capture an equivalent amount of carbon dioxide elsewhere. Explore the economic impacts and policy debates surrounding these approaches to climate change mitigation.

Why it is important

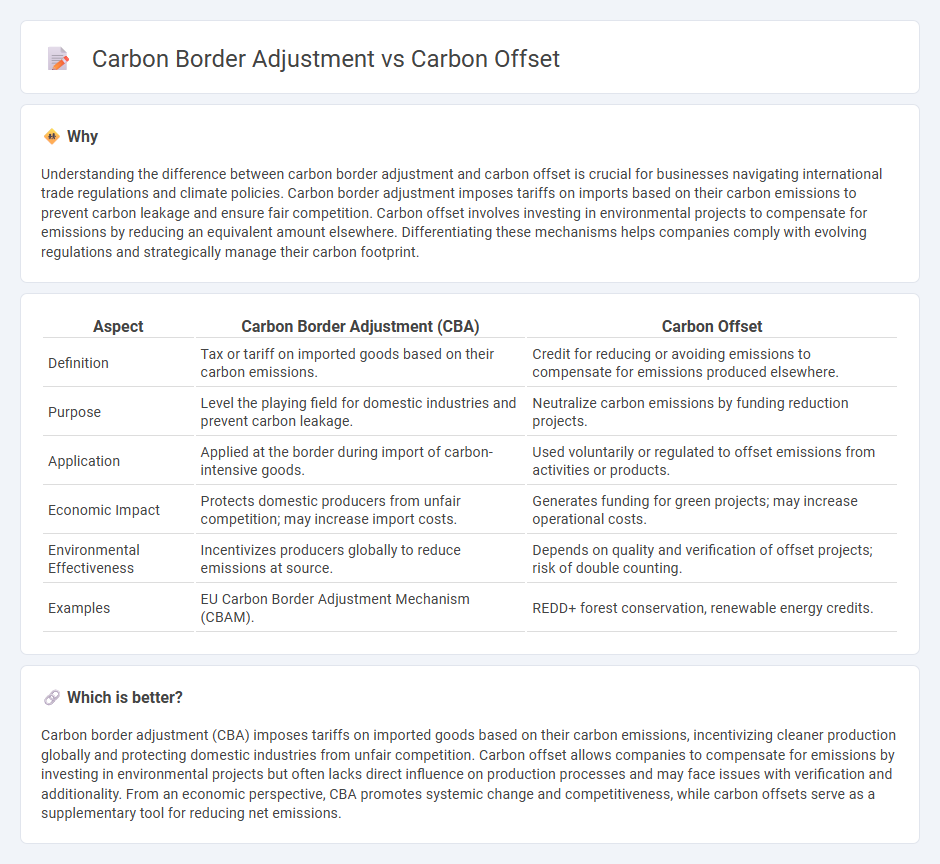

Understanding the difference between carbon border adjustment and carbon offset is crucial for businesses navigating international trade regulations and climate policies. Carbon border adjustment imposes tariffs on imports based on their carbon emissions to prevent carbon leakage and ensure fair competition. Carbon offset involves investing in environmental projects to compensate for emissions by reducing an equivalent amount elsewhere. Differentiating these mechanisms helps companies comply with evolving regulations and strategically manage their carbon footprint.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Carbon Offset |

|---|---|---|

| Definition | Tax or tariff on imported goods based on their carbon emissions. | Credit for reducing or avoiding emissions to compensate for emissions produced elsewhere. |

| Purpose | Level the playing field for domestic industries and prevent carbon leakage. | Neutralize carbon emissions by funding reduction projects. |

| Application | Applied at the border during import of carbon-intensive goods. | Used voluntarily or regulated to offset emissions from activities or products. |

| Economic Impact | Protects domestic producers from unfair competition; may increase import costs. | Generates funding for green projects; may increase operational costs. |

| Environmental Effectiveness | Incentivizes producers globally to reduce emissions at source. | Depends on quality and verification of offset projects; risk of double counting. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | REDD+ forest conservation, renewable energy credits. |

Which is better?

Carbon border adjustment (CBA) imposes tariffs on imported goods based on their carbon emissions, incentivizing cleaner production globally and protecting domestic industries from unfair competition. Carbon offset allows companies to compensate for emissions by investing in environmental projects but often lacks direct influence on production processes and may face issues with verification and additionality. From an economic perspective, CBA promotes systemic change and competitiveness, while carbon offsets serve as a supplementary tool for reducing net emissions.

Connection

Carbon border adjustment mechanisms impose tariffs on imported goods based on their carbon emissions, incentivizing producers to reduce greenhouse gas output. Carbon offsets allow companies to compensate for their emissions by investing in environmental projects, effectively balancing their carbon footprint. Integrating carbon offsets with border adjustments ensures imported products meet global emission standards while promoting sustainable economic practices.

Key Terms

Emissions Trading

Carbon offset involves purchasing credits to compensate for emissions by funding external reduction projects, while carbon border adjustment imposes tariffs on imported goods based on their carbon footprint to level the playing field in emissions trading. Emissions Trading Systems (ETS) integrate these mechanisms to regulate carbon pricing and encourage reductions within industries. Explore how these strategies reshape global carbon markets and compliance frameworks.

Carbon Leakage

Carbon offset involves compensating emissions by investing in environmental projects, whereas carbon border adjustment (CBA) imposes tariffs on imported goods based on their carbon footprint to prevent carbon leakage. Carbon leakage occurs when companies relocate production to countries with lax emissions regulations, undermining climate goals. Explore the mechanisms and impacts of these policies to understand how they address carbon leakage effectively.

Import Tariffs

Carbon offset involves companies investing in environmental projects to compensate for their carbon emissions, while carbon border adjustment (CBA) imposes import tariffs on goods based on their carbon footprint to level the playing field. Import tariffs under CBA target emissions-intensive imports, aiming to prevent carbon leakage and protect domestic industries adhering to strict climate policies. Explore how these mechanisms impact global trade and climate goals in detail.

Source and External Links

Carbon offsets and credits - Carbon offsets are a mechanism to compensate for greenhouse gas emissions by investing in projects that reduce or remove emissions elsewhere, with one carbon credit representing one metric tonne of CO2 equivalent reduced or removed, and these credits are standardized, certified, and traded in markets globally.

Carbon Offsets - MIT Climate Portal - Carbon offsets are tradable certificates funding projects that lower atmospheric CO2 through methods like reforestation or renewable energy, allowing buyers to offset their own emissions by supporting emission reductions elsewhere with verified standards ensuring actual emissions reductions.

What are Carbon Offsets? | CarbonNeutral - Carbon offsets enable businesses and governments to meet climate goals by investing in projects that reduce or store carbon emissions, thus helping entities that cannot completely eliminate their emissions still reduce global net emissions toward net zero targets.

dowidth.com

dowidth.com